Yes, Your Business Can Live Free From Financial Covenants

Content

- Overview

- Types of debt covenants

- What are affirmative covenants?

- What are negative covenants?

- Why are debt covenants needed?

- How do debt covenants restrict growth?

- What happens when a debt covenant is breached?

- So, how are your debt covenants doing?

- The flexibility of alternative lending solutions

- Benefits for the borrower

- Conclusion

- Key Takeaways

Borrowing money is essential for businesses to finance operations, invest in growth, and manage cash flow. However, to effectively leverage borrowed funds, business leaders must thoroughly understand the terms and conditions of loan agreements. One aspect of borrowing can create more work and accountability than expected. Financial covenants (better known as debt covenants) are conditions set by conventional lenders that borrowers must adhere to during the life of a loan.

It is critical for business leaders to understand debt covenants because these conditions set specific financial performance standards that can affect their company’s operations, borrowing capacity, and overall financial health. Breaching or failing to comply with debt covenants can lead to penalties, increased interest rates, or even default, jeopardizing the business’s stability and growth prospects.

Debt covenants are a standard part of most conventional loan agreements to protect the lender’s position. They are generally designed to ensure the borrower remains financially stable and can pay the debt. However, meeting the obligations associated with some debt covenants can also tie your business up in regular excessive reporting and cap its ability to grow.

The good news is there are other ways to find the funding you require without getting bogged down in a world of restrictive debt covenants. In fact, by choosing the right lending partner, it’s more than possible to meet your business goals and live free from highly restrictive covenants that hinder the fiscal management of your company.

Overview

First, it’s essential to understand that not all debt covenants are the same. All conventional loan agreements will contain debt covenants to safeguard the lender’s position and clarify the borrower’s responsibilities. Debt covenants are generally affirmative or negative, documenting what the borrowing business agrees to do (affirmative) or not do (negative) throughout the loan.

Second, it is important to note that within the realm of affirmative covenants, a specific group of financial ratios must be met regularly. These specific covenants require the borrower to meet explicit financial goals each month. As a result, the lender gains a deeper level of scrutiny, allowing them to monitor and control the borrower’s financial decisions. In effect, this can tie the borrower’s hands, constraining their ability to expand and grow.

Breaching or failing to comply with debt covenants can lead to devastating results. Fortunately, alternative lending options that are free from most of these covenants are readily available. As a result, alternative financing options can better support, not restrict, the growth of your business.

With this basic overview in mind, let’s get deeper into the weeds to understand better the debt covenants that are a part of conventional loans:

- Why they are needed.

- How they work.

- Are they restricting your growth to the point where you should consider alternatives.

Types of debt covenants

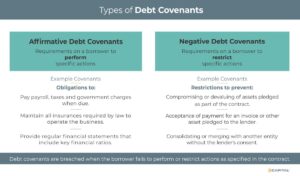

Debt covenants are generally categorized by two major types:

- Affirmative covenants– Requirements on a borrower to perform specific actions.

- Negative covenants– Requirements on a borrower to restrict specific actions.

What are affirmative covenants?

Affirmative covenants assert the borrower’s actions to be performed to maintain the financial health and well-being of the business.

Examples of affirmative covenants:

- Obligations to pay all payroll and taxes when due.

- Obligations to maintain all insurances required by law to operate the business.

- Provide regular financial statements that include key financial ratios.

Examples of key ratios include:

- Debt/EBITDA Ratio: A leverage ratio used to measure the borrower’s ability to pay off debt.

- Dividend Payout Ratio:The dividends paid to shareholders in relation to the company’s total net income.

- Fixed-Charge Coverage Ratio: A measure of a company’s ability to meet fixed-charge obligations.

Affirmative debt covenants are breached when the borrower fails to perform actions as specified in the contract.

What are negative covenants?

Negative covenants are put in place to restrict the borrower from performing specific actions.

Examples of negative covenants:

- Restrictions to prevent the compromising or devaluing of assets pledged as part of the contract.

- Restrictions to prevent the acceptance of payment for an invoice or other asset pledged to the lender.

- Restrictions to prevent the borrower from consolidating or merging with another entity without the lender’s consent.

Negative covenants are breached when the borrower exceeds limitations as specified in the contract.

Why are debt covenants needed?

Conventional lenders make credit decisions based on the company’s cash flow, financial performance, and operational performance. They then take assets as collateral to mitigate risk. As these lenders are not in the business of collecting assets, they focus on ensuring borrowers remain able to pay their debt. Debt covenants allow the lender to closely monitor the borrower’s financial performance. The tight controls debt covenants impose may require regular financial reporting from the borrower and audits by the lender to ensure the loan stays on their radar as a safe investment.

How do debt covenants restrict growth?

Businesses in expansion mode need additional capital above and beyond normal operating budgets. Investments in equipment, human resources, facilities, technology systems, training, marketing, and more are needed to create an infrastructure in which the business can flourish. As growth develops in stages, constant access to working capital is needed throughout the development. Too often, a company focused on a growth opportunity will breach a financial covenant without realizing as it directs capital resources in contradiction to a debt covenant.

What happens when a debt covenant is breached?

If a debt covenant is breached, the lender will take corrective action, which could include blocking further credit to the borrower. At that point, the loan will likely be renegotiated with further conditions and restrictions implemented until the covenant is cured. If the debt covenant is not cured within a specified time, the loan will trigger a default. At this point, the borrower generally has only a few days to repay the loan in full, or the debt will be assigned to a debt collection agency. Defaulting will drastically reduce the company’s credit score, impact its ability to receive credit, and can lead to the seizure of assets.

So, how are your debt covenants doing?

Now that you have a clearer understanding of debt covenants in general, how they work, and why they exist, ask yourself, “How are your covenants doing?” Take a moment to review the debt covenants in place with your current loans. If you can’t decipher the details, speak with your lender to get the answers you need. They should be forthright with those answers, as debt covenants are essential for how lenders do their business. Once you have the complete picture, you’ll be better able to decide if your covenants are workable or if they could present a challenge down the road that you would rather avoid.

Suppose your findings suggest a future free of debt covenants is the preferred route. In that case, you may want to consider a more flexible lending solution designed specifically for your funding needs without unwanted covenant-based restrictions. Those options fall under the category of alternative lending solutions and come in many forms.

The flexibility of alternative lending solutions

As noted above, a conventional lender will base lending decisions largely on the borrower’s financial performance. If the borrowing company repeatedly fails to meet fiscal goals as defined in the debt covenants, the withdrawal of credit is imminent. Alternative lending solutions such as invoice factoring or asset-based lending (ABL) provide a far more flexible lending arrangement.

Benefits for the borrower

With few covenants to control the borrower’s actions, alternative lending provides flexible financing options to help businesses grow. Unlike conventional lines of credit, when a company utilizes invoice factoring or asset-based lending to support growth, more credit becomes available as assets such as equipment, real estate, inventory, and invoice receivables increase. In other words, the more you grow, the more access to working capital you gain.

Industry-leading alternative lenders often actively participate in supporting the growth and success of the borrowing company. Acting as financial partners to their borrowers, alternative lenders such as eCapital contribute resources such as:

- Faster access to working capital

- More credit with less hassle

- Supportive risk management

- Accounts receivable management

- Full transparency and accountability

- 24/7 access to online account portal

- Dedicated customer support

Conclusion

If you are concerned about the possible impacts of your existing debt covenants, or if you are looking at future borrowing, you should now understand what to look for, what debt covenants you can live with, and when it may be time to consider an alternative. In the right situation, using asset-based loans and invoice factoring can reduce your time worrying about current debt. It can help you increase your available time for business planning and goal setting. Deciding to work with an innovative and trusted alternative lender opens the opportunity to operate free of highly restrictive covenants and better enables you to grow your business.

Contact us today for more information on how eCapital can help your business grow with flexible alternative financing options.

Key Takeaways

- Debt covenants are standard conditions of most conventional loan agreements as a safeguard to protect the lender’s position.

- Debt covenants are generally affirmative or negative, documenting what the borrowing business agrees to do (affirmative) or not do (negative) throughout the loan.

- Breaching or failing to comply with covenants can lead to devastating results.

- With few covenants to control the borrower’s actions, alternative lending provides flexible financing options to help businesses grow.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.

Fact-checked by:

Fact-checked by: