Corporate Restructuring Can Save Your Business Whether In Decline Or Growth!

Markets are dynamic and subject to constant change. This has never been more evident than over the past four years.

Market volatility brings opportunities and risks to businesses throughout the various industries that drive our economy. For many companies, the harsh economic conditions of high production costs, diminishing market demand, stiff competition, and a tightening credit market threaten the business’s sustainability. Many companies are having to deal with sinking profits and stagnate cash flow, leading to the possibility of insolvency and bankruptcy. Meanwhile, other companies in robust industries, such as e-commerce, renewable energy, AI, and more, must scale up to meet demand. Whether your business is upside down or stretched beyond capacity due to the demands of growth, financial instability is often the result of market volatility.

Whether your company is declining or growing, corporate restructuring can become critical to save your business with improved operational efficiency, restored profitability, and financial stability.

Learn what corporate restructuring is, when it is needed, and how businesses are funding their restructuring efforts to drive long-term success and build resilience in harsh economic conditions.

What is corporate restructuring?

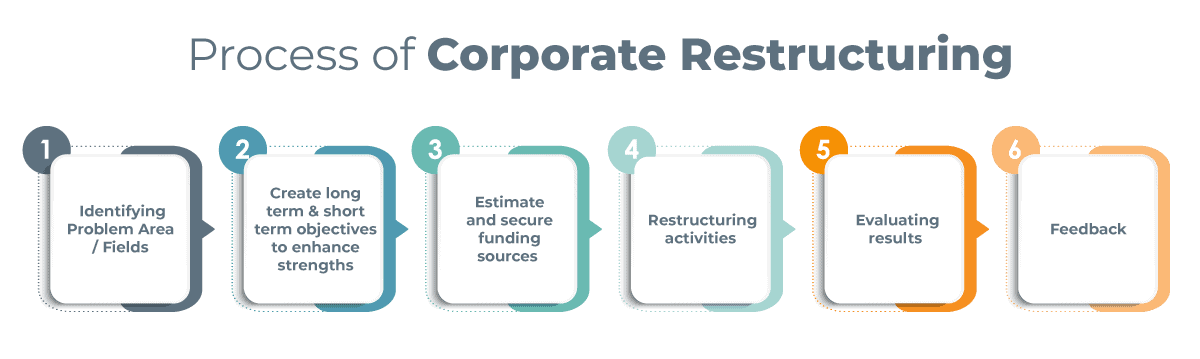

Restructuring is a corporate action that involves reorganizing or changing a company’s management, operational, or financial structure to improve its overall performance. This strategy can help companies address declining sales, improve efficiencies, increase competitiveness, and overcome financial constraints such as excessive debt or poor cash flow.

A successful restructuring strategy can help a company achieve the following goals:

- Increase productivity

- Improve product and service quality

- Reduce costs

- Raise urgently needed cash

- Reduce existing debt and improve the bottom line

- Stabilize business operations

- Serve and meet the needs of customers and shareholders

- Become competitive and attractive to potential cash investors or buyers

Why do businesses restructure?

Many scenarios call for restructuring. Typically, restructuring happens due to financial distress, such as when a business struggles to pay its debt or is no longer competitive. However, restructuring can also aid a company experiencing significant growth or needing to re-orient its business model.

Here are a few common scenarios that prompt businesses to pursue restructuring:

Chapter 11 bankruptcy: An insolvent company may be able to file for bankruptcy to pause or amend debts it can’t repay and renegotiate unprofitable contracts.

In Chapter 11 bankruptcy, the business must propose a financial restructuring plan that outlines how it intends to repay creditors, restructure debt, and operate profitably. The plan is subject to court approval and must be accepted by creditors.

To be successful, restructuring plans typically require significant funding to support investments in change. This type of funding is often acquired through a Debtor In Possession (DIP) financing agreement. Under this arrangement, a business can maintain control of its operations and finances if it demonstrates the ability to make regular payments on outstanding loans.

Repositioning: When a company wants to reposition itself in a changing market, it might need to change its industry focus or strategic direction. For example, following disappointing revenue results, Natura &Co—a Brazilian cosmetics maker—announced plans to restructure at an operations level in line with its strategic direction to increase the accountability of the individual business units and brands.

Natura &Co decentralized its corporate structure and delegated decision-making to individual brands and subsidiary business units to better manage their individual markets. As a result, the company cut costs by up to 40% and anticipates an improved second half of the year after a soft start to 2023.

Revenue drops and cash flow shortages: Revenue decline can lead to cash flow shortages and the business becoming no longer profitable. Netflix, which essentially founded and dominated the video streaming industry, suffered intense competition, dropping revenues, and increased production costs that hit the company a near-fatal blow in 2022.

Restructuring its film group, the company conducted layoffs, dismissed two of its most experienced executives, and leveraged technology to analyze what people watched. Then, they used an algorithm to guide the production of fewer but higher-quality movies tailored to their customers’ interests. Restructuring efforts also affected adjustments to its business model to include ad-tier subscription packages and a crackdown on password-sharing. As a result, revenues spiked in May and June, helping propel Netflix to a monster Q2 in 2023.

Rapid growth: Restructuring isn’t always a sign of poor performance. A company may need restructuring to maintain efficiency as increased demand stretches operations, financial, and management resources.

For example, in February 2023, The Walt Disney Company announced a strategic restructuring to reorganize the company into core segments – Disney Entertainment, ESPN , and Disney Parks, Experiences and Products. By decentralizing and delegating creative development, technology, marketing, sales, and distribution strategies to these new entities, immediate gains to efficiency and profitability were reported. Earnings for its 2023 second quarter and six months grew 13% and 10%, respectively.

Mergers and acquisitions: A corporation may purchase another company through a merger and acquisition (M&A) to increase assets, improve supply chains, or corner markets.

M&As can change both companies’ structures, sometimes rendering some departments redundant or changing hierarchical reporting. A restructuring may be necessary to fully incorporate the two companies’ operations, improve efficiencies, and incorporate the new department’s resources and assets.

Financing corporate restructuring

Corporate restructuring requires more than effective leadership. It involves money – usually a lot of it.

Often, businesses undergoing restructuring struggle to acquire traditional business loans or lines of credit. As banks continue to tighten lending standards, companies with underperforming business levels and poor financial health are unlikely to secure much-needed working capital through these traditional channels.

Alternative finance companies offer a simple, more accessible path to credit.

Here are five ways alternative finance companies are positioned to fund business’s restructuring efforts:

1. Fast, easy qualification processes Alternative finance companies assess funding approvals mainly based on the business’s quality of collateral rather than its credit status. Funding decisions can be made within days or weeks, compared to bank financing, which could take months to approve. Onboarding and first funding take place quickly once the agreement is signed.

2. Accelerated invoice payments Invoice factoring can be one of the most flexible ways to obtain funding and recapitalize during restructuring. In this financing arrangement, a factoring company buys your business’s accounts receivable invoices at a discount in exchange for immediate payment. Invoice factoring has become a go-to alternative to traditional financing, alleviating the strain of irregular cash flow without incurring further debt.

3. Large investment funding An asset-based lending arrangement can provide a significant injection of capital upfront if a business needs to make large-scale changes to its operating strategy. Leveraging the equity value in accounts receivable, inventory, or equipment such as CNC machines, leading alternative lenders can advance funds up to $50MM.

4. Expanded funding limits Unlike the strict credit limits imposed by traditional lenders, alternative lending offers flexible funding limits. For instance, invoice factoring users can have the credit limit raised if their business begins to grow and generates more invoices to creditworthy customers.

Your credit limit can be adjusted without applying for a new funding agreement to scale with your business and to keep pace with increasing capital needs as your business recovers and grows.

Conclusion

As volatile economic conditions prevail, companies across most industries face extreme pressure to remain viable. Many are struggling to avoid insolvency, others must claim bankruptcy, and some are stretching to meet growth demands.

For companies on the brink, restructuring offers the potential to adjust and return to profitability. For those facing growth challenges, restructuring provides the opportunity to reorganize and expand efficiently while maintaining financial stability. Whether in decline or growth, restructuring can provide the means to save your company.

Businesses undergoing a turnaround or growth challenge are well advised to consult with restructuring professionals. To ensure the financial flexibility to support restructuring, look for an alternative lender experienced in financing companies in distress.

About eCapital

eCapital is an innovative alternative lender with the flexibility to manage complex financial challenges and the resources to fund double-digit million-dollar facilities. Since 2006, eCapital has been a trusted financial partner for thousands of small to mid-size companies in all stages of development. Our customer base continues to grow as our reputation for dedicated service and forward-thinking solutions to even the most complex situations endures. Strong client relationships anchored in mutual trust are essential to our business model.

For more information about how our experienced team supports businesses’ capital requirements through all stages of development, visit ecapital.com