Reliable cash flow is crucial to business success as it empowers companies to meet their financial obligations, invest in growth opportunities, and respond rapidly to mitigate disruption. Just like regular maintenance preserves the reliability of working equipment, invoice factoring ensures reliable cash flow.

Invoice factoring is subcategorized into different types to address the unique needs and conditions of various industries and business models. This article is intended to explain the difference between two types – spot factoring vs contract factoring and which is better for your business.

The problem

Maintaining reliable cash flow is one of the most frustrating and often problematic aspects of business operations. Your customers are demanding – they expect quality output and on-time delivery. A commonly faced and disruptive problem is that too many customers don’t respond in kind – they are slow to pay. A survey conducted in 2023 reveals that 55% of all B2B invoiced sales were overdue.

65% of businesses report spending a staggering 14 hours each week on administrative tasks related to payment collection. That’s nearly two full working days dedicated to accounts receivable management (AR management) tasks that could be better spent driving business growth.

The solution

Many businesses recognize that efficient AR management can extend beyond the traditional practice of spending time, resources, and money on chasing invoice payments. For a growing number of mid-market enterprises, a more efficient solution is to expedite their payment cycle. Using flexible financing solutions, these companies implement a cost-efficient strategy to convert invoice receivables into immediate cash in hand. Invoice factoring is a mainstream financial strategy to improve cash flow and financial stability.

How does invoice factoring improve cash flow?

Invoice factoring is the practice of selling invoice receivables at a discount in exchange for immediate payment. Invoices are submitted and processed with advance funds, up to 95% of the invoice face value, transferred within 24 hours. It dramatically improves the cash conversion cycle, converting DSO to less than one day.

Leading factoring companies provide different types of factoring arrangements to optimize funding speed, credit availability, and cost-efficiency.

For B2B companies, two of the main types of factoring to consider are:

- Spot factoring

- Contract factoring

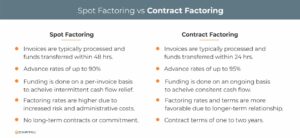

While both types of invoice factoring provide quick cash on outstanding invoices, they differ in features, terms, and conditions. Let’s take a closer look at these two types of invoice factoring to help determine which is better for your business.

What is spot factoring vs. contract factoring?

Spot factoring and contract factoring are two distinct types of invoice factoring, each offering different advantages and suited to varying business needs.

Spot factoring – a transaction for short-term cash flow needs

Used by businesses to sell an individual invoice at a discount to receive immediate payment for that particular invoice. It is an option, not an obligation. Companies can pick and choose which invoices they would like to have funded. Once a factoring arrangement is in place, a business can factor invoices as often or as little as needed to maintain positive cash flow. There are no long-term contracts or monthly minimums, so an arrangement of this nature is a very flexible form of funding.

The downside of spot factoring is that it is a more expensive option than contract factoring and does not provide continuous cash flow. It also provides a lower advance rate and a higher factoring rate than contract factoring. Another downside to spot factoring is that it typically only works on large invoices. Financing smaller invoices is rarely worth the factoring company’s time and effort.

Spot factoring benefits businesses that need quick cash for specific invoices without committing to a long-term factoring agreement. It’s ideal for companies with occasional cash flow gaps or those seeking flexibility without needing ongoing factoring services. Generally speaking, spot factoring is best suited for industries with large projects, such as construction, engineering, and consulting companies.

Contract factoring – a relationship to improve cash flow

Provides a steady stream of cash flow by continuously factoring invoices over the term of the agreement. This arrangement offers ongoing financial support and helps manage cash flow more predictably.

Businesses typically use it to create positive cash flow and maintain regular funding through the peaks and valleys of rapid growth, seasonal fluctuation, unpredictable market demand, and economic downturns. It is an arrangement where a business factors the majority of its invoices for a specified term.

Contract invoice factoring offers the advantage of consistent cash flow, enabling better financial planning and improved budgeting. It functions as a partnership, typically resulting in more favorable terms and streamlined processes than spot factoring. Funds are transferred within hours of a funding request. All transactions and account details are recorded in real time for efficient management and transparency.

The best factoring companies provide customized factoring agreements with terms tailored to meet the user’s needs. This customization typically begins with the user choosing specific categories of invoice factoring to structure their factoring facility.

These categories often include, but are not limited to:

- Recourse factoring

- Non-recourse factoring

- Confidential non-notification factoring

For companies needing only occasional cash flow relief, the downside of contract factoring is its longer-term commitment compared to spot factoring.

Choosing between spot and contract factoring depends on the company’s financial needs and preference for single cash injections or ongoing cash flow support.

Which is the best factoring type for your company?

Due to the ongoing nature of the relationship, contract factoring companies typically offer more comprehensive support services than spot factoring companies. The best invoice factoring companies typically include enhanced services such as dedicated account management, customized financial solutions, and integrated credit management services. They also may provide more favorable terms and conditions, leveraging the long-term partnership to offer better rates and additional services like invoice processing and collections support. In contrast, spot factoring companies usually offer more limited services and focus on individual transactions without the same level of personalized support.

Why choose an experienced factoring company?

The best invoice factoring companies are industry leaders experienced in providing specialized services to various industries. They understand your business – how it works, the challenges you face every day, and the need for convenient, reliable funding that’s easy to manage. The products and services these specialized factoring companies offer are designed to seamlessly provide reliable funding, cost effectively and without hassle.

When you partner with an experienced factoring company, you get the backing of several professional teams to support your business. An industry experienced accounts receivable team manages collections courteously to protect your company’s customer relations while maximizing efficiency. A credit department is on hand to guide you through risk management and help protect your company against bad debt (customers who won’t pay). A dedicated service team streamlines processes, responds rapidly to complications, and ensures ease of use. To further support managing your business, experienced factoring companies provide industry insights and expertise to help guide strategic decisions.

Conclusion

Navigating today’s economic challenges requires strategic financial solutions that ensure stable cash flow and operational efficiency. Invoice factoring, in its various types and forms, offers valuable options for managing cash flow effectively.

To maximize the speed of funding, credit availability, and cost-effectiveness, factoring companies provide different types of factoring arrangements. These may include spot factoring and contract factoring. Spot factoring provides flexibility for occasional funding needs, while contract factoring delivers consistent, predictable cash flow for long-term stability.

Partnering with an experienced factoring company can further enhance these benefits, offering tailored support, favorable terms, and comprehensive services to keep your business thriving. Selecting the right type of factoring and a trusted partner can make a significant difference in maintaining your company’s financial health and sustaining growth.

Contact us today to request a free financing consultation and see how we can help maximize your company’s cash flow efficiency.

Key Takeaways

- Maintaining reliable cash flow is one of the most frustrating and often problematic aspects of business operations.

- Invoice factoring offers an efficient way for mid-market enterprises to expedite their payment cycle to improve cash flow.

- For B2B companies, two main types of factoring to consider are spot vs. contract factoring.

- Contract factoring generally provides more comprehensive support, whereas spot factoring offers more limited, transaction-focused support.

- Experienced invoice factoring companies offer flexible financing terms and valuable business expertise to help guide strategic decisions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.