This article explores the two main categories of accounting ledgers, identifies the most commonly used ledgers, and their importance for monitoring financial health.

Analyzing the data within accounting ledgers helps companies to determine if external financing is needed to bridge the gap between available resources and financial obligations. Keep reading to discover the importance of ledgers when arranging business financing options.

What are accounting ledgers?

Accounting ledgers are a comprehensive record-keeping system that documents all financial transactions of a business, categorized into individual accounts. Ledgers encompass a variety of accounts derived from journal entries, providing a structured and categorized record of all financial activities.

The top-level accounting ledger (general ledger) is essentially an all-inclusive record providing a comprehensive view of the company’s financial activities. It is used for generating financial statements, such as cash flow statements, balance sheets, and income statements.

The process involves categorizing and consolidating these details into an organized sequence of debits and credits within the ledger, making it known as the second book of entry due to its role in recording information for the second time.

What are the main categories of accounting ledgers

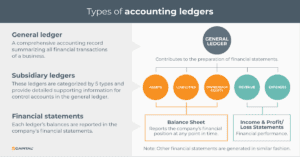

There are primarily two types of ledgers: the general ledger, and subsidiary ledgers.

As the top-level accounting ledger, a general ledger consolidates and summarizes data from subsidiary ledgers (lower level accounting ledgers). Subsidiary ledgers provide detailed information about specific types of transactions, such as accounts receivable or accounts payable.

Each ledger serves a unique purpose in financial reporting and analysis:

- General ledger

The general ledger is the foundation of a company’s accounting system. It contains summary details of all the accounts used to record transactions relating to the company’s assets, liabilities, equity, revenue, and expenses. Every financial transaction flow from the journal to the general ledger. The general ledger provides a complete record of financial transactions over the life of the company and is used to prepare the primary financial statements: the balance sheet, income statement, and cash flow statement.

- Function: Serves as the top-level accounting ledger that consolidates all transactions recorded in various journals.

- Subsidiary ledgers

Subsidiary ledgers, also known as subledgers or subaccounts, are lower-level accounting ledgers containing the details that support a general ledger control account. For instance, if the general ledger has an account receivable control account, the subsidiary ledger for accounts receivable would list individual transactions with customers. Subsidiary ledgers help in tracking detailed information about specific accounts, making it easier to review and manage them without cluttering the general ledger with too much detail.

- Function: Provides a breakdown of the transactions that contribute to balances in the general ledger’s control accounts.

Commonly used subsidiary ledgers

Subsidiary ledgers enhance the organization and management of financial data by breaking down individual accounts into more granular records. These detailed accounting ledgers allow for accurate transaction tracking, and streamlined reporting for specific accounts, aiding in financial analysis and decision-making.

The most common subsidiary ledgers that businesses use to improve financial management include the following:

- Accounts Receivable Ledger (Sales Ledger): Tracks amounts owed by customers, helping businesses manage cash flow and arrange financing through invoice factoring or receivables financing.

- Accounts Payable Ledger: Monitors amounts owed to suppliers, ensuring timely payments and managing working capital.

- Inventory Ledger: Details inventory levels, purchases, and sales, crucial for managing stock and assessing cost of goods sold.

- Fixed Assets Ledger: Records information about a company’s fixed assets, such as property, equipment, and machinery, essential for depreciation calculations and financial reporting.

- Payroll Ledger: Manages employee compensation, benefits, and deductions, aiding in accurate payroll processing and financial planning.

These lower-level accounting ledgers provide detailed insights to support the summary balances recorded in the general ledger’s control accounts.

Monitoring financial health

Regularly analyzing accounting ledgers is akin to taking a business’s vital signs. It allows for the early detection of potential issues and provides the necessary data to make informed decisions. For instance, monitoring cash flow trends can reveal liquidity problems that may require immediate attention, while tracking expenses can highlight areas of overspending or inefficiency. By keeping a vigilant eye on these indicators, businesses can proactively address financial challenges before they escalate into crises.

Determining financing requirements

A critical function of accounting ledgers is to serve as a barometer for determining business financing needs.

When revenues fall short of expenses or capital investments are required for growth opportunities, businesses must reevaluate their financing position. By analyzing the data within accounting ledgers companies can ascertain whether external financing is necessary to bridge the gap between available resources and financial obligations. This assessment enables businesses to make informed decisions about financing options and develop appropriate financing strategies to meet their short-term and long-term financial requirements.

Using accounting ledgers to secure financing

Maintaining accurate ledgers can provide benefits above and beyond enhanced financial management.

Lenders often use accounting ledgers to provide various financing solutions by determining the value and quality of the company’s assets. This information helps lenders assess the collateral value to secure a line of credit or term loan, ensuring that there are sufficient and reliable assets to cover the loan amount in case of default.

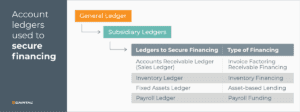

Accounting ledgers can be used to secure various forms of business financing. Here are a few common examples of how ledgers are utilized for this purpose:

- Accounts Receivable Ledger (sales ledger): This ledger details outstanding invoices owed by customers. Lenders can use this information to approve invoice factoring or accounts receivable financing, where the business receives immediate cash based on the value of its receivables.

- Inventory Ledger: This accounting ledger tracks the value and quantity of inventory on hand. Inventory can be used as collateral for inventory financing, where lenders provide funds based on the value of the inventory.

- Fixed Assets Ledger: This ledger lists the company’s fixed assets, such as property, machinery, and equipment. These assets can be used as collateral for asset-based lending, allowing businesses to obtain financing based on the value of their tangible assets.

- Payroll Ledger: This accounting ledger provides detailed information about all payroll-related transactions, ensuring accurate payroll processing and compliance with tax regulations. This information can be used by lenders to approve payroll funding, a specialized financing option for staffing firms.

By maintaining accurate and detailed ledgers, businesses can demonstrate their financial health and the value of their assets to lenders, making it easier to secure various types of financing.

Conclusion

The meticulous recording of transactional data in general and subsidiary ledgers ensures that financial information is accurately recorded, organized, and accessible for making informed business decisions. The information from accounting ledgers is used for preparing financial statements, complying with audit and regulatory requirements, and securing various forms of business financing.

Contact us today to learn about using accounting ledgers to secure fast, flexible financing options to overcome financial challenges and foster long-term success.

Key Takeaways

- Accounting ledgers encompass a variety of accounts derived from journal entries, providing a structured and categorized record of all financial activities.

- The information from ledgers is used for preparing financial statements, assessing the financial health of a business, and securing various forms of business financing.

- Lenders often use accounting ledgers to provide various financing solutions by determining the value and quality of the company’s assets.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.