SUPPLY CHAIN FINANCE FOR SUPPLIERS

Accelerate payments from your buyers

Stop waiting on long payment terms—get paid faster with our best-in-class supply chain finance solution. Unlock cash flow, reduce risk, and fuel growth without delays.

Stop waiting on long payment terms—get paid faster with our best-in-class supply chain finance solution. Unlock cash flow, reduce risk, and fuel growth without delays.

Cash flow isn’t just about covering expenses—it’s about seizing opportunities. Supply chain finance helps you get paid faster and reduce financial strain at low costs. Gain the flexibility to invest in growth, meet demand, and strengthen your competitive edge—all without taking on debt.

Get paid early on approved invoices—without taking on debt or chasing collections.

Improve supply chain efficiency with a steady, predictable cash flow.

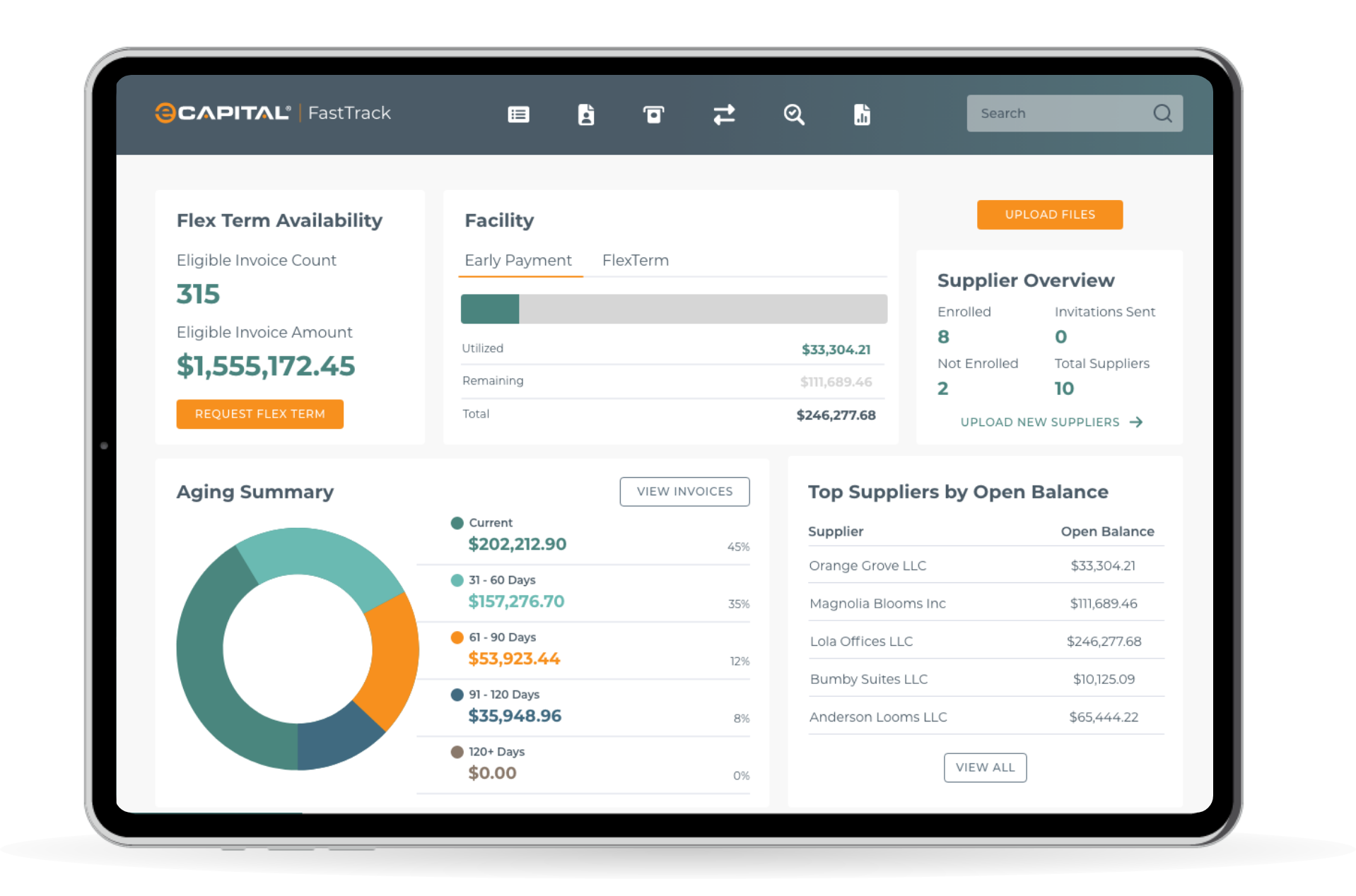

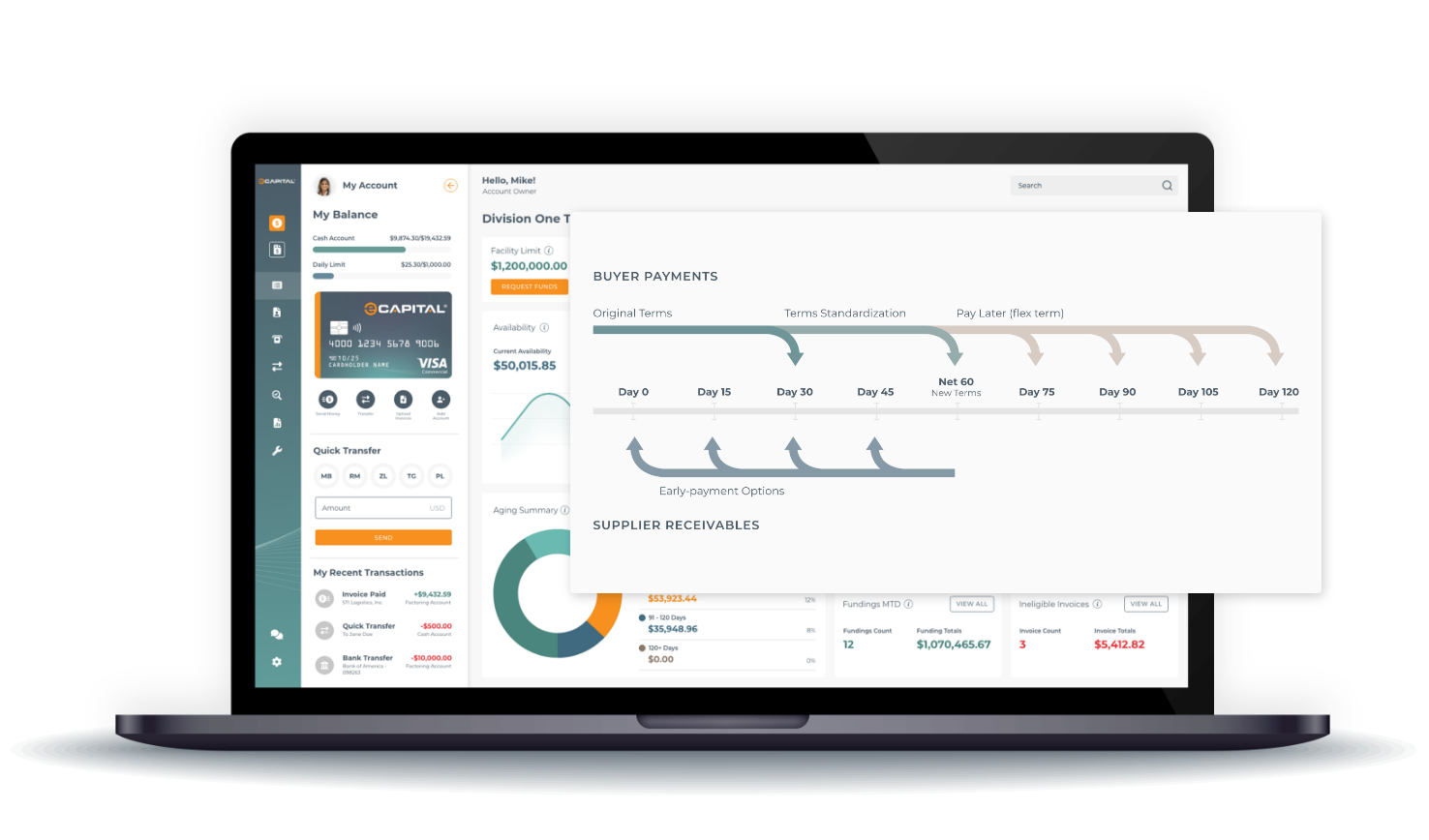

Optimizing working capital in the supply chain often means buyers extending payment terms at your expense. Supply chain finance flips the script—allowing early payments for suppliers while strengthening all parties liquidity and supply chain stability.

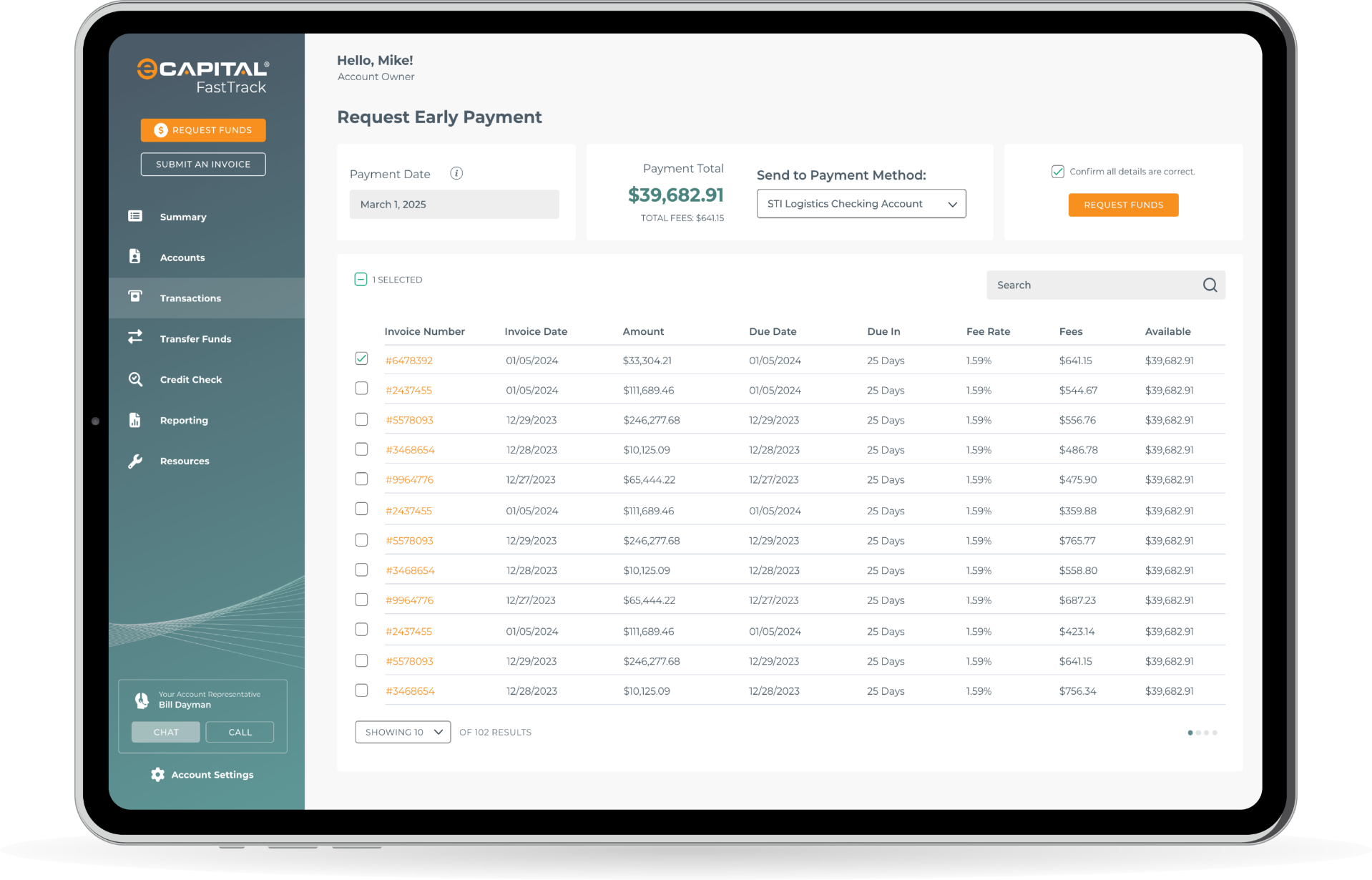

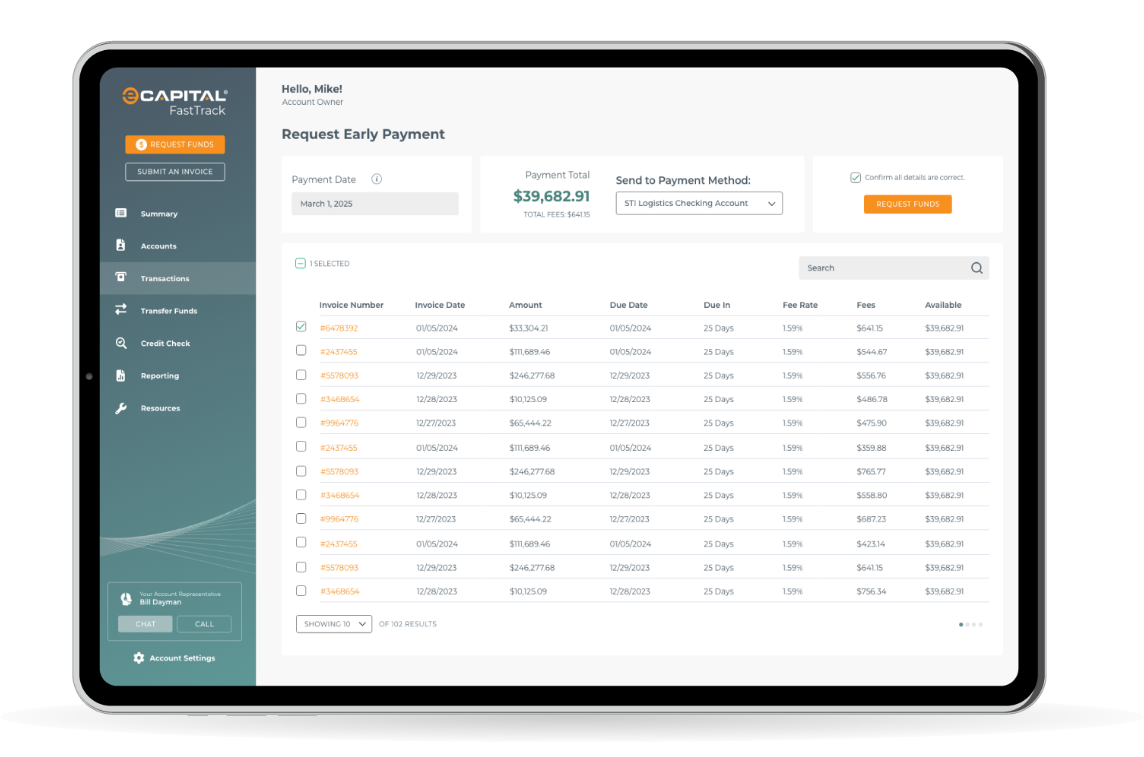

Our platform is simple, intuitive, and secure. Select invoices and receive early payment electronically in as little as one business day from any device.

Supplier enrollment is quick and easy—you can sign up in just two minutes with no invasive background checks, complicated liens, or personal information required. We’ll verify your bank and confirm you’re an authorized supplier, and you’ll be ready to start accessing on-demand payments.

Clients choose eCapital when they need an engaged, solutions-oriented, long-term credit partner with proven capacity, creativity, and continuity. Our expertise is customization—whether on a $5 million or $150 million facility, employing a meticulous, hands-on strategies.

Our tight-knit group of financing experts are agile and client-centric, yet backed by extensive resources with the scale to conquer any challenge. This means we are going to be a better credit partner through every business cycle, bringing capabilities and passion—as patient, flexible problem-solvers—other providers simply do not have. Our track record speaks for itself.

"*" indicates required fields

Supply Chain Finance is a buyer-led financing solution that allows suppliers to receive early payment on approved invoices, while the buyer extends their payment terms. It improves working capital for both parties and strengthens supply chain relationships.

Once a buyer approves a supplier’s invoice, a third-party funder (like a specialty lender or fintech platform) pays the supplier early—often within days. The buyer then repays the funder at the agreed-upon, extended due date. This creates a win-win: suppliers get paid faster, and buyers keep their cash longer.

Faster access to cash, often within 1–3 days of invoice approval

Improved liquidity without taking on debt

Lower-cost financing based on the buyer’s credit, not their own

Increased predictability in cash flow and payment cycles

SCF is ideal for mid-size to large buyers with strong credit and significant supplier networks, and for suppliers who want to access working capital quickly without borrowing against their own credit.

Not necessarily. SCF is designed to enhance—not disrupt—supplier relationships. Participation is usually voluntary for suppliers, and buyers can roll it out selectively across their vendor base.

For suppliers, SCF typically does not appear as debt since they’re receiving early payment for an approved invoice. For buyers, it’s often treated as a trade payable rather than financial debt, depending on how it’s structured and accounted for.