ACCOUNTS RECEIVABLES FINANCING

Transform your receivables into working capital

Unlock the value of your invoices for immediate financial flexibility and growth with the industry-leaders in specialty finance for businesses.

Unlock the value of your invoices for immediate financial flexibility and growth with the industry-leaders in specialty finance for businesses.

Unlock growth with our tailored A/R financing—designed for ambitious mid-market businesses. Get paid faster, boost liquidity discreetly, and maintain strong business relationships.

Convert unpaid invoices into immediate working capital to cover expenses, invest in growth, and maintain smooth operations.

Strengthen financial stability without taking on debt, ensuring consistent cash flow to support business needs.

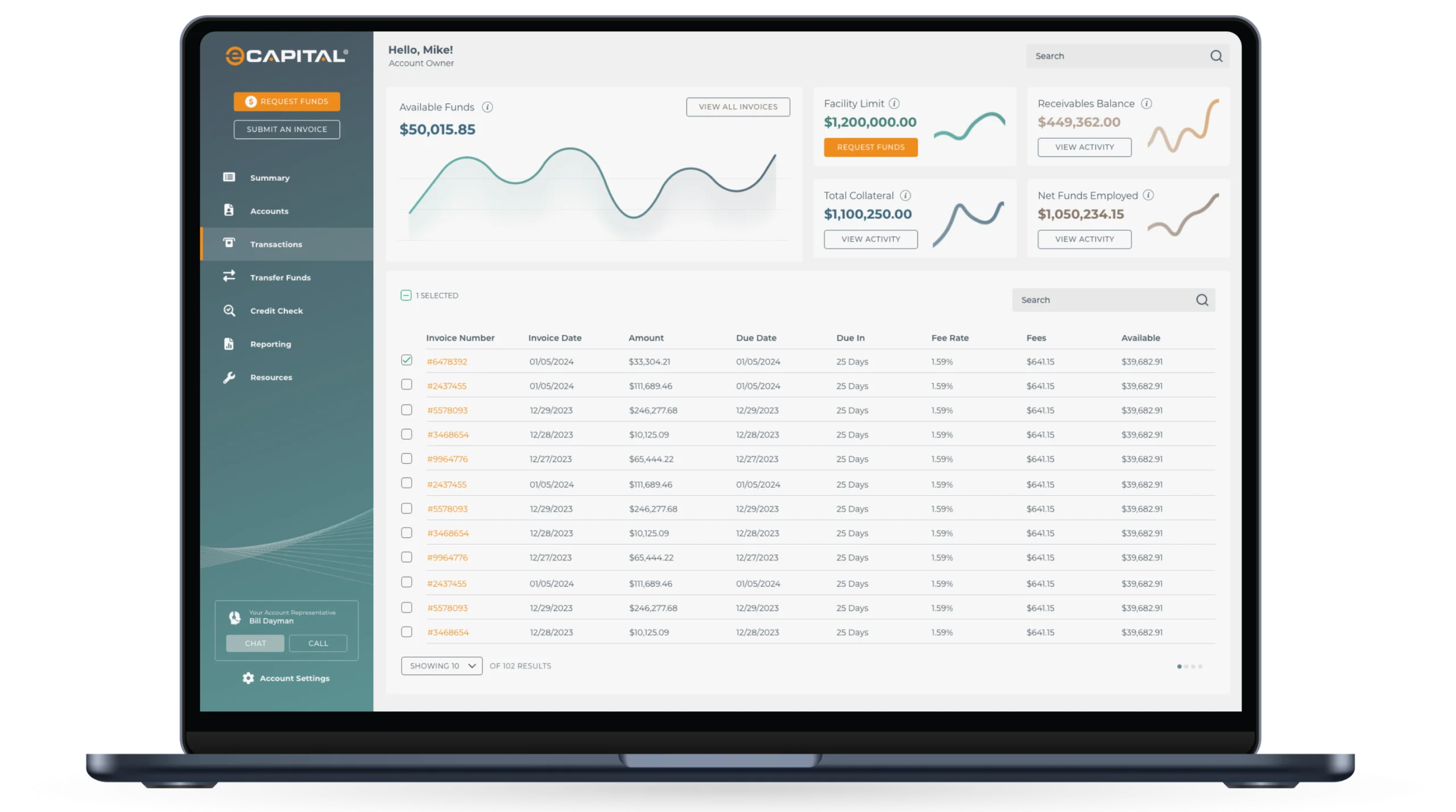

Our clients have 24/7 control to effortlessly manage their funds. Transfer money quickly to traditional bank accounts or third parties with just a few taps.

Clients choose eCapital when they need an engaged, solutions-oriented, long-term credit partner with proven capacity, creativity, and continuity. Our expertise is customization—whether on a $5 million or $150 million facility, employing a meticulous, hands-on strategies.

Our tight-knit group of financing experts are agile and client-centric, yet backed by extensive resources with the scale to conquer any challenge. This means we are going to be a better credit partner through every business cycle, bringing capabilities and passion—as patient, flexible problem-solvers—other providers simply do not have. Our track record speaks for itself.

"*" indicates required fields

Accounts receivable financing is a funding solution where a business receives immediate cash by leveraging its outstanding customer invoices. Instead of waiting 30, 60, or 90 days for payment, companies can access working capital tied up in unpaid receivables.

Accounts receivable financing from eCapital is a true sale of receivables, the business sells its invoices and receives cash upfront. If the arrangement qualifies as a true sale under accounting rules, it can be treated as off-balance sheet, meaning it doesn’t appear as debt.

Key Characteristics:

You sell your invoices outright.

The third-party (eCapital) assumes the risk of non-payment in a non-recourse agreement.

Customers are often notified and may pay the third-party directly.

The third-party typically handles collections.

Because the receivables are sold, this can be treated as off-balance sheet (if it qualifies under accounting rules).

Because you no longer own the receivables, they’re removed from your balance sheet.

eCapital also offers the alternative to traditional A/R financing—Sales Ledger Financing (also known as a ledgered line of credit or borrowing base facility). Unlike A/R financing, this is not a sale of receivables, but a loan secured by your outstanding invoices.

Key Characteristics:

You borrow money using receivables as collateral.

You retain ownership of the receivables and handle collections.

The lender advances a percentage (e.g., 80%) of eligible AR.

Customers are usually not notified (in non-notification arrangements).

The receivables stay on your books, and the loan appears as a liability.

A business submits its outstanding invoices to a financing provider, who advances a percentage of the invoice value—often 80–90%. Once the customer pays the invoice, the provider releases the remaining balance minus a fee.

In a true sale of receivables, the business sells its invoices and receives cash upfront. If the arrangement qualifies as a true sale under accounting rules, it can be treated as off-balance sheet, meaning it doesn’t appear as debt. A/R financing from eCapital is the true sale of receivables to a third party.

Key Characteristics:

You sell your invoices outright.

The third-party (eCapital) assumes the risk of non-payment in a non-recourse agreement.

Customers are often notified and may pay the third-party directly.

The third-party typically handles collections.

Because the receivables are sold, this can be treated as off-balance sheet (if it qualifies under accounting rules).

Because you no longer own the receivables, they’re removed from your balance sheet.

A/R financing is popular among B2B companies with long payment cycles, including manufacturers, distributors, staffing agencies, logistics firms, healthcare providers, and government contractors.

Improves cash flow without taking on new debt

Reduces reliance on slow-paying customers

Allows businesses to meet payroll, purchase inventory, or invest in growth

Scales as your sales grow

They are closely related. In factoring, the financing provider may take over collections and customer communication. In A/R financing, the business typically retains those responsibilities. However, many use the terms interchangeably.

Not necessarily. A/R financing is based primarily on the creditworthiness of your customers—not your company’s credit score—making it accessible for businesses with limited or challenged credit histories.

eCapital can approve and fund businesses within a few days. Once set up, future advances can happen in 24–48 hours after invoices are submitted.

It depends. With non-notification A/R financing, customers may not be aware. In notification or factoring arrangements, customers are notified and may pay the financing company directly.

This varies by lender and agreement. In recourse financing, your business is responsible for repayment if the customer defaults. In non-recourse financing, the lender assumes the risk—usually at a higher cost. At eCapital, we offer a large scope of options that best suit your business. Connect with an eCapital expert to see which option is best for your business.