Consumer Goods Massachusetts

eCapital Creates EXIM-backed SCF Program for Specialty Energy Firm

Transaction Details

- $25MMFUNDED

- Supply Chain Finance

PRODUCT- Energy

INDUSTRY- Kentucky

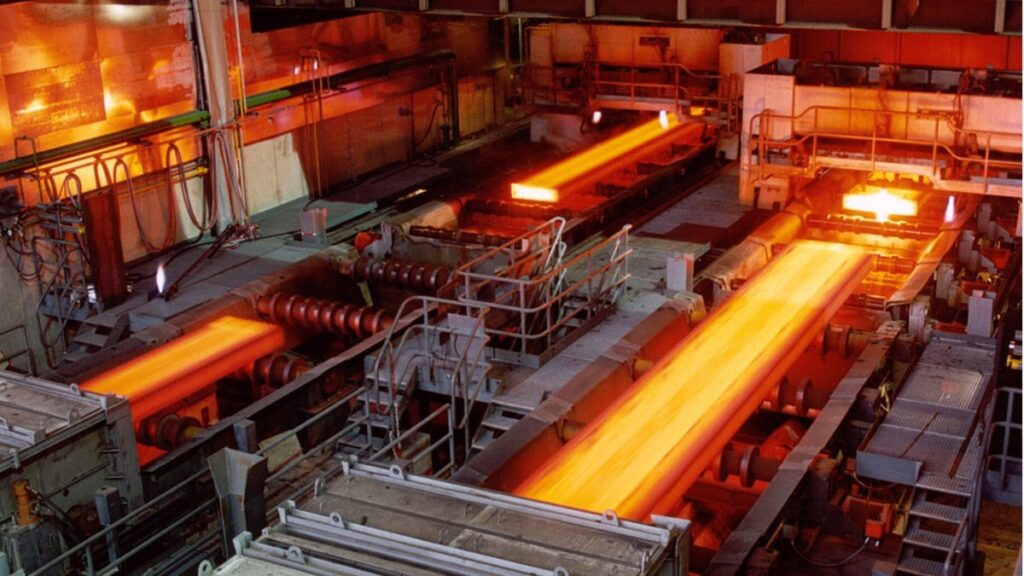

LOCATIONMay, 2024eCapital, a leading provider of working capital and payments management solutions, recently announced the creation of a $25 million supply chain finance (SCF) program with a large Kentucky-based specialty energy company serving the metals manufacturing industry globally.

The new SCF program allows the company to provide third-party-funded early-payment opportunities to their suppliers while standardizing payment terms to create working capital for the entire supply chain.

“We are seeing more and more emphasis put on working capital management – especially among exporters,” said Miguel Serricchio, Chief Channel Development Officer at eCapital. “A supply chain finance program is a great way to free up liquidity for both buyers and suppliers, and we are eager to help drive growth for our new client.”

EXIM Supply Chain Finance Guarantee

The new facility for the energy firm is backed by the Export-Import Bank of the United States (EXIM) as part of their Supply Chain Finance Guarantee Program. The program incentivizes lenders to fund SCF programs by reducing risk, increasing availability, and lowering costs by providing a 90-percent guarantee to lenders who fund supply chain finance programs for U.S. exporters.“EXIM’s support was critical in making this SCF facility possible,” said Serricchio. “By providing the guarantee, they are leveling the playing field for U.S. exporters as they look to compete in global markets and, by extension, supporting American jobs.”

Building on an Existing Relationship

The new facility is not the energy firm’s first engagement with eCapital: they have been a long-time supplier participating in U.S. Steel’s EXIM-backed SCF program.“We are excited every time we get the opportunity to work with a new company,” said eCapital Senior Vice President Lori Sternola. “This relationship is doubly rewarding since it’s based on an existing relationship and eCapital’s ability to provide exemplary service and working capital to our SCF suppliers. It’s a testament to our customer success and product teams and the work they do to support our buyers and suppliers.”

About This Transaction: This transaction was completed by LSQ before its acquisition by eCapital in late 2024. The details reflect the deal as originally announced at that time. Following the acquisition, aspects such as company branding, leadership titles, or organizational structure may have changed.

Latest Transactions

Start your journey with a world-class leader in specialty finance

Start an application instantly to get started OR contact us to design a custom financing package for your business.

Expert-Backed Financing, Tailored for Your Business

Leverage our expertise and dedicated support to build a custom funding solution—quickly and efficiently.

Discover the speed of tech-enabled funding

Learn how we’re using cutting edge technology to get you the capital you need faster than ever before.

- Supply Chain Finance