Trucks and trailers are the workhorses of every trucking company. These assets keep freight moving, revenue flowing, and customers satisfied. But, as fleets expand or age out, owners face a critical decision: whether to lease or buy new or used equipment?

Each strategy has advantages, depending on your company’s financial strength, operational priorities, and growth goals. The best option is the one that aligns with your company’s cash flow position and long-term strategy. Understanding when each strategy makes sense can mean the difference between growth and financial strain.

Financial stability and disciplined equipment management are essential to every successful trucking business. This article is part of a guide designed to provide fleet owners and managers with actionable financial strategies to enhance operational reliability and profitability.

About the guide: A Trucker’s Guide to Cash Flow Management is a strategy blueprint and best-practice resource designed to help fleet owners and managers optimize working capital, control costs, and build financially resilient operations that keep trucks moving and business profitable.

In this article, we explore the challenges of equipment acquisition and replacement, and how specialized cash flow solutions provide the working capital needed to replace assets, upgrade equipment, or expand fleets.

What’s at stake?

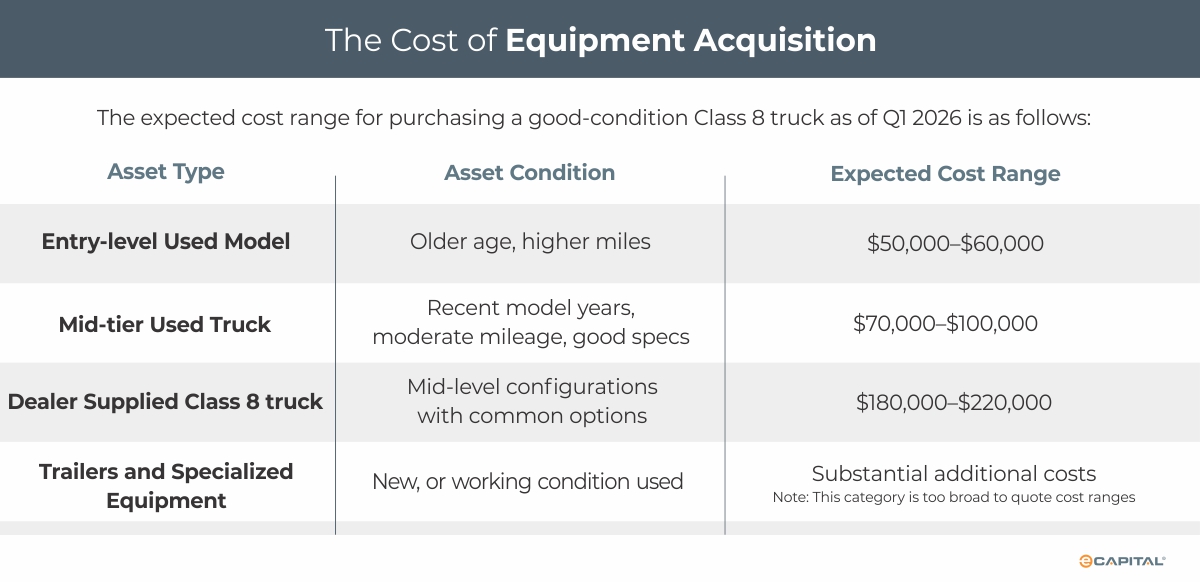

Because working equipment directly affects fuel efficiency, maintenance costs, reliability, and tax implications, every purchase or lease decision has long-term financial outcomes. The cost of acquiring equipment is one of the most significant financial burdens for trucking companies. For most operations, trucks and trailers represent the largest capital investment and a major determinant of cash flow, profitability, and growth capacity.

To stay competitive and profitable, a sound cost-benefit analysis is essential when deciding between used or new, and leasing or purchasing.

Used or New

When deciding between new or used trucks, fleets must balance cost, reliability, and growth goals. The right choice depends on a company’s cash flow, maintenance capabilities, and long-term strategy.

- Used equipment supports fast, cost-effective growth by lowering upfront costs and reducing financing barriers. It allows fleets to add capacity quickly, test new routes, or expand operations without taking on heavy debt.

Although the upfront and monthly carrying costs are substantially lower than those of new equipment, the trade-off is typically higher maintenance requirements and a shorter service life.

- New equipment supports stability and uptime because it’s under warranty, less prone to breakdowns, and equipped with the latest technology for efficiency. This means fewer service interruptions and more predictable operating costs, however, new trucks come with higher upfront costs and faster depreciation.

Ultimately, the best option is the one that aligns with your fleet’s financial position, operational priorities, and long-term growth strategy. Consulting with your accountant, financial advisor, or financing partner is the best way to determine which option strengthens your cash flow, supports your goals, and positions your fleet for sustainable growth.

The next decision is whether to lease or buy.

The Case for Leasing

Trucking companies can lease both new and used trucks and trailers, though the structure and availability depend on the lessor and the equipment’s condition.

- Used equipment leasing is available but less standardized. However, these leases may come with shorter terms, higher maintenance responsibilities, and stricter condition requirements due to the higher risk of wear and depreciation.

- New equipment leasing is more common. These leases often include warranties and maintenance plans, making them attractive for fleets seeking reliability and lower downtime.

Whether acquiring used or new, leasing provides flexibility. Instead of a large upfront purchase, leasing allows you to use equipment for a fixed term with relatively low monthly payments.

Leasing is best when:

- You prioritize cash flow and flexibility over long-term ownership.

- You want to regularly upgrade equipment to meet compliance and efficiency standards.

- Maintenance and repair costs are included in your lease agreement.

- You’re expanding quickly and need to deploy equipment without heavy capital investment.

Key advantages:

- Lower upfront costs and preserved working capital.

- Easier disposal – simply return or renew the lease at the end of the term.

- Reduced maintenance risk when covered by the lessor.

However, leasing can entail higher lifetime costs and limited equity, as you’re essentially renting the asset.

The Case for Purchasing through Financing

Buying equipment, whether new or used, builds equity and offers more control. Loans spread the cost over time, but ownership means you retain full use and potential resale value once it’s paid off.

Purchasing is best when:

- You plan to keep trucks for several years and want long-term ROI.

- Your company’s cash flow is stable enough to support financing.

- You want to customize or modify equipment as needed.

- You’re focused on the total cost of ownership rather than short-term flexibility.

Key advantages:

- Full ownership and equity buildup over time.

- Freedom to sell or refinance equipment.

- Greater flexibility to customize or upfit the truck for your specific operations.

Because purchasing costs represent the largest capital expense for most trucking companies, financing is generally required.

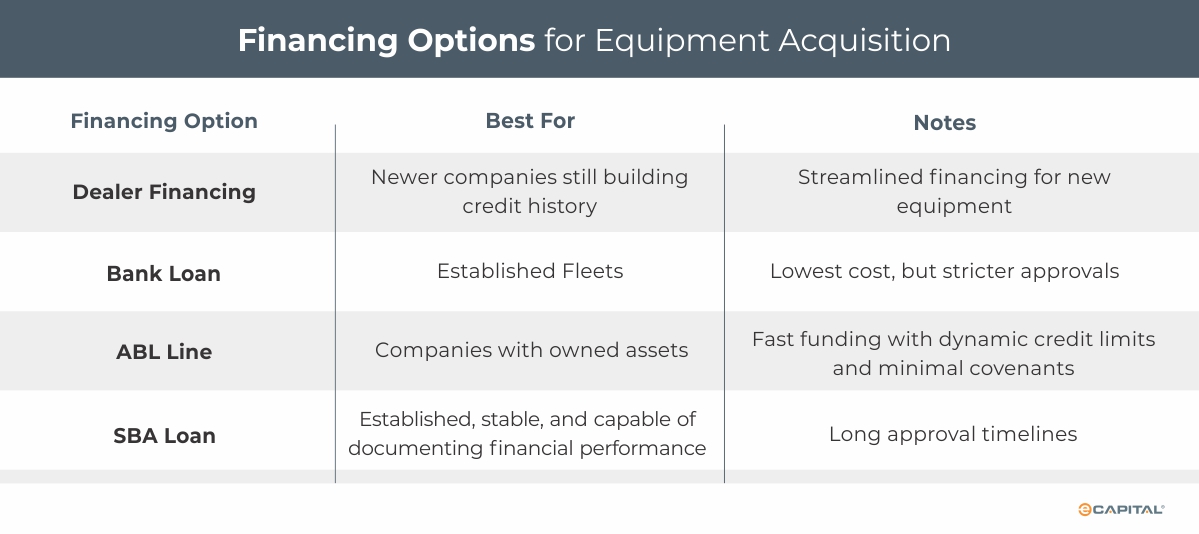

Financing your purchase

Banks typically evaluate credit strength, debt-to-income ratios, and collateral value – criteria that many small or mid-sized carriers struggle to meet. Long approval processes and rigid loan structures don’t align well with the dynamic nature of the freight industry, where cash flow ebbs and flows with load volume, rates, and seasonality.

Fortunately, fintech companies that specialize in transportation offer alternative financing solutions. Fast, flexible funding tools like freight factoring and asset-based lending (ABL) improve cash flow and stabilize financial structures. This improved stability builds financial stability, which lenders look for, helping companies meet the criteria for bank or leasing approval.

How Freight Factoring and ABL Help

Both factoring and ABL are tailored financial structures designed to align with your company’s cash flow cycles.

Why these options often outperform traditional loans:

- Fast approvals and funding times.

- Credit decisions based on asset strength, not just your credit score.

- Minimal covenants create flexible structures that scale with revenue and seasonal demand.

- No long-term debt burden – funding grows and contracts with your business activity.

Freight factoring converts unpaid invoices into immediate cash. Instead of waiting 30, 60, or 90 days for payment, you get funds as quickly as one hour from a funding request.

Funds can be used to:

- Make down payments or lease deposits.

- Cover regular loan or lease payments.

- Purchase used equipment outright.

Asset-based lending (ABL) unlocks working capital by using assets, such as receivables and equipment, as collateral. This creates a revolving line of credit that grows with your business, providing immediate and ongoing access to substantial capital for fleet renewal or expansion.

Funds can be used to:

- Purchase one or more pieces of new or used equipment outright.

- Support strategic business initiatives to scale operations.

- Fund strategic acquisitions such as buying another carrier, opening terminals, or entering new markets.

Conclusion

Ultimately, the ability to acquire and maintain reliable equipment comes down to strong cash-flow management and the right financing strategy. By leveraging solutions like freight factoring and ABL, trucking companies can protect working capital, secure better financing terms, and strengthen their long-term growth potential.

- Lease when you want flexibility, lower upfront costs, and newer equipment on a predictable schedule.

- Buy when you’re focused on long-term value, customization, and ownership equity.

- Use factoring or ABL to strengthen your cash position and fund either strategy – without waiting on bank approvals.

Contact us to explore how freight factoring and ABL can help you fund new or used equipment, maintain steady operations, and drive profitability – no matter which acquisition strategy you choose.

Next in the series

Maximizing Equipment Utilization – How to Keep Trucks Moving and Profitable

- Maximizing equipment utilization is one of the most important operational levers for growing and protecting fleet margins.

- Resilient fleets don’t chase nonstop movement – they build systems that keep trucks moving consistently and profitably.

- Most utilization problems don’t start with dispatch mistakes. They start with cash flow constraints that ripple through operations. Cash flow is a key determinant of whether trucks can be deployed when freight is available.

- By aligning financial strategy with operating reality, trucking companies can reduce downtime, protect margins, and grow safely – ensuring that trucks, drivers, and capital work in sync.

Key Takeaways

- Because working equipment directly affects fuel efficiency, maintenance costs, and reliability, every purchase or lease decision has long-term financial implications.

- As fleets expand or age out, owners face a critical decision: whether to lease or buy new or used equipment?

- The best option is the one that aligns with your company’s cash flow position and long-term strategy.

- Ultimately, the ability to acquire and maintain reliable equipment comes down to strong cash-flow management and the right financing strategy.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.