Low-growth freight markets test even the most experienced trucking operators. When load volumes stagnate, spot rates soften, and competition intensifies – acquiring consistent, profitable freight becomes significantly harder. In these environments, trucking companies must compete on price and service quality. To secure new opportunities, preserve reliable revenue streams, and maintain predictable cash flow, they have to act quickly with agile operations to outperform competitors.

Low-growth markets do not eliminate opportunity – they reshape it. Carriers that adapt how they source freight, prioritize the right types of loads, and strengthen their networks can stabilize volume and protect cash flow even when demand is muted.

Agile operations and effective cash flow management are essential to gain momentum as the market rebalances. This article is part of a guide designed to provide fleet owners and managers with actionable financial strategies to enhance operational reliability and profitability.

About the guide: A Trucker’s Guide to Cash Flow Management is a strategy blueprint and best-practice resource designed to help fleet owners and managers optimize working capital, control costs, and build financially resilient operations that keep trucks moving and business profitable.

When volume tightens and competition intensifies, carriers and brokers that prioritize load quality, strengthen relationships, optimize lanes, and align freight decisions with cash flow realities are better positioned to stabilize utilization and protect profitability. This article frames load acquisition as a strategic function – one that balances volume, margins, and liquidity to build long-term resilience even in challenging conditions.

Rethinking Load Strategy: Quality Over Quantity

In soft markets, rates come under pressure and optimizing utilization becomes a relentless challenge. As a result, many fleets respond by running harder – accepting lower-paying freight, extending miles, and taking inefficient lanes just to keep trucks moving. Experienced operators understand that chasing every available load often backfires, driving up fuel spend, increasing deadhead, accelerating equipment wear, and reducing revenue per mile.

Over time, this pattern compresses margins and creates greater cash flow strain. In a low-growth market, the goal isn’t simply more loads – it’s disciplined load acquisition that protects utilization, margins, and liquidity.

Resilient trucking companies shift focus from total loads hauled to load quality, measured by:

- Revenue per mile (RPM)

- Consistency and repeatability

- Payment reliability

- Fit with existing lanes and equipment

This mindset shift is foundational to acquiring freight sustainably.

The following are five load acquisition strategies designed to build long-term resilience in challenging conditions:

Strategy #1: Leveraging Load Boards Strategically

Industry leading load boards remain an important tool in low-growth markets, but how they’re used matters.

Instead of passively searching for freight, disciplined operations:

- Monitor specific lanes consistently to identify patterns

- Track brokers who post repeat, reliable freight

- Avoid one-off loads that increase deadhead without margin benefit

- Use load boards to fill gaps – not build the entire business

Load boards work best as a supplemental tool, not a primary growth strategy. Fleets that rely exclusively on spot boards tend to experience the most volatility when markets tighten.

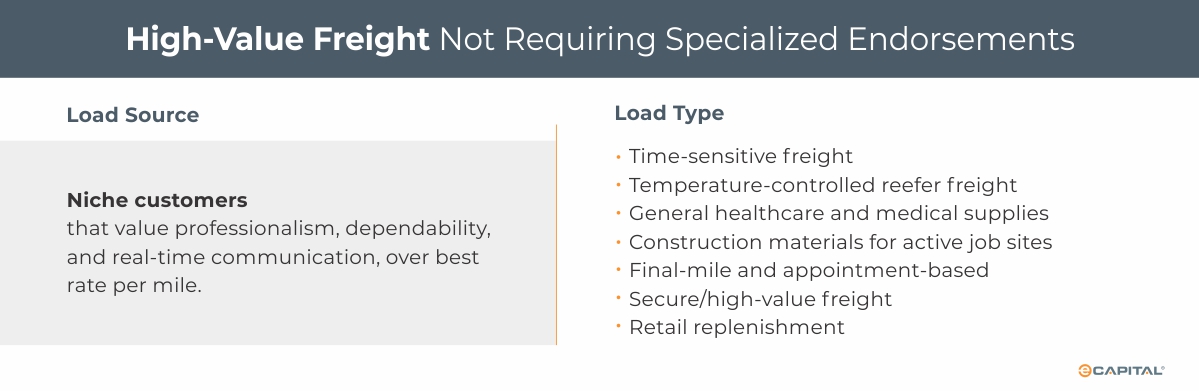

Strategy #2: Targeting Higher-Value Freight Without Specialized Endorsements

Not all freight is created equal. Some loads offer better margins, faster turns, or more consistent demand, without requiring specialized CDL endorsements.

Carriers can improve outcomes by targeting freight that:

- Moves year-round regardless of economic cycles

- Has tighter service requirements that favor reliable carriers

- Commands premium rates due to handling complexity rather than endorsements

Examples of service-sensitive, and/or complexity-driven freight that often offer premium rates includes, but is not limited to the following:

Disciplined, agile operations backed by the financial capacity to respond quickly to emerging opportunities are best positioned to meet the rigorous demands of high-value freight.

Strategy #3: Building Direct Relationships to Reduce Volatility

One of the most effective ways to acquire consistent freight in a low-growth market is through direct relationships with shippers, receivers, and trusted brokers.

Strong relationships:

- Reduce dependence on volatile spot markets

- Improve rate stability

- Increase load predictability

- Shorten payment cycles

Trucking companies that invest time in relationship-building often secure:

- Repeat lanes

- Dedicated or semi-dedicated freight

- First-call opportunities when volume is limited

This requires more than occasional outreach. It means delivering consistently, communicating clearly, and following up professionally after each haul.

Strategy #4: Networking

Networking is often overlooked as a formal business strategy, yet it becomes increasingly valuable in low-growth markets.

Effective networking includes:

- Maintaining relationships with brokers who value reliability over price

- Connecting with other carriers to share overflow or backhaul opportunities

- Participating in industry associations and local business groups

- Leveraging referrals from satisfied customers

In slow markets, freight often moves through trusted relationships before it ever hits public load boards. Being part of those networks increases access to better freight earlier in the cycle.

Strategy #5: Optimizing Lanes and Reducing Deadhead

Acquiring more loads doesn’t always mean finding new customers – it often means optimizing where and how trucks operate.

Lane discipline includes:

- Focusing on core lanes where relationships already exist.

- Not chasing freight that pulls equipment far from profitable networks.

- Conducting backhaul planning to improve utilization, even at lower RPMs.

Reducing deadhead improves revenue per mile and lowers fuel costs – significant contributing factors to preserve margins even when rates are compressed.

The Cash Flow Impact of Load Acquisition Decisions

Effective cash flow management is the system that keeps a trucking business financially stable, resilient, and ready to grow. It provides the liquidity to operate efficiently, ensuring trucks can be fueled, maintained, and driven by professionals to meet customer expectations. Acquisition decisions directly affect cash flow, not just revenue.

Accepting freight without considering payment reliability can create liquidity strain, even when loads appear profitable on paper.

Resilient trucking companies evaluate loads based on:

- Rate quality

- Payment terms

- Dispute risk

- Impact on cash conversion timing

Cash flow discipline ensures that load acquisition strengthens the business rather than destabilizing it. Use a credit check tool for fast verification of a customer’s ability to pay before accepting new loads.

How Financial Flexibility Supports Load Stability

In low-growth environments, financial flexibility is a competitive advantage.

Trucking companies with stable access to working capital can:

- Be selective with freight instead of reactive

- Decline unprofitable loads without risking payroll or fuel coverage

- Invest in relationship-building rather than short-term survival

- Maintain service levels that attract repeat business

When cash flow is predictable, operators can focus on long-term load strategies instead of day-to-day liquidity pressure.

Adapting Load Strategy to Market Conditions

Low-growth markets reward adaptability. Successful fleets regularly reassess:

- Which freight segments remain resilient

- Which customers prioritize service over price

- Where operational efficiency can offset rate pressure

Rather than waiting for markets to rebound, disciplined operators adjust their load acquisition strategy to current conditions – positioning themselves to grow when demand returns.

Conclusion

Acquiring more loads in a low-growth freight market requires more than working harder – it requires working smarter. By prioritizing load quality, strengthening relationships, optimizing lanes, and aligning freight decisions with cash flow realities, trucking companies can stabilize volume and protect profitability even in challenging conditions.

This article is part of a broader educational series designed to help trucking company owners and fleet managers navigate volatility with discipline and confidence. In low-growth environments, success belongs to carriers who treat load acquisition as a strategic function – one that balances volume, margins, and liquidity to build long-term resilience.

When growth slows, strategy matters more.

Contact us to learn how effective cash flow management can help stabilize utilization, protect margins, and position your fleet for long-term resilience – even in challenging freight markets.

Next in the series

How Does Artificial Intelligence (AI) Improve Fleet Efficiencies In Freight Transportation

- Many transportation companies already utilize AI tools to leverage machine learning, big data analytics, and AI-enabled devices to increase profit margins and expand their competitive edge.

- AI technology is used to automate operational efficiencies, lower costs, and reduce the risk of human error.

- Investments in technology is no longer a privilege for large, profitable fleets – it is a necessity for all trucking companies.

- Alternative lenders specializing in transportation financing offer cost-effective funding solutions providing the working capital needed to invest in AI.

Key Takeaways

- Low-growth markets do not eliminate opportunity – they reshape it.

- Chasing every available load often backfires, driving up fuel spend, increasing deadhead, accelerating equipment wear, and reducing revenue per mile.

- Over time, this pattern compresses margins and creates greater cash flow strain.

- By prioritizing load quality, strengthening relationships, optimizing lanes, and aligning freight decisions with cash flow realities, trucking companies can stabilize volume and protect profitability even in challenging conditions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.