Intense competition, inflation, low rates, and a host of other adverse conditions are challenging thousands of freight company operations in 2023. If performance levels decline, your finances can become stretched. These short-term financial challenges can evolve into significant problems, threatening your fleet’s ability to meet payments when they become due. If this situation is left unresolved, it may lead your trucking company to insolvency.

To avoid this financial crisis, fleet owners must know how to spot any warning signs on the horizon. Learn to avoid a financial crisis and keep your trucking business in good standing by understanding insolvency, spotting early warning signs, and knowing effective strategies to rectify the situation.

What is insolvency?

Before diving into the warning signs and strategies to rectify insolvency, it’s essential to understand it fully.

There are two forms of insolvency:

Cash flow insolvency is when a company has enough assets to pay what is owed but does not have access to available capital to pay debts when they become due. For example, your fleet may have thousands of dollars in accounts receivable and inventory on its balance sheet but needs more liquid assets to pay debt when it becomes due.

Cash flow insolvency can be rectified by applying strategies that accelerate cash flow and release capital that may be buried in your current assets. More details on this topic will be discussed further in this article.

Balance sheet insolvency is when a company’s liabilities exceed its assets. Sometimes referred to as “technical insolvency” means the company does not have enough assets to cover all its debts.

This condition is more complex than cash flow insolvency. Companies in this situation are best advised to contact a reputable insolvency professional to help navigate the resulting financial distress.

Insolvency is often mistakenly confused with the term bankruptcy. Insolvency is a state of financial distress. Bankruptcy is the legal process an insolvent debtor must follow to surrender assets in exchange for debt relief. A company can be insolvent but not bankrupt, whereas a bankrupt company must, by law, be insolvent.

Causes of Insolvency

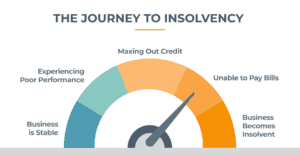

Insolvency is typically a result of unresolved operational challenges or lack of business. Instances of insolvency often rise when market conditions are poor. Companies facing falling performance levels often focus on day-to-day challenges or short-term fixes finding new loads or contracts but fail to track or focus on overall financial progress. Instead, they may convert available funds from struggling cash flow into operating capital to keep trucks on the road.

In this scenario, only the most pressing financial obligations are paid to keep the wolves at bay. This isn’t a strategy: it’s a tactic – and a dangerous one – that sacrifices sustainable operations for quick cash. Unless the company suddenly reverses trends and becomes more profitable, this path won’t prevent insolvency.

A more effective strategy involves resolving issues while closely monitoring the company’s overall financial health. A company’s financial standing will soon eclipse operational challenges if an insolvency crisis occurs.

Insolvency warning signs

To balance operational challenges and sales initiatives while monitoring financial health, freight businesses must watch closely for warning signs of financial distress. Warning signs are easy to monitor if you know what to look for.

Here are indicators of a potential slide towards insolvency.

Early Warning Signs of Insolvency: If left unchecked, business conditions could prompt a slide toward insolvency.

- Declining or negative cash flow

- Declining sources of working capital

- Negatively trending financial ratios

- High rate of aging accounts payable or accounts receivable

- Regularly accessing overdrafts

- Breaking debt covenants

- Declining industry conditions

- Extended cash conversion cycles

- Increases in employee turnover

- Declining service quality

Signs of immediate danger: Business conditions that signal a high likelihood of insolvency.

- A sustained decline in revenue

- Declining EBITDA margins

- Lenders restricting credit

- Late payments to creditors

- Taxes not being paid

- Loss of key customers

- Increasingly large liabilities

- Vendors cutting off credit

- Increased regulatory inquiries

- High management turnover

- Payroll in danger of being missed

- Employee benefits have not been paid

Testing for insolvency

Watching for warning signs of insolvency in your freight company is only the first level of defense. Testing for insolvency takes your scrutiny to a higher level. Calculating financial ratios and analyzing results is a more advanced method of gauging your company’s financial health and determining whether you are at a heightened risk of insolvency.

These four ratios can help measure insolvency:

- interest coverage ratio

- debt-to-assets ratio

- shareholder equity ratio

- debt-to-equity ratio

Evaluating financial ratios requires experience since results must be interpreted to accurately paint a picture of your business’s financial health. For instance, a company with rising accounts payable but low debt may appear in good standing if you only include insolvency ratios that include debt.

Consult with trusted professionals knowledgeable in financial ratios to help determine the true financial health of your freight business.

Avoiding insolvency: next steps

If your company is sliding towards insolvency, don’t hesitate: take action to avoid the impending crisis! Avoiding insolvency is preferred, but recovery and turnaround are viable if managed well. That’s why it’s always best to seek professional help to secure a lifeline when your business begins to tread water.

Cash flow insolvency is the easier form of insolvency to rectify. Freight companies facing cash flow insolvency should contact a reputable alternative lender experienced in your industry as a first step. Their options of flexible business financing solutions are designed to unlock capital and improve cash flow. Transitioning to this type of flexible financing structure can provide immediate relief by providing quick access to capital needed to meet your freight business’s financial obligations. Asset-based lending and invoice factoring are two powerful financial tools that unlock capital tied up in collateral. Both tools help quickly deliver the capital businesses need when they need it.

Balance sheet insolvency is the more complex form of insolvency to deal with, but it can be fixed without significant disruption if the situation is managed efficiently. In this case, consult with an insolvency lawyer or turnaround consultant to fully understand your business’s options and chart a path to recovery through a customized turnaround or restructuring plan.

Conclusion

Always keep an eye out for early warning signs of insolvency. With the freight market throwing constant challenges at carriers across the country, it’s crucial to stay vigilant and monitor your fleet’s financial health while juggling operational hurdles. If you start sensing a major cash flow squeeze looming in the future, don’t hesitate to reach out to an alternative financing specialist. They can help you steer clear of a crisis through innovative financial services like freight factoring or asset-based lending. And if it seems like insolvency is becoming inevitable, it’s time to bring in an insolvency lawyer or consultant who can guide you through a turnaround strategy and chart a route to recovery.

Monitoring for insolvency and acting quickly at the first sign of distress will help to mitigate disruption and accelerate your return to profitability.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.