FINANCING FOR TRUCKING FLEETS

Grow faster with fleet financing that goes the extra mile

From faster payments to receivables management, streamline your fleet’s finances with factoring built to keep drivers moving and your business growing.

From faster payments to receivables management, streamline your fleet’s finances with factoring built to keep drivers moving and your business growing.

eCapital helps you manage and grow your fleet with fast funding and factoring tailored to your unique operation. Backed by a team of trucking experts, we handle everything from cash flow to collections—so you can stay focused on increasing revenue and moving your business forward.

Get paid within hours of delivery, not weeks. Use that capital to cover payroll, fuel, insurance, maintenance, and more—without tapping into reserves.

Let us handle billing, invoicing, and collections, freeing up your team to focus on dispatching and growth.

Our team of transportation experts will help you strengthen your cash flow and provide the trusted support you need to scale your business with ease.

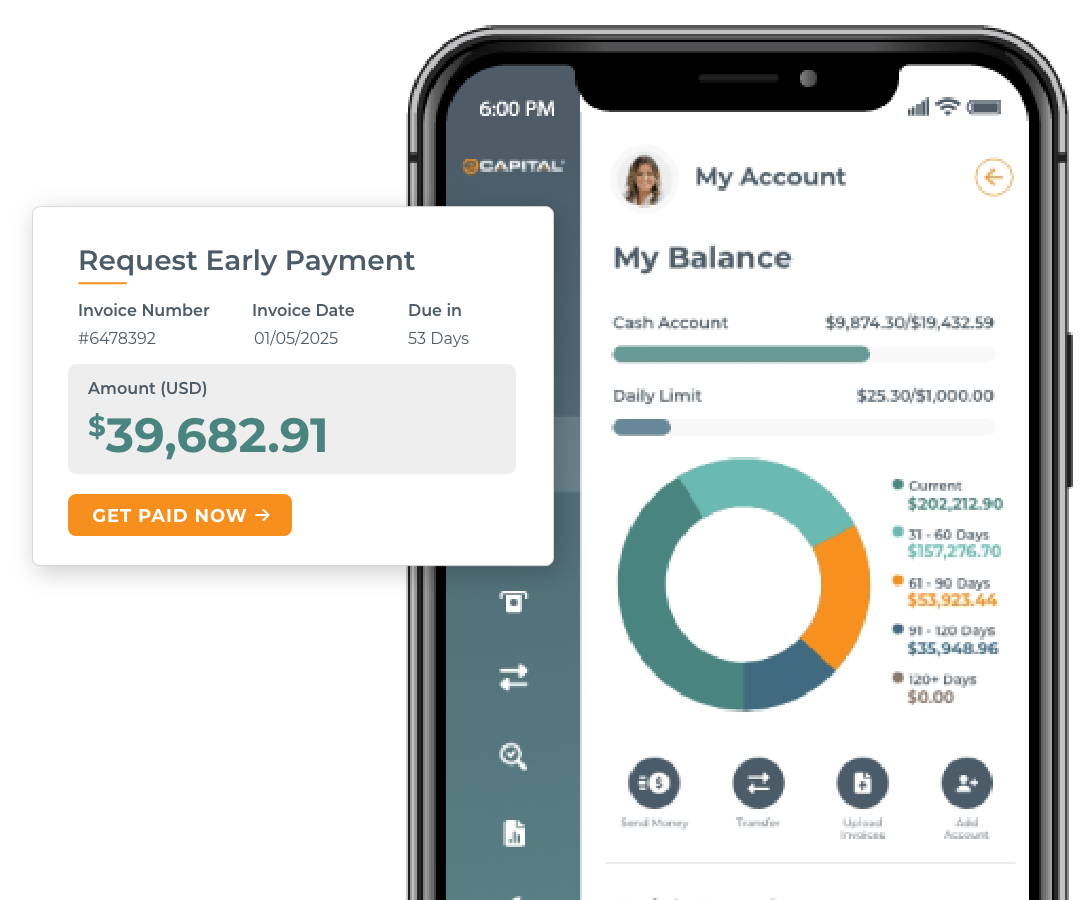

Manage your cash flow and simplify operations with technology built for the pace of trucking. The eCapital platform and mobile app make it easy to submit invoices, track payments, and access funds – anytime, anywhere. Get real-time insights, faster funding, and the tools you need to keep your business running smoothly.

A regional 10 truck company experienced rapid growth and secured new long-haul contracts that required expanding its fleet and workforce.

The business faced a significant working capital shortfall due to extended customer payment terms and rising fuel and maintenance costs. Traditional loans were too rigid and slow to meet immediate needs.

eCapital provided a freight factoring solution, unlocking capital from unpaid invoices. This gave the company the steady cash flow needed to fuel expansion, pay drivers, and maintain service levels—without waiting 30–60 days for customer payments.

A mid-sized carrier needed to upgrade a portion of its fleet to meet evolving emissions regulations and avoid downtime from non-compliant trucks.

Despite strong receivables, the business lacked upfront capital to invest in new vehicles without disrupting daily operations or delaying payroll.

eCapital delivered an asset-based lending (ABL) facility using the company’s existing assets and receivables as collateral. The funding enabled immediate vehicle purchases while preserving day-to-day liquidity and avoiding traditional debt.

A large national fleet operator needed to smooth out cash flow fluctuations caused by seasonality and varied payment schedules from multiple brokers and shippers.

The company wanted to maintain financial privacy and avoid customer disruption while still accessing cash tied up in its sales ledger.

eCapital implemented a confidential invoice discounting (CID) program, enabling the business to convert receivables into working capital without notifying clients. The discreet funding ensured payroll, fuel, and repair expenses were covered—keeping the business running smoothly.

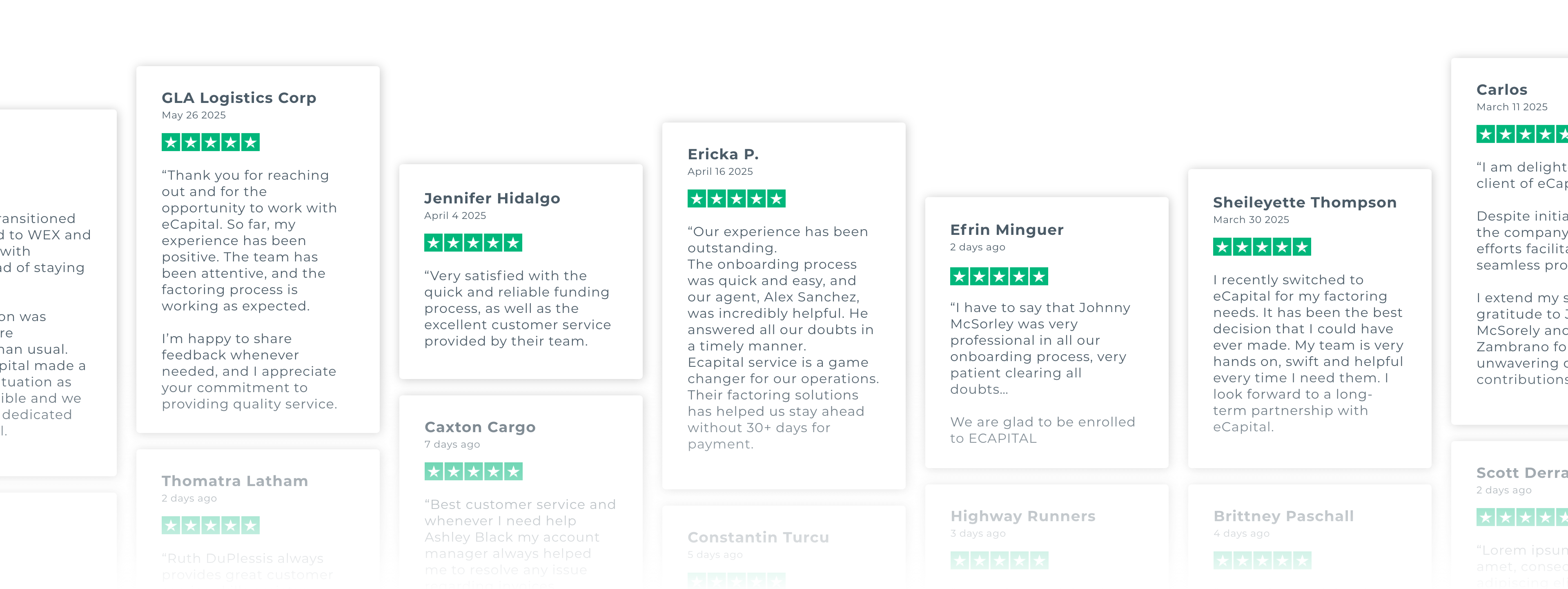

For over 18 years eCapital, a freight factoring company, has helped more than 30,000 businesses grow. We want to do the same for you. Take a look at the latest reviews from our customers.

The most effective financing solutions for trucking fleets include freight factoring, asset-based lending (ABL), and sales ledger financing. Each option provides flexible access to working capital based on your receivables or assets — without relying on traditional credit requirements.

At eCapital, we tailor these options to meet the specific needs of your fleet so you can scale faster, improve cash flow, and stay competitive.

Freight factoring gives fleet owners predictable cash flow by converting invoices into working capital, usually within 24 hours. Instead of waiting 30, 60, or even 90 days for payment, you can get paid upfront and reinvest in your fleet.

Factoring helps cover key operating expenses like driver wages, fuel, maintenance, and insurance. It also gives you the power to grow without relying on bank loans or giving up equity. For fleets managing multiple trucks and high volumes of freight, factoring is a fast, flexible financing strategy that grows with your business.

Getting funding for a trucking business usually involves a combination of financing options, grants, and partnerships. Some entrepreneurs explore small business grants such as the SBA 8(a) Business Development Program, the FedEx Small Business Grant Contest, or USDA Rural Business Enterprise Grants. While helpful, these grants are often competitive and not guaranteed.

Asset-based lending (ABL) provides a revolving line of credit secured by business assets — such as accounts receivable, equipment, and inventory. This type of funding is ideal for fleets looking to expand while maintaining access to capital as operations scale.

Unlike traditional loans, ABL adjusts to your asset base, giving you more borrowing power as your fleet grows. At eCapital, our ABL programs are built specifically for transportation companies, providing flexible terms and deep industry expertise to help fleet owners make confident financial decisions.

Yes, commercial fleet financing is a legitimate and widely used method for trucking companies to acquire vehicles and grow their operations. Many reputable lenders specialize in fleet financing, offering structured payment plans that help preserve cash flow while building business credit.

Sales ledger financing is a more advanced version of invoice-based funding. While factoring is invoice-specific, sales ledger financing leverages your entire accounts receivable ledger. This gives larger fleets more control over their collections while accessing capital across all customer accounts.

This solution is ideal for fleets with an established back-office that wants to manage collections internally but still needs immediate access to working capital. eCapital helps you bridge the gap between invoicing and payment while maintaining your customer relationships and preserving your credit control process.

Yes. Many fleet operators benefit from combining financing solutions to support different aspects of their business. For example, a growing fleet might use:

At eCapital, our team works with you to create a customized financing strategy that aligns with your goals. We make it simple to bundle services, streamline your funding, and focus on what matters most — growing your fleet.

With eCapital, most fleet clients receive funding within 24 to 48 hours of approval. Our application process is streamlined and designed specifically for the trucking industry — no long waits or red tape.

Whether you need to cover payroll this week or finance a major expansion, our team delivers the capital you need with speed, transparency, and expert support.

Traditional lenders often rely on strict credit requirements, lengthy approval processes, and limited flexibility — which can slow down a growing fleet. eCapital takes a different approach. We specialize in transportation finance, offering fast, flexible solutions like freight factoring, asset-based lending, and sales ledger financing designed specifically for fleets.

We evaluate your business based on real-world operations, not just a credit score. Our team understands the cash flow challenges fleet owners face and delivers personalized support to help you grow with confidence. With eCapital, you’re not just getting funding — you’re gaining a partner in long-term success.