If you’ve been in the transportation industry for a while, you’ve heard of factoring. It is far from a new financial service. And there’s a reason it’s been around forever: Freight invoice factoring has maintained its presence in the industry because of how it improves business cash flow, enabling transportation companies to be successful.

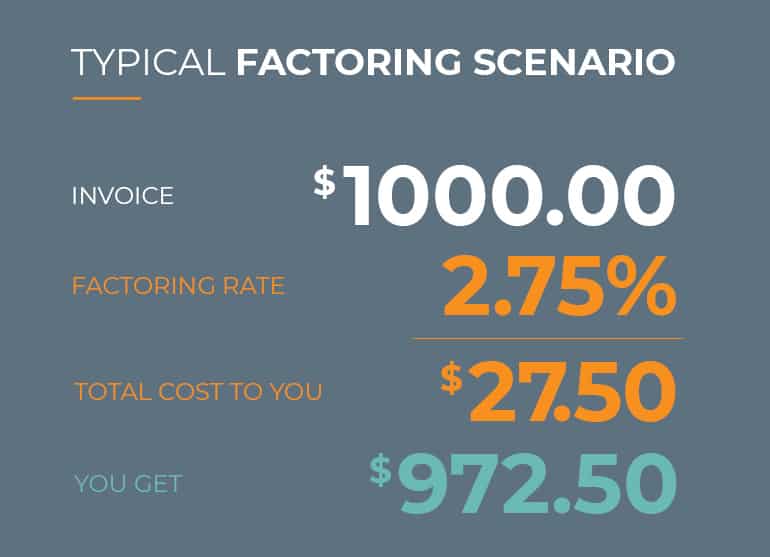

To put it simply, freight invoice factoring is when owner operators or small and large fleet owners sell their unpaid invoices to a factoring company for a small fee. Factoring pays you up to 98% of your outstanding invoices within 24 hours so you can keep your business moving. When your customer (also known as the debtor) pays the invoice, the factoring company pays you the remainder of the invoice amount (called a reserve), minus a small fee.

What are the PROS of freight invoice factoring?

- Freight invoice factoring is easy to qualify, and approval is fast.

Applying for freight invoice factoring takes as little as a few minutes. And approval usually takes a few days or less. It’s a lot easier than trying to secure a loan from a bank which involves tons of time, scrutiny over your finances and a mountain of paperwork. - You’ll get paid faster.

Once you’re approved for freight invoice factoring, you can submit invoices and get paid within 24 hours. No more waiting anywhere from 30 to 90 days for invoices to be paid or watching your mailbox for checks to arrive. Cash is transferred directly into your business account. - Your credit isn’t much of a factor.

Does your company have bad credit? If so, that’s not a problem for qualifying for freight invoice factoring. If you have a low credit score or even bad credit history, you can still qualify for factoring. Approval is mostly dependent on the creditworthiness and payment history of your customers. This makes freight invoice factoring an accessible business financing solution for struggling trucking companies, fast growing fleets, and start-up operations. - No debt is created.

Factoring isn’t a loan. You’re not borrowing any money. Instead, you’re advanced the cash for loads that you’ve already hauled and delivered. It’s your money – freight invoice factoring accelerates cash flow to deliver the money you’ve already earned faster. - Your business equity isn’t lost or compromised.

Factoring is a unique type of financial transaction that won’t tie up your business equity or prevent you from securing future bank financing for investments such as the purchase of new trucks. Again, this is your money that you’ve already earned. Freight invoice factoring just eliminates the uncertainty of when you’ll receive it. - Save on your biggest expense – FUEL.

Some factoring companies have fuel card programsto offer you significant savings on your largest expense – fuel. Freight invoice factoring clients often qualify for fuel discount cards to save money every time you visit the pumps. - Freight invoice factoring companies offer more than fast cash.

In addition to fuel discount cards, established factoring companies are able to offer other perks like fuel advances, tire discounts, access to load boards and more! These pre-negotiated discounts and time-saving tools help you run your business more profitably and they don’t cost you anything. In fact, the discounts usually take care of the cost of factoring. - Free credit checks on potential customers.

When you work with a factoring company you can confirm up front if your customer is creditworthy before you take on a load. Some factoring companies even provide an online portal or mobile app for clients that can be used for credit checking potential new customers in seconds. You’ll never have to worry if you’ll get paid for your hard work. - Put away the envelopes and submit invoices online.

With an online portal, you can easily submit invoices to your factoring company online. Use your computer, tablet or smartphone and you don’t even have to leave the cab of your truck. And the best part is that you can send in your invoices 24/7, not just during business hours. - Powerful billing and collections team.

If you hate juggling unpaid invoices and hounding clients for payment, any good factoring company has got you covered. The factor takes over your billing and collections for you. - Free up time so you can be more productive.

You have more time to concentrate on your work now that you’ve offloaded your billing and collections to a freight invoice factoring company. That means you have more time to haul loads and increase your revenue. - Increased cash flow means an opportunity to grow.

When you factor your invoices and create a consistent cash flow, you can take advantage of new business options as they arise. This opens the chance to make more money.

What are the CONS of freight invoice factoring?

- Well, nothing in business is ever free.

You know that it takes money to make money. However, the cost of freight invoice factoring is minimal compared to the benefits of having fast access to working capital. Having cash in hand within hours of delivering a load eliminates the uncertainty of when you’ll get paid – allowing you to put your money back into your business to keep your trucks rolling. - You may be liable if your customer doesn’t pay.

If your customer fails to pay, or is late paying according to the terms, you may be on the hook for the invoice. Although, if you have a non-recourse arrangement, the factor will take the hit if the debtor fails to pay due to insolvency. This protection comes with a slightly higher rate because the factoring company is accepting the credit risk of your customers.

When it comes down to it, it’s easy to see how the pros of freight invoice factoring far outweigh the cons. Get your invoices paid FAST with factoring, often in 24 hours. Use the money to buy fuel, cover expenses and fund growth.

If freight invoice factoring sounds like it’s right for you, align yourself with a trusted partner like eCapital. We’ve been working in the transportation industry for more than 25 years, making us trusted experts in the field. By partnering with eCapital, you can keep your wheels turning instead of waiting around to get paid and you’ll get:

- A robust fuel discount program with credit terms to save thousands at the pump.

- An exclusive broker network where all high-paying loads are factorable.

- The best-in-class online portal and mobile app to help you run your business from anywhere, anytime.

- All of your billing and collections handled so you can focus on hauling your next load.

- A dedicated account rep. You’re more than just a number.

- And so much more!

Conclusion

Freight invoice factoring is a widely used financial service in the transportation industry, offering numerous benefits to trucking companies and fleet owners. The key benefits of freight invoice factoring, such as fast payments, credit flexibility, and support for business growth, outweigh the cost of factoring. By partnering with a trusted provider like eCapital, trucking businesses can quickly access working capital and gain additional perks and expertise in the transportation industry.

Key Takeaways

- Freight invoice factoring improves business cash flow, enabling transportation companies to maintain operations.

- The pros of freight invoice factoring far outweigh the cons, making this a highly beneficial financing solution for undercapitalized trucking companies.

- Aligning your trucking company with a trusted financial partner, like eCapital, ensures reliable cash flow, cost saving services, and professionally managed collection services to maximize accounts receivable efficiencies.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.