OVERVIEW

IronPath Logistics, a mid-sized fleet based in the Midwest, was on the brink of bankruptcy after a major client default and several unexpected repairs drained reserves. With creditors circling and payroll at risk, they turned to eCapital as a last resort to avoid shutting down.

CHALLENGE

Unable to cover operational costs due to cash flow gaps and unpaid invoices, IronPath was facing legal pressure, driver turnover, and missed loan payments. The leadership team needed an immediate and reliable solution to avoid insolvency and restore day-to-day business continuity.

SOLUTION

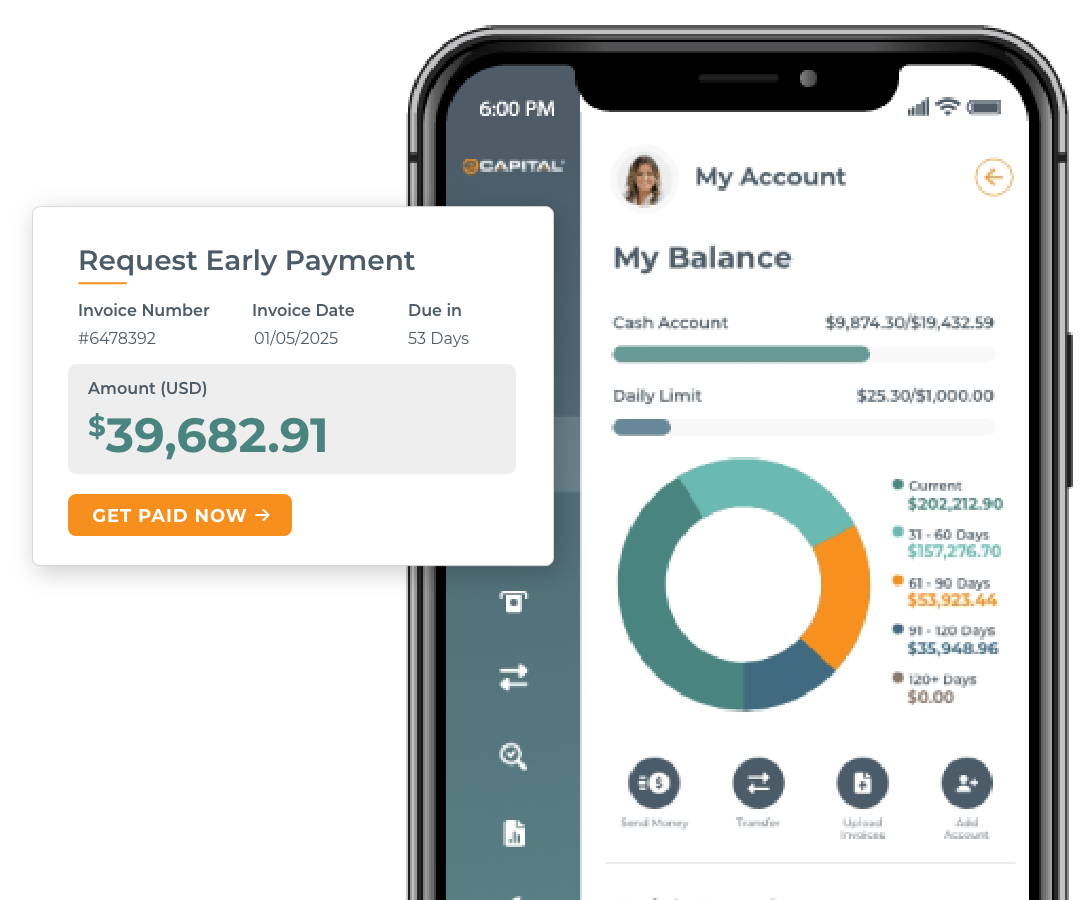

eCapital stepped in with a high-limit freight factoring facility and rapid onboarding, injecting the necessary capital to cover overdue payroll, critical repairs, and vendor obligations. Within weeks, the company stabilized operations and avoided bankruptcy proceedings. Ongoing access to factoring helped IronPath restructure its financial model, rebuild credit, and retain its position in the regional market.