What is SCF - An Essential Guide to Supply Chain Finance

Content

In today’s fast-paced global economy, maintaining a healthy cash flow is more crucial than ever for businesses across the supply chain. Supply Chain Finance (SCF) has emerged as a vital financial tool to enhance efficiency, improve liquidity, and strengthen relationships between buyers and suppliers. This guide delves into the nuances of SCF, outlining its history, variations, how it works, and its impact on the global supply chain.

What is SCF (Supply Chain Finance)?

Let’s start by clarifying what is SCF, and what role it plays in optimizing cash flow along the supply chain. Supply Chain Finance (SCF), also known as Supplier Finance, is a collection of financial solutions designed to enhance cash flow management for buyers and suppliers. It achieves this by enabling companies to extend the time to pay invoices, while simultaneously offering an early payment option to suppliers.

This approach creates a mutually beneficial scenario for both buyers and suppliers to optimize financial efficiency across the supply chain. Buyers can better manage their working capital, while suppliers gain access to increased operating cash flow, thereby reducing risk throughout the supply chain.

History of SCF

Let’s first explore what is SCF by looking at its history to fully appreciate and understand its significance in modern finance.

Supply Chain Finance has its roots tracing back to methods of financing trade and ensuring liquidity in supply chains that have existed for centuries. However, the modern form of SCF began to take shape in the late 20th century.

Here’s a brief overview of its development:

Early Beginnings: Trade finance, the ancestor of SCF, has been around for thousands of years, facilitating trade and commerce through various financial instruments like letters of credit and bills of exchange. These tools provided the foundation for what would eventually evolve into more sophisticated forms of financing aimed at optimizing the supply chain.

1970s-1980s – The Concept of Just-In-Time (JIT): The JIT inventory strategy from the 1970s emphasized lean supply chains and efficient capital use. This approach paved the way for modern supply chain financing innovations, as companies sought ways to minimize inventory costs and improve cash flow efficiency.

1990s – Emergence of Supply Chain Management: The 1990s saw the rise of supply chain management as a strategic discipline, leading to the exploration of how financial solutions could be integrated into supply chain strategies to improve efficiency and reduce costs. This was the dawning of a new era in which companies began to recognize what is SCF and how it benefits suppliers and buyers.

Early 2000s – Formalization of SCF: Leveraging the rise of the internet and fintech advancements, financial institutions and tech firms developed structured Supply Chain Financing programs. Awareness of what is SCF grew as companies discovered the benefits of arranging short-term financing to optimize working capital for both buyers and suppliers.

2008 Financial Crisis – A Catalyst for Growth: The global financial crisis of 2008 was a significant catalyst for the growth of SCF. As traditional forms of credit became more difficult to obtain, many businesses discovered what is SCF and employed its use to secure financing and ensure liquidity. The crisis underscored the importance of having efficient, resilient supply chains, further driving interest in SCF solutions.

2010s to Present – Technological Advancements and Expansion: Significant technological advancements, such as the rise of blockchain, artificial intelligence, and big data analytics, have further refined and expanded the capabilities of SCF. These technologies have made it possible to automate many aspects of SCF, reduce risks, and enhance transparency across the supply chain.

Today, SCF is recognized as a critical tool for companies looking to optimize their working capital, improve liquidity, and strengthen their supply chain relationships. Awareness of what is SCF and its benefits continues to grow as new technologies emerge and global supply chains become even more complex and interconnected.

Understanding SCF Variations

Understanding what is SCF can be convoluted as it is a broad term that encompasses various financial solutions designed to optimize the working capital and liquidity of both buyers and suppliers in the supply chain.

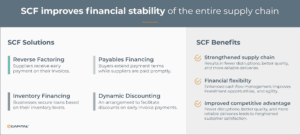

SCF variations include several mechanisms, such as:

Reverse Factoring: Where suppliers receive early payment on their invoices from a third party, typically a factoring company, based on the buyer’s creditworthiness. A deeper knowledge of reverse factoring provides a better understanding of what is SCF.

Payables Financing: Where buyers extend their payment terms and use SCF solutions to manage the extended periods.

Inventory Financing: Where businesses secure loans based on their inventory levels.

Dynamic Discounting: Where buyers offer discounts to suppliers for early payment of invoices.

In general, SCF refers to a set of solutions that optimize cash flow by facilitating early payments to suppliers and extending payment terms for buyers. This financial innovation creates a win-win situation both buyers and suppliers, enhancing the financial stability of the entire supply chain.

A Win-win for Buyers and Suppliers

SCF improves the financial stability of the entire supply chain, facilitating a win-win situation for both buyers and suppliers.

When companies and their suppliers have a full understanding of what is SCF and take advantage of its benefits, the stability of the entire supply chain is strengthened.

The following are three of the significant outcomes expected from the utilization of SCF:

Strengthened Supply Chain: The overall health and efficiency of the supply chain improves due to enhanced financial stability, leading to fewer disruptions, better quality, and more reliable deliveries.

Financial Flexibility: Both parties gain greater financial flexibility, allowing for better cash flow management, investment in growth opportunities, and adaptation to market changes.

Improved Competitive Advantage: Companies that are part of a supply chain finance program can enjoy a competitive advantage through more efficient operations, better financial health, and stronger partnerships.

How SCF Works

Implementing SCF is a simple process. Here’s how it works:

- A Buyer Initiated Program: In most SCF arrangements, the buyer initiates the program to benefit both parties. The buyer collaborates with a financial institution, experienced in what is SCF, to set up a system where suppliers can receive early payments on approved invoices.

- Supplier Delivers Goods/Services: The supplier delivers the products or services to the buyer and submits an invoice.

- Buyer Approves Invoice: The buyer reviews and approves the invoice.

- Supplier Seeks Early Payment: The supplier, seeking quicker access to cash, can use a SCF solution to get paid earlier.

- Financial Provider Pays Supplier: The financial provider pays the supplier early (usually at a discount) and takes over the collection of the invoice.

- Buyer Repays Financial Institution: On the agreed payment date (which might be the original due date or a different one), the buyer repays the financial provider.

A complete understanding of what is SCF and implementing an effective program to optimize financial efficiency across the supply chain requires collaboration with a trusted financial provider. Businesses should consider their supply chain’s specific needs, assess their eligibility and the creditworthiness of their suppliers, and select a financing provider that offers competitive rates and seamless integration with existing processes.

In today’s global economy, supply chains span continents, connecting multinational buyers with a varied network of suppliers located in different countries. Be sure to select a financial provider with expertise in what is SCF. Experienced specialized lenders, knowing what is SCF and how it optimizes cash flow along the supply chain, helps corporations free up the working capital they have tied within their supply chains.

Conclusion

Understanding what is SCF and applying its benefits can play a pivotal role in enhancing the resilience and competitiveness of businesses in the global market. SCF (supply chain financing) is a powerful collection of financial solutions offering tangible benefits to buyers and suppliers alike. Adopting innovative solutions like SCF will be key to navigating the complexities of global supply chains by improving cash flow, reducing financial risks, and strengthening supply chain relationships.

Contact us today to clarify what is SCF, how it will enhance efficiency, improve liquidity, and strengthen relationships with your suppliers.

Request a free financing consultation and see what we can do to help maximize your company’s cash flow efficiency.

Key Takeaways

- Supply Chain Finance (SCF) has emerged as a vital financial tool to enhance efficiency, improve liquidity, and strengthen relationships between buyers and suppliers.

- SCF refers to a set of solutions that optimize cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their suppliers to get paid earlier.

- Understanding what is SCF and applying its benefits can play a pivotal role in enhancing the resilience and competitiveness of businesses in the global market.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.