Drivers are the backbone of a trucking company, turning freight demand into revenue by safely moving loads from origin to destination. They are your company’s ambassadors in the field, engaging with customers face-to-face and shaping your brand. But recruiting and retaining quality talent is an ongoing struggle, as the driver shortage persists. Yet keeping professional, loyal drivers behind the wheel is critical to optimizing utilization, maintaining service reliability, and sustaining long-term profitability.

For most carriers, payroll isn’t just an expense – it’s a commitment that must be funded on time, every time, regardless of when shippers pay. Owner-operators need a steady income to meet personal obligations, and fleets must pay accurately and consistently to maintain a loyal, productive driver pool. As operations grow, added roles such as dispatch and safety increase payroll costs. Because payroll is one of the highest and most cash-intensive costs, any cash flow squeeze can quickly put retention, utilization, and safety at risk.

Financial stability and efficient cash flow management are essential to every successful trucking business. This article is part of a guide designed to provide fleet owners and managers with actionable financial strategies to enhance operational reliability and profitability.

About the guide

A Trucker’s Guide to Cash Flow Management is a strategy blueprint and best-practice resource designed to help fleet owners and managers optimize working capital, control costs, and build financially resilient operations that keep trucks moving and business profitable.

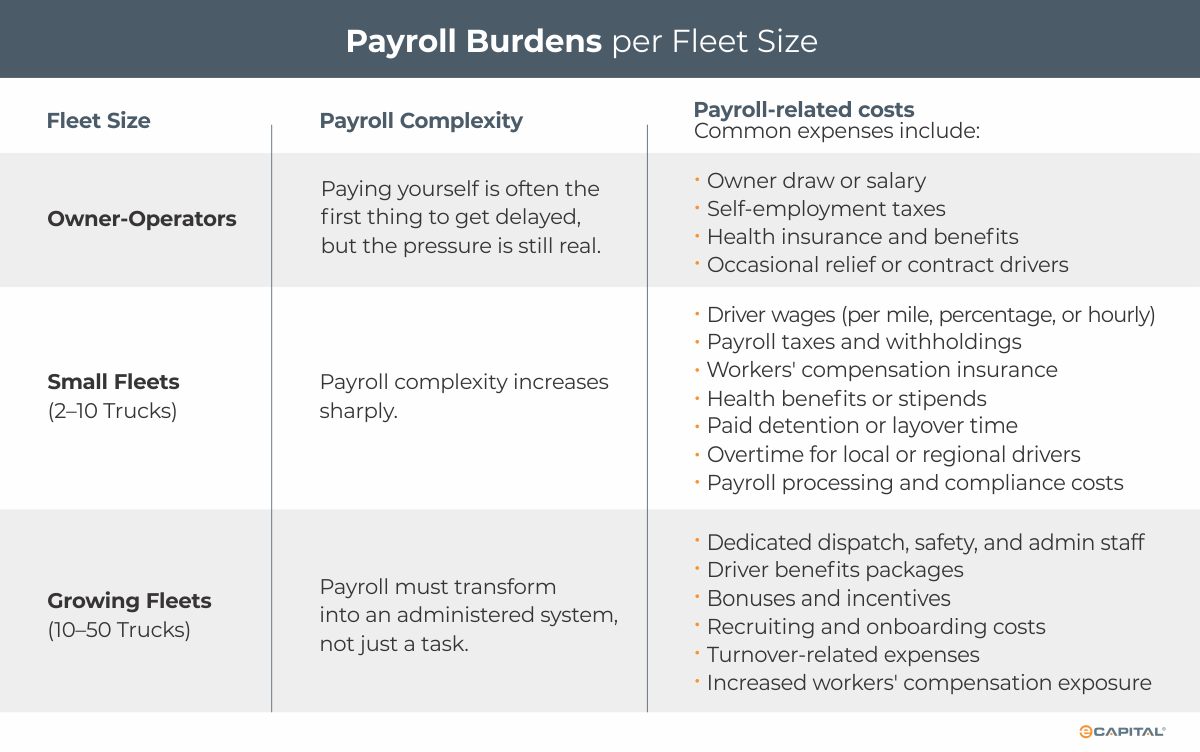

This article outlines how to scale your team in line with market opportunities, breaks down the true costs of payroll, and presents proven financial strategies to support payroll obligations while growing safely.

Scaling your team

As a trucking business grows, its team should scale in step with operational complexity and cash flow capacity. A one-truck operation can handle most functions independently, relying on technology and trusted service providers for dispatch, accounting, and compliance. As the company adds trucks, solutions and strategies must be put in place to attract and hire drivers. Continued growth typically requires dedicated support for dispatch, safety, and billing to maintain utilization, driver satisfaction, and regulatory compliance. Once a company takes on employees, effective cash flow management becomes even more critical to ensure payroll costs are met on time and in full.

Payroll burdens

As trucking companies grow, payroll shifts from a manageable, variable expense into one of the largest and most inflexible financial obligations, requiring consistent cash outflows regardless of load volume, payment timing, or market conditions.

As operations scale, payroll obligations can reach six figures per pay period. Meanwhile, millions of dollars may be tied up in receivables waiting to be paid.

Payroll risk directly impacts operational stability. If payroll falters, utilization drops quickly as drivers quit, and equipment sits idle.

Why payroll is different from other trucking costs

Fuel payments can be delayed if appropriate arrangements, such as a fuel card program, are in place. Maintenance can sometimes be scheduled, and equipment purchases can be timed. Payroll is unlike any of that.

Payroll is time-sensitive, highly visible to employees, non-negotiable, and directly tied to retention and utilization. Missed or late payroll damages trust – very quickly! Even the perception of instability can cause drivers to leave, sidelining trucks and reducing revenue capacity.

Effective cash flow management to ensure reliable payroll is essential for operational stability and long-term resilience.

The cash flow challenge

Most trucking companies don’t struggle to pay drivers because payroll is too high – they struggle because payroll is due long before revenue is collected. Extended customer payment terms, invoice disputes, seasonal swings, and daily operational expense draw heavily on cash flow, often creating funding gaps that impede timely payroll.

This mismatch compels many fleets to find flexible alternative sources of funding to ensure payroll is met on time. While traditional financing may be the first option explored, bank loans are typically slow and restrictive, as lender oversight and credit limits can impede growth.

How specialty financing supports payroll stability

Leading transportation financing companies offer specialty financing tailored to trucking’s cash flow realities. With fast funding and minimal covenants to ensure financial flexibility, these cash flow solutions provide easy access to working capital when it’s needed.

Common solutions include:

Freight factoring

- Converts invoices into immediate cash.

- Provides funds within hours

- Helps ensure payroll is met on time

- Grows with load volume

Asset-Based Lending (ABL)

- Provides revolving access to capital

- Secured by receivables or equipment

- Supports larger payroll obligations

- Scales as fleets expand

Fuel Programs

- Convenient driver access to significant fuel discount pricing at thousands of truck stops along the lanes they run across North America.

- Instant transfer methods for fleet managers to send funds to drivers with 24/7/365 availability.

- Can be used for vehicle or business-related expenses, including maintenance, tolls, tires, and much more.

Together, these tools help fleets streamline drivers’ pay and fund over-the-road expenses without impeding day-to-day operations, disrupting cash flow, or forcing short-term decisions that limit utilization and growth.

Treating payroll as a strategic priority

Growth rises payroll risk by expanding headcount, lengthening payroll cycles, intensifying insurance exposure, and increasing the cash trapped in receivables. The strongest fleets manage this with disciplined forecasting, liquidity buffers, and proactive financing, treating payroll as a strategic priority rather than a last-minute scramble.

Conclusion

Payroll is the most human and unforgiving expense in trucking. Drivers expect consistency, reliability, and respect. Meeting payroll on time supports utilization, enhances performance, and protects trust. In an industry where payment delays are common, disciplined cash flow management ensures that the people moving your freight are never the ones waiting to get paid.

Contact us to learn how tailored cash flow solutions can help you confidently meet payroll, protect driver relationships, and support sustainable fleet growth.

Next in the series

Equipment Maintenance: Financial Strategies to Keep Trucks Road-Ready

- Managing trucks and trailers is as much a financial challenge as an operational one.

- Keeping equipment road-ready, compliant, and cost-efficient in an industry where expenses are high and margins are tight is a constant challenge for most trucking companies.

- Delayed maintenance often leads to breakdowns, higher costs, safety risks, and lost revenue. Yet, when freight volumes surge or cash flow tightens, it’s tempting for operators to delay maintenance, trading short-term savings for long-term costs.

- Tailored financial strategies provide the working capital needed to stay operational, safe, and profitable.

View the complete Table of Contents.

Key Takeaways

- Keeping professional, careful, and loyal drivers behind the wheel is critical.

- For most trucking companies, payroll isn’t just an expense – it’s an investment in the stability of the entire operation and a driving force behind growth.

- As trucking companies grow, payroll shifts from a manageable, variable expense into one of the largest and most inflexible financial obligations, requiring consistent cash outflows regardless of load volume, payment timing, or market conditions.

- In an industry where payment delays are common, disciplined cash flow management ensures that the people moving your freight are never the ones waiting to get paid.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.