Unlocking Growth: The Power of Debtor Finance for Leading Organizations

Content

- What is Debtor Finance?

- Does the term “debtor finance” historically refer to what is now commonly known as accounts receivable financing?

- The Mechanism

- Immediate Access to Working Capital

- Enhances Financial Stability

- Supports Growth and Expansion

- Reduces the Need for Debt

- Improves Debt Management

- Offers Competitive Advantage

- Streamlines Operations

- Flexibility and Scalability

- Implementing Debtor Finance

- Debtor Finance FAQs

- Conclusion

- Key Takeaways

In today’s fast-paced and competitive business landscape, maintaining a steady flow of capital is crucial for sustained growth and market leadership. For many leading organizations, debtor finance has emerged as a strategic financial tool to unlock growth potential and navigate the challenges of cash flow management. This article explores how debtor finance can empower market-leading organizations to further their dominance and achieve their ambitious growth targets.

What is Debtor Finance?

Debtor finance, also known as invoice financing or accounts receivable financing, is a financial arrangement where businesses use their outstanding invoices as collateral to secure immediate funding. Instead of waiting for customers to pay within their usual credit terms, organizations can access a significant portion of the invoice value upfront, thereby accelerating cash flow and enhancing their ability to invest in growth initiatives.

Debtor finance refers to a financial strategy where a business utilizes its accounts receivable ledger, or the outstanding invoices owed by customers, as collateral to secure funding. This approach is particularly beneficial for companies experiencing low working capital reserves, which can lead to cash flow challenges, especially when invoices are subject to net 30 payment terms. By financing these slow-paying invoices, debtor finance solutions enhance a company’s cash flow, enabling it to more effectively manage and meet its operating expenses.

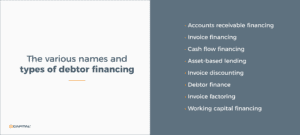

There are various types of debtor financing solutions available, including invoice discounting, invoice factoring, cash flow finance, asset-based lending, invoice finance, and working capital finance. Each of these options provides a mechanism for businesses to unlock the value tied up in their accounts receivable, thereby improving liquidity and financial stability.

Does the term “debtor finance” historically refer to what is now commonly known as accounts receivable financing?

Yes, “debtor finance” is often used interchangeably with “accounts receivable financing.”

Both terms refer to the financial arrangement where a business uses its accounts receivable (the money owed by customers for goods or services delivered on credit) as collateral to secure immediate funding from a finance provider. This type of financing helps businesses improve their cash flow by providing them with immediate access to a portion of the money tied up in unpaid invoices, rather than waiting for the usual credit terms to expire.

While the term “debtor finance” might be more commonly used in certain regions or by certain financial institutions, the concept remains the same across different terminologies, including invoice financing, receivables financing, and accounts receivable financing.

The Mechanism

The process involves selling your outstanding invoices to a finance provider, who then advances you up to 90% of the invoice value within 24 to 48 hours. The remaining balance, minus a fee, is paid once the customer settles the invoice. This setup not only injects immediate working capital into the business but also mitigates the risk of delayed payments.

How Does Debtor Financing Improve Cash Flow and Create a Strategic Advantage?

Immediate Access to Working Capital

Fast Funding: Instead of waiting for the usual 30, 60, or even 90 days for customers to pay, debtor financing provides businesses with up to 90% of the invoice value almost immediately. This rapid infusion of cash ensures that businesses have the funds needed for daily operations, purchasing inventory, and other short-term financial commitments.

Enhances Financial Stability

Predictable Cash Flow: By converting sales into cash without the wait, debtor financing offers a more predictable cash flow, enabling businesses to plan and budget with greater accuracy. This stability is crucial for meeting regular expenses like payroll, rent, and utility bills on time.

Supports Growth and Expansion

Investment Opportunities: With improved liquidity, businesses can seize growth opportunities more readily, such as expanding into new markets, increasing production capacity, or investing in marketing efforts without the constraint of slow-paying invoices.

Reduces the Need for Debt

Alternative to Traditional Loans: Debtor financing provides an alternative to taking on new debt. Since the financing is secured by invoices, it does not incur traditional debt or affect a business’s debt-to-equity ratio, preserving the company’s credit rating and borrowing capacity.

Improves Debt Management

Paying Off Existing Debts: The immediate cash flow from debtor financing can be used to reduce or eliminate existing debts, lowering interest expenses and improving the overall financial health of the business.

Offers Competitive Advantage

Agility in the Market: Enhanced cash flow from debtor financing allows businesses to respond more quickly to market changes and customer demands, providing a competitive edge in tight markets.

Streamlines Operations

Focus on Core Activities: With cash flow concerns addressed, management can focus on core business activities, innovation, and strategy, rather than spending time and resources on chasing payments or managing cash flow gaps.

Flexibility and Scalability

Adapts to Business Needs: Debtor financing is highly flexible, with the amount of financing available growing in tandem with the business’s sales. This scalability ensures that as a business expands, its financing capabilities can adjust accordingly.

In summary, debtor financing is a powerful mechanism for improving cash flow, offering businesses immediate access to working capital without the need for additional debt. By alleviating the pressure of waiting for customer payments, companies can maintain operational efficiency, invest in growth, and navigate financial challenges more effectively.

Implementing Debtor Finance

Integration and Technology

Advancements in financial technology have streamlined the debtor finance process, allowing for seamless integration with a company’s accounting systems. Leading organizations should leverage these technologies to maximize efficiency and gain real-time insights into their financial position.

Strategic Planning

Debtor finance should be part of a broader financial strategy. Organizations need to assess how it fits into their overall funding mix, ensuring it complements other forms of financing and aligns with long-term strategic goals.

Choosing the Right Partner

Success in debtor finance hinges on selecting the right financial partner. Market-leading organizations should look for finance providers with a deep understanding of their industry, a track record of reliability, and the flexibility to tailor solutions to their specific needs.

Debtor Finance FAQs

Debtor finance, an important tool for businesses seeking to improve cash flow and manage working capital more effectively, often prompts several common questions. Here are some frequently asked questions (FAQs) about debtor finance:

- How does debtor finance work? In debtor finance, a business sells its outstanding invoices to a finance provider for a percentage of their total value, typically up to 90%. The finance provider then advances this amount to the business, improving its immediate cash flow.

- What are the types of debtor finance? The main types are invoice discounting (confidential) and factoring (disclosed). Invoice discounting allows businesses to borrow against their invoices without customers knowing, while factoring involves selling invoices to a financier who then collects payment directly from the customers.

- Who can benefit from debtor finance? Businesses across various sectors with a strong ledger of accounts receivable can benefit, especially those that experience long payment cycles, have seasonal cash flow fluctuations, or need working capital to fund growth.

- What are the costs involved in debtor finance? Costs vary but typically include a service fee (for managing the sales ledger and collecting payments) and a discount charge (interest on the money advanced). Rates depend on the finance provider, the volume of invoices, and the risk profile of the receivables.

- Is debtor finance suitable for all businesses? While debtor finance can be incredibly beneficial, it’s best suited for businesses that sell on credit terms to other businesses (B2B). It’s less applicable to retail or cash sales-focused businesses.

- How quickly can I access funds through debtor finance? Once set up, funds can often be accessed within 24 to 48 hours of submitting invoices for financing, providing businesses with rapid liquidity.

- Do I lose control over my invoices with debtor finance? With invoice discounting, you maintain control over your sales ledger and the collection process. In contrast, with factoring, the finance provider takes over the management and collection of payments.

- What is the difference between recourse and non-recourse debtor finance? In recourse finance, the business must buy back any invoices that the customer fails to pay. Non-recourse finance, however, provides additional protection against non-payment, as the finance provider assumes the credit risk, often at a higher cost.

- How do I choose a debtor finance provider? Consider factors such as the provider’s experience in your industry, the flexibility of their solutions, transparency of fees, and the level of customer service. It’s also beneficial to seek recommendations from peers or advisors.

These FAQs offer a basic understanding of debtor finance, but it’s crucial to consult with a financial advisor or a debtor finance provider to explore how this financing solution can be tailored to meet your specific business needs.

Conclusion

For market-leading organizations, growth is not just an objective; it’s a necessity. In the quest for dominance, managing cash flow effectively is paramount. Debtor finance offers a powerful solution to unlock growth, providing the capital needed to innovate, expand, and lead. By strategically utilizing debtor finance, leading organizations can not only safeguard their current position but also pave the way for future success in an ever-evolving market landscape.

Key Takeaways

- Maintaining a steady flow of capital is crucial for sustained growth and market leadership.

- Debtor finance has emerged as a strategic financial tool to unlock growth potential and navigate the challenges of cash flow management without incurring debt..

- The process involves selling your outstanding invoices to a finance provider, who then advances you up to 90% of the invoice value within 24 to 48 hours.

- It is best suited for businesses that sell on credit terms to other businesses (B2B).

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.