Trucking companies cannot depend on the banking system to provide working capital solutions or trucking business loans. Prior to the coronavirus (COVID-19) outbreak, carriers and brokers had great difficulty getting approved for trucking business loans. This is because the banking system views trucking as an unstable industry. Fortunately, freight factoring and Factoring Line of Credit provide alternative funding solutions for trucking companies needing reliable access to working capital.

Why Banks Won’t Lend to Most Trucking Companies

As a depressed freight market forced excessive numbers of trucking companies to fail in 2019, bank loans became even more inaccessible to truckers. However, this changed dramatically at the end of March 2020 when the federal government announced emergency relief benefits to companies in all industries.

This program included natural disaster assistance in the form of low-interest loans to businesses. These working capital loans were designed to keep businesses afloat during the COVID-19 economic shutdown. But system failures and under-funding plagued the government’s ability to deliver cash flow assistance as promised. Even with government aid, bank institutional lending provides little support for trucking. As the economy struggles to recover following the global pandemic, commercial loans for trucking companies will undoubtedly become even harder to acquire.

To further complicate matters, the overall financial stability of customers are now at risk. Almost every market sector is stressed as a result of the economic disruption. Even solid companies, who are operating at a profit, are holding onto their cold hard cash. What does this mean for trucking companies? It often means slower payment from even the most regular of customers.

Invoice Freight Factoring is the Answer

Is there hope? The answer to this question is a resounding yes! Factoring invoices in exchange for immediate cash is a common business financial strategy and an ongoing trend in the trucking industry. It is not a loan, it is the selling of invoice receivables at a discount in exchange for immediate payment.

Freight factoring (a.k.a. invoice factoring for trucking) is a stable form of funding allowing trucking companies to take control of their cash flow. Rather than reacting to the unpredictable inflow of cash, they control their cash flow with immediate payment following the delivery of freight. In this way, business owners can better predict their cash flow and receive instant access to cash. This helps to stabilize business operations and provides the financial means for long- term expansion.

Trucking businesses that achieve positive cash flow will gain market advantage over the competition. The ability to access working capital without bank restrictions is of vital importance to ongoing operations. With funds available to support truck movement, freight carriers and brokers are free to react to demand without hesitation. This is of extreme importance when booking loads in a highly competitive spot market or responding swiftly to secure a lane.

How Does Freight Factoring Work

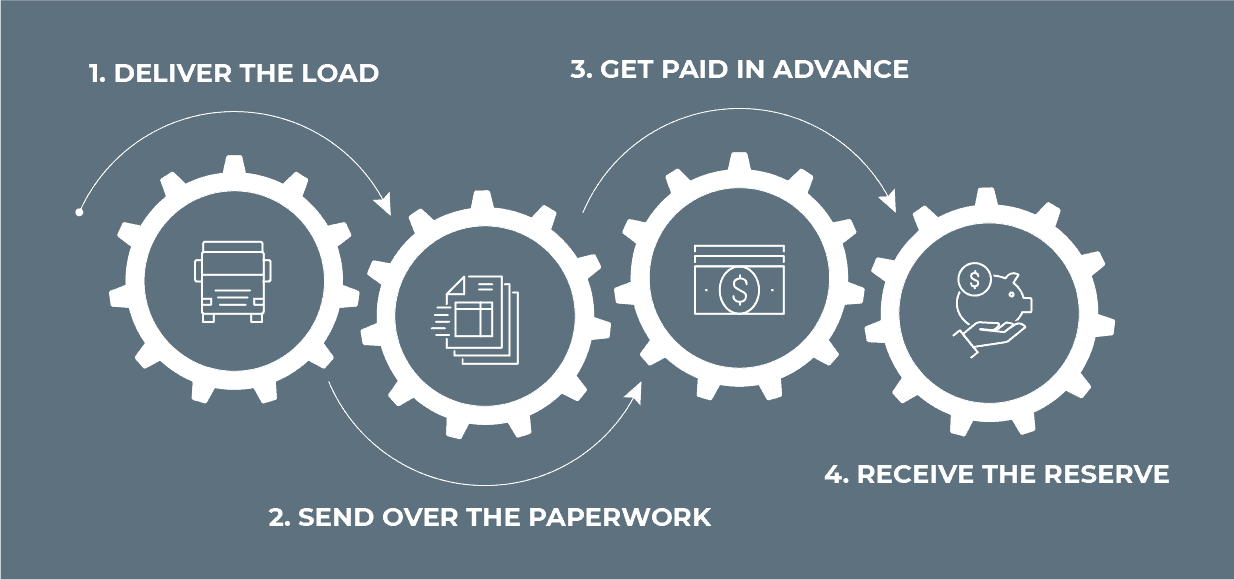

1. Deliver the load.

You pick up the freight, deliver it, and get your paperwork signed.

2. Send over the paperwork.

Submit the invoice, rate confirmation, and bill of lading to the factoring company, who verifies load delivery.

3. Get paid in advance.

The factor buys your invoice and pays you up to 97% of that invoice within hours instead of days.

4. Receive the reserve.

The unpaid remainder is called the reserve. You get it minus a small fee when your customer pays the invoice.

Why Use Freight Factoring

Banks are in the business of lending money to borrowers who can prove they are a good credit risk. Once approved for the loan, the borrower is obligated to uphold the terms of the loan agreement which are generally slanted in favor of the bank. Few trucking companies are able to meet the approval requirements, and most can’t maintain the restrictive borrowing covenants that govern the loan if they do manage to get funded.

Freight factoring works in a completely different manner. Trucking companies with creditworthy customers are qualified quickly and easily. A reputable freight factoring company provides dedicated customer support, credit advice, accounts receivable management and cost-saving services like fuel cards to support the trucking business. By partnering in this manner, the factoring company strengthens the viability of both businesses. Supported by reliable funding, the trucking company is positioned to operate with minimal financial constraints.

Small- and medium-size trucking operations benefit the most from freight factoring services designed for owner operators and small fleets. Larger, more established fleets depend on a Factoring Line of Credit to support operations. This cost-effective option provides flexible terms to meet the needs of expanding fleet operations, companies in transition or businesses struggling just to make payroll.

Getting approved for freight factoring is quick and easy.

Business that have applied for a bank loan know the volumes of financial reports and lengthy delays that must be endured to complete the application process. For trucking companies, this ordeal is normally concluded with a rejection notice denying approval for the loan. On the other hand, trucking companies that apply for freight factoring are approved within hours.

Freight factoring is the ideal cash flow solution.

In times of economic uncertainty, businesses are best to avoid taking on further debt obligations. Government-sponsored forgivable loans are the exception to the rule, but only if your business is able to honor the conditions of the loan. Otherwise, the debt remains and the loan must be repaid. Alternatively, freight factoring is not a loan, it is merely a means of financing your business through accumulated invoices. The more business your trucking company generates, the more funding becomes available.

For trucking companies needing easy access to working capital without the burden of debt, freight factoring and Factoring Line of Credit are the ideal cash flow solution. If factoring sounds like it’s right for your business, align yourself with a trusted partner like eCapital. We’ve been working in the transportation industry for more than 25 years, making us trusted experts in the field. By partnering with eCapital, you can keep your business going strong instead of waiting around to get paid.

What is Non-Recourse Freight Factoring?

Another option to consider when shopping for freight factoring is non-recourse factoring. Unlike traditional factoring, in non-recourse factoring, the factor assumes the risk of non-payment by the original debtor. If the debtor doesn’t pay the invoice, the business is not required to repay the factor. This method allows businesses to obtain immediate liquidity without the liability of potential non-payment by their customers. Not all companies that offer non-recourse factoring cover the same liabilities. You can find some things to look out for in our blog Top 11 Things to Understand Before Signing A Non-Recourse Factoring Agreement.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.