How to Conquer Cash Flow Issues in Your Seasonal Business

Content

Seasonal businesses that experience significant fluctuations in volume throughout the year often face unique financial challenges as they work through their peaks and valleys of demand. This is particularly true as the ebbs and flows of customer demand cause financial strain during off-peak seasons. Industries with high operational costs and narrow margins, such as manufacturing, distribution, and transportation, are especially tested when managing cash flow in these circumstances.

Despite the rollercoaster effect of seasonality, a well-managed operation can conquer cash flow challenges and overcome financial strain with good planning and execution.

In this article, discover effective strategies to offset your seasonal variances and learn about the advantages of flexible financial structures to help conquer the turbulence of irregular cash flow.

Effective strategies to help conquer the financial strains of seasonality

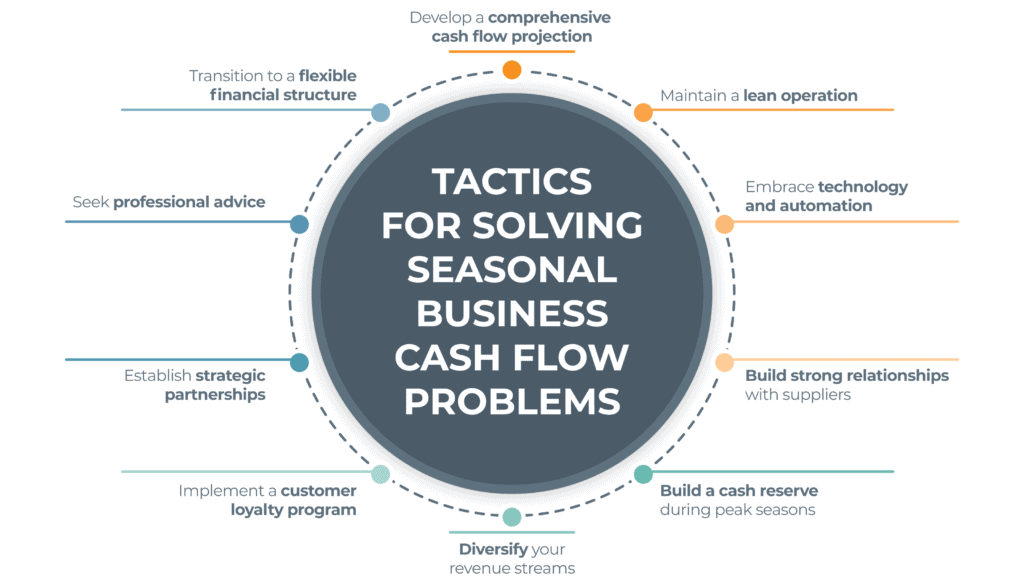

Maintaining regular, positive cash flow is a strong indicator of good financial health. By being strategic and proactive, you can minimize the strain of extreme fluctuations in accounts receivable and payable. Here are some valuable tips to help you navigate more smoothly through the ups and downs of your seasonal business:

- Develop a comprehensive cash flow projection: A cash flow projection is a crucial tool for understanding the financial health of your business and plotting a path forward. Start by analyzing your historical data to identify trends and anticipate cash inflows and outflows throughout the year. While this may seem obvious, this insight helps you more accurately predict periods of cash flow highs and lows and may enable you to take appropriate measures in advance.

- Maintain a lean operation: Keeping your overhead expenses in check during high seasons can help you help minimize the impact of low cash flow periods. Be flexible and adaptable. For example, consider hiring temporary employees during peak periods to avoid overstaffing during slow seasons. In addition, always run a tight ship and negotiate favorable terms with suppliers to reduce costs.

- Embrace technology and automation: Technological advancements can enhance efficiencies to help increase production, reduce costs, and improve customer service. Automation allows companies to streamline operations and improve cash flow management. Also, learn to leverage your technology to process data faster and more accurately. This will enable you to predict future changes and respond more quickly.

- Build strong relationships with suppliers: Maintaining good relationships with your suppliers is crucial for managing cash flow effectively. Clear communication with your suppliers regarding your production cycles and anticipated demand will assist them in planning their resources accordingly. Building strong relationships can help to negotiate favorable payment terms, such as extended payment periods during slow seasons or bulk purchase discounts.

- Build a cash reserve during peak seasons: It’s a wise practice to save consistently during the high season to ensure a smooth transition into slower months. Setting aside a portion of your profits as a cash reserve is essential when business is booming. This reserve will serve as a buffer during off-peak seasons when cash flow may be limited.

- Diversify your revenue streams: While your business may heavily rely on a specific season, explore opportunities to generate supplemental income throughout the year. Consider offering complementary products or services that can attract customers during off-peak periods. For example, if you manufacture winter sports equipment, consider expanding your product line to include outdoor gear for other seasons. This diversification can help generate revenue and maintain a steady cash flow throughout the year.

- Implement a customer loyalty program: Encourage repeat business by implementing a customer loyalty program. Rewarding loyal customers with discounts, exclusive offers, or other incentives can help drive sales during slow periods. By nurturing a loyal customer base, you can mitigate the impact of seasonal fluctuations on your cash flow.

- Establish strategic partnerships: Collaborating with other businesses that operate in different seasons can create mutually beneficial opportunities. Consider partnering with a complementary business to cross-promote each other during your respective peak seasons. Strategic partnerships can help attract new customers and extend your reach, boosting cash flow for both parties.

- Seek professional advice: If cash flow issues persist or become overwhelming, seek guidance from financial professionals who specialize in working with seasonal businesses. They can offer valuable insights, provide tailored advice, and help you navigate challenging financial situations.

Cash flow management is an ongoing process. Regularly review your financial statements and use financial ratios to monitor financial health and liquidity. The Following are three common liquidity ratios typically used to measure cash flow:

Current Cash Debt Coverage Ratio

Operating Cash Flow Ratio

Interest Coverage Ratio

Identify trends, adjust, and develop efficiencies to run a tight ship. Stay agile and be prepared to adapt your strategies based on changing market conditions.

Explore the advantages of a more flexible financial structure

Despite employing effective management practices and implementing strategic measures, cash flow gaps can still occur – it’s a tough market and getting tougher!

A more flexible financial structure gives businesses the agility to adjust quickly to changing conditions and to support efficiencies. But more importantly, specialized financing options, such as invoice factoring and ABL financing, are explicitly designed to improve cash flow and provide easy access to working capital to fill cash flow gaps.

Qualification for alternative financing is fast and easy if your company has quality assets, such as accounts receivable, inventory, machinery and equipment, or real estate. To arrange a flexible financial structure tailored to your business needs, choose a reputable alternative lender experienced in your industry. They have the resources to combine flexible products, services, and expertise to maximize access to the working capital you need when you need it.

Conclusion

By implementing proactive management practices and strategic measures, seasonal businesses can minimize the strain of fluctuating market demand to maintain financial health.

Many resilient companies are transitioning to flexible financing structures to smooth out cash flow and fill funding gaps to help manage the turbulence of irregular cash flow.

With effective management practices, strategic measures, and flexible financing, well-managed seasonal operations can conquer cash flow issues and build long-term success.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.