Unlocking Financial Flexibility: The Key Role of DSCR in Asset-Based Financing

Content

![]() Reviewed by: Bruce Sayer

Reviewed by: Bruce Sayer

As a finance professional, I’ve assisted companies across various industries in achieving financial flexibility by navigating the challenges of securing business financing. A critical metric that consistently plays a pivotal role in determining a company’s eligibility for business financing is its Debt Service Coverage Ratio (DSCR). Understanding and optimizing your DSCR is not just about impressing lenders—it fosters financial flexibility and stability, enabling companies to navigate challenges and capitalize on opportunities confidently. Effective DSCR management helps to unlock financial flexibility and maximize the full potential of your financial strategy, especially when considering asset-based financing.

The Essence of Debt Service Coverage Ratio (DSCR)

At its core, DSCR measures a company’s ability to service its debt with its operating income. It’s a litmus test for financial flexibility and health, indicating whether your business generates enough cash flow to cover loan payments.

A strong DSCR signals robust cash flow generation, indicating how well the business manages its income and expenses. It reflects the company’s financial flexibility and operational profitability. Companies with a healthy DSCR may have greater financial flexibility to expand operations or launch new products, as they are less constrained by debt obligations.

In asset-based financing, where loans are secured against your company’s assets, lenders scrutinize DSCR to gauge the risk involved in lending to your business.

Why DSCR Matters

Imagine setting sail on turbulent financial seas. Your DSCR is the lighthouse guiding you towards a safe harbor—a beacon of your business’s resilience. A good DSCR positions your business as a low-risk borrower and unlocks more favorable loan terms, lower interest rates, and greater financial flexibility. It’s about demonstrating to lenders that your business isn’t just staying afloat but sailing smoothly toward its growth destinations.

Steering Towards a Strong DSCR

While DSCR is primarily a measure of a company’s ability to meet its debt obligations, it also offers valuable insights into its overall financial flexibility, operational efficiency, growth potential, and risk management practices. Navigating towards a strong DSCR involves strategic financial management.

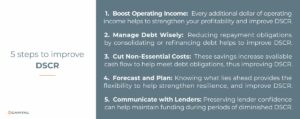

Here are practical tips to optimize your DSCR and enhance your eligibility for asset-based financing:

- Boost Operating Income: Companies able to invest in growth opportunities, such as expanding operations or launching new products, can boost operating income and profitability. Diversify revenue streams and focus on high-margin products or services. Every additional dollar of operating income strengthens your DSCR and increases your financial flexibility.

- Manage Debt Wisely: Refinancing debt can achieve financial flexibility and optimize DSCR by reducing monthly payments and interest rates. Consider extending term dates to reduce monthly carrying costs, or consolidating multiple debts into a single loan with better terms.

- Cut Non-Essential Costs: Cutting non-essential costs can improve a business’s DSCR by increasing available cash flow, which enhances the company’s ability to meet its debt obligations and allows for better adaptation to changing circumstances with enhanced financial flexibility.

- Forecast and Plan: Companies that proactively anticipate future cash flow needs can better plan, allocate resources, and adapt to changing market conditions. Forecasting and planning enhances business financial flexibility, strengthens resilience, and helps to improve DSCR.

- Communicate with Lenders: No matter your company’s circumstance, unexpected events, a turn in market trends, or operational disruption can alter your growth projections and compromise your financial flexibility. If you anticipate a temporary dip in your DSCR, communicate with your lender in advance. Demonstrating awareness and a plan to address the issue can preserve lender confidence, allowing you to maintain funding during periods of diminished returns.

A Real-World Application

Consider “Bella’s Boutique,” a retail business seeking to expand its online presence. By analyzing its financials, Bella’s Boutique identified opportunities to increase its operating income through e-commerce while renegotiating terms with suppliers to reduce costs and increase its financial flexibility.

By implementing these strategies, Bella’s Boutique significantly increased its ability to service debt requirements, improving its DSCR from 1.2 to 1.8. These results significantly enhanced its appeal to asset-based lenders. Based on its improved ratios and collateral strength the company attracted an ABL lender willing to provide the capital needed to pursue its growth goals.

How to Calculate Debt Service Coverage Ratio (DSCR)

Calculating the Debt Service Coverage Ratio (DSCR) involves a straightforward formula that assesses a borrower’s ability to repay debt using its operating income. Here’s how you can calculate DSCR:

DSCR Formula:

DSCR = Net Operating Income (NOI) / Total Debt Service

Components Explained:

- Net Operating Income (NOI): This is the income generated from a company’s everyday operations after all operating expenses have been deducted from total revenue. It’s important to note that this figure excludes income from non-operating sources, taxes, interest expenses, depreciation, and amortization.

- Total Debt Service: This represents the total amount of money required over a given period to cover the repayment of interest and principal on a debt. For annual calculations, this includes all debt obligations for the year.

Step-by-Step Calculation:

- Determine Net Operating Income (NOI):

- Start with your total revenue.

- Subtract all operating expenses (such as wages, rent, materials, and utilities) from the total revenue to get the NOI.

- Calculate Total Debt Service:

- Sum up all the debt payments you must make over the analyzed period. This includes loan principal repayments, interest payments, and lease payments.

- Apply the Formula:

- Divide the NOI by the total debt service to find the DSCR.

Example Calculation:

Let’s say a business has an annual NOI of $500,000 and its total debt service for the year is $250,000.

DSCR = $500,000 / $250,000 = 2

This means the business generates $2 in operating income for every $1 of debt service, indicating a strong ability to cover its debt obligations.

Interpretation:

- A DSCR greater than 1indicates the business has sufficient income to cover its debt payments.

- A DSCR of less than 1suggests the business does not generate enough income to cover its debt service, signaling potential difficulties in meeting debt obligations.

- A DSCR of 1means the business generates just enough income to cover its debt payments, with no surplus.

Lenders often have a minimum DSCR requirement to approve a loan. The higher the DSCR, the more financial flexibility is needed to ensure the borrower can handle the debt service even if income decreases. The required DSCR can vary by lender and type of loan but typically ranges from 1.1 to 1.35 or higher for safer investments.

Conclusion

In the quest for asset-based financing, your DSCR is more than a number—it reflects your business’s financial flexibility and strategic acumen. By focusing on improving your DSCR, you’re not just working towards securing financing; you’re building a stronger, more resilient business capable of navigating the challenges and opportunities of the modern marketplace.

Remember, the journey to a strong DSCR is ongoing. It requires constant vigilance, strategic planning, and a commitment to financial excellence. But the rewards—a thriving business equipped with the resources to pursue its goals—are well worth the effort. So, set your sights on that financial lighthouse and steer your business towards success.

Key Takeaways

- A critical metric in determining a company’s eligibility for business financing is its debt service coverage ratio (DSCR).

- DSCR measures a company’s ability to service its debt with its operating income. It’s a litmus test for financial flexibility and health.

- Effective DSCR management helps to unlock financial flexibility and maximize the full potential of your financial strategy.

- By focusing on improving your DSCR, you’re not just working towards securing financing; you’re building a stronger, more resilient business capable of navigating the challenges and opportunities of the modern marketplace.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.

James Poston

James is an experienced product expert in receivables financing, trade finance including purchase order financing, and asset-based lending. In his role, he oversees eCapital’s sales strategy by driving business development and creating unified revenue generation processes across our organization. Utilizing his experience in developing strategic relationships and nurturing strong networks, James is positioned to expand our company’s market footprint and industry associations.

Prior to joining the eCapital organization, James served as Executive Vice President and Sales Director for Bibby Financial Services Canada. During that time, he participated in all aspects of the organization including operations, credit and finally business development where he was named a 40 under 40 Award recipient by Secured Finance Network.

James is a Chartered Professional Accountant and Certified Management Accountant and holds a Bachelor of Economics degree with concentrations in international relations and political economy from McGill University.