Trucking is traditionally a low-profit industry. But as inflation, low demand, low rates, and high competition continue to ravage the industry in 2023, trucking companies are struggling just to break even. With spot rates remaining low, and contracts harder to find, increasing revenue has become ever more difficult. In this environment, the most effective way to remain profitable is to reduce operational expenses to lower your company’s cost-per-mile.

The purchasing of diesel fuel represents 39% of your trucking company’s regular operational expenses. Any savings in this category will generate significant improvements to your bottom line. Fuel card programs, designed specifically for the trucking industry, provide extended payment terms, cost control measures, and more savings than commercial credit cards!

If you read no further, here’s the main takeaway of this article:

Fuel cards provide discounts up to $0.20 per gallon!

Do the math, over a 12 month period, that’s a lot of savings to improve your bottom line!

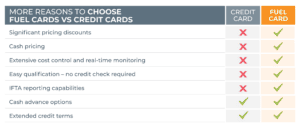

However, fuel cards provide much more than cost reduction. Read on to learn the difference between the features and benefits of fuel and credit cards. This information will equip you to make an informed decision when choosing the most effective purchasing program for the procurement of diesel fuel.

The main differences between fuel cards and credit cards

The principal differences between fuel cards and credit cards are savings and cost control. To better explain the difference, let’s start with a brief description of both cards.

Fuel cards, or fleet cards, are payment systems used to purchase diesel and other transport-related items at truck stops and fueling stations. These cards provide substantial discounts on the price of fuel, a significant benefit for struggling trucking companies!

Depending on your chosen card, additional features may include credit terms on all fuel purchases to keep more money in your pocket longer and cash advance options to provide drivers with cash in hand to cover over-the-road expenses. A robust online fuel management portal typically accompanies these payment systems to monitor transactions, control expenditures, and assist with IFTA reporting.

Credit cards are payment systems that allow users to borrow funds to pay for all types of goods and services with merchants that accept cards for payment. No discounts are provided when purchasing items, but some company owners do get reward points for purchases. As alluring as this may be, no reward program can match the value of pricing discounts provided by leading fuel card providers.

In short, fuel cards have a specific purpose – to maximize your company’s purchasing power and deliver more expense control when purchasing fuel. Credit cards have a more general purpose, allowing the cardholder to purchase more varied items at more retail locations, but without the deep savings that fuel cards provide.

Now, let’s dive deeper to better understand the full benefits of using fuel cards to improve your trucking company’s bottom line.

1. Cash price vs credit price

To fully appreciate the extent of savings a fuel card provides, you must first consider the difference between cash price and credit price.

As a business owner, you have likely noticed the different prices for diesel fuel based on whether you pay with cash or credit. This is because the fuel station is charged a processing fee by the credit card company every time their customers swipe a credit card. Less aware consumers may miss this difference as not all states require fueling stations to advertise both prices.

Some may advertise a price and charge more if you pay by credit – a credit surcharge

Some may advertise a price and charge less if you pay with cash – a cash discount

Some advertise two prices – one credit price and one cash price

The difference between the two pricing structures can range from $0.05 to $0.10 per gallon with credit being the more expensive option. Fuel card discounts are based on cash prices to provide savings upon savings.

The savings add up!

Let’s look at a commercial truck that consumes the industry average of 20,500 gallons per year to calculate the combined savings by purchasing diesel using a fuel card program instead of a credit card.

A truck that is refueled using cash pricing saves up to $0.10 per gallon.

20,500 gallons x $0.10 = $2,050.00 per year

A truck that is refueled using fuel cards gains additional savings of up to $0.20 per gallon.

20,500 gallons x $0.20 = $4,100.00 per year

The combined saving is $6,150.00 per year per truck simply by using a fuel card program vs a credit card.

Savings are just the start – more ways fuel cards bolster profitability

If huge savings on the cost of fuel isn’t enough to convince you of the real value of fuel cards, keep reading – there’s more!

2. Expense management and control

Fuel cards provide real time monitoring of each transaction. You’ll know when, where, how much, and by whom each purchase was made as it happens. This simplifies fleet management, making it easier to track costs and identify any anomalies.

Some fuel cards also enable you to restrict purchases to certain times of day or specific geographical areas. This level of control can prevent unauthorized spending and reduce instances of fraud. Authorized managers of the account can easily and quickly limit or cut off funds to any cardholder within the company’s program to abate any suspected fraud or misuse of the card.

Tight expense management and control is essential to protect your bottom line in an underperforming market.

Credit cards also provide statements detailing purchases, but they are not as detailed as those from fuel cards. Monthly statements show transactions, but little other data is provided making cost control and card security more difficult to manage.

3. Reporting

Fuel cards provide comprehensive and detailed reporting on account activity allowing your company to analyze fuel consumption trends and guide decisions aimed at cost control. As an added benefit, fuel cards simplify IFTA fuel tax reporting by collecting and consolidating all your fuel and state mileage data into a single, exportable report.

Credit cards have no equivalent reporting capabilities.

4. Credit terms

Fuel cards provide extended payment terms, allowing your company to buy now pay later. When trucking companies combine the fast-funding benefits of freight factoring with a robust fuel card program, trucks can be fueled, perform their P&D service, invoice the job, and get paid well in advance of making payment for the fuel purchase.

Credit cards also provide extended payment terms but impose conditions that cardholders pay back the borrowed money, plus any applicable interest, as well as any additional agreed-upon charges, either in full by the billing date or over time. This can result in accrued debt for trucking companies that don’t regularly pay off their balance owing by the due date. In this economy, reoccurring debt is a condition to be avoided!

5. Qualification

Fuel Cards provided by alternative lenders that specialize if the trucking industry are often bundled together with other financing services, such as freight factoring. Because of this arrangement, qualification does not rely on the borrower’s credit score or business performance level. Instead, it is based on the credit quality of the truckling company’s customers. If your trucking company serves creditworthy customers, the approval process is quick and easy.

Credit cards can be hard to qualify for in an increasingly cautious lending market – especially for trucking companies with bad credit, or who may struggle to meet payments due to cash flow fluctuations. In many cases a personal credit inquiry as needed to support the credit application.

Many fuel card and credit card programs offer similar features, such as cash advance options to improve cash flow. But despite a few commonalities, significant differences separate these as two distinctly different financing options.

Conclusion

Both fuel cards and credit cards have their purposes – many trucking companies opt for a combination of both. Business credit cards provide a line of credit that can be used to purchase anything you need for your business, from supplies to equipment. But they lack the significant savings offered by fuel cards when purchasing diesel. For maximum purchasing power, detailed reporting, control over spending, and industry-specific benefits, the use of fuel cards may be your best bet. They offer you more oversight and huge savings in your fleet’s biggest expense category: fuel.

No matter what you choose, it’s important to regularly review your expenses and adjust your strategy as needed. A well-managed and flexible approach to your expenses can go a long way in ensuring the financial health of your trucking business.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.