No matter how good your sales are, your company will face insolvency if you can’t access working capital to pay current financial obligations. Assessing your company’s working capital determines how much is available to meet short-term obligations, seize opportunities, and navigate challenges effectively. Calculating working capital requirement tells you how much of that capital is needed to support day-to-day operations and maintain business activities.

Regularly monitoring working capital requirements will help develop a forward-looking view and assist in planning. This allows companies to adjust their strategies, optimize resource allocation, and mitigate risks to ensure financial health and continuity.

Read on to discover how to calculate and assess working capital requirements. Plus, learn how businesses leverage alternative business financing to maximize access to working capital to pay bills and invest in future growth.

Working Capital vs Working Capital Requirement

Working capital and working capital requirements are closely related concepts in finance and business management – they are interlinked yet distinct.

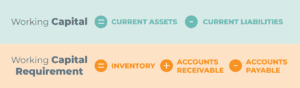

Working capital is a metric to determine a company’s liquidity, cash, cash equivalents, and other current assets a business has available after all its current liabilities are accounted for. A common way to analyze your working capital is by calculating the current ratio:

Working capital current ratio = Current assets / Current liabilities

A working capital ratio greater than 1.0 means the company’s assets are kept ahead of its short-term debts. A working capital ratio somewhere between 1.2 and 2.0 is generally considered good. However, this varies depending on the industry.

Working capital requirement (WCR) is the amount of working capital a business needs to cover its operating expenses. It represents the company’s current inventory, accounts receivable, and accounts payable. It is a simple formula:

Working capital requirements = Inventory + Accounts receivable – Accounts payable

The difference between “working capital” and “working capital requirement” is the availability of capital vs. capital need.

How to assess working capital requirement results

Businesses must regularly monitor their working capital requirements to maintain liquidity, support operational needs, manage cash flow effectively, and sustain financial stability and growth.

There can be three different scenarios resulting from the calculations:

- If your working capital requirement is positive, your company’s current assets exceed its current liabilities, indicating that your business has sufficient financial resources to meet its short-term liabilities.

- A working capital requirement of zero indicates that your company has enough operational resources to cover all requirements.

- If your working capital requirement is negative, your company’s current liabilities exceed its current assets.

A negative working capital requirement is often a red flag indicating potential cash flow or liquidity issues. However, depending on a business’s specific circumstances, industry dynamics, and management practices, a negative working capital requirement is not necessarily a bad indicator. It can be a strategic choice for certain companies with solid cash flow management capabilities or efficient operating models.

A positive working capital requirement indicates that a company maintains the necessary resources to operate effectively, meet short-term obligations, and pursue opportunities for success. While a high positive working capital requirement can indicate financial strength and operational efficiency, companies must manage it effectively to avoid excessive tied-up capital, optimize resource allocation, and maximize overall financial performance.

Businesses should regularly monitor their working capital requirement monthly or quarterly. Monitoring helps to identify trends, seasonal fluctuations, and potential issues early on, allowing for timely adjustments.

How to manage working capital requirement

Here are some steps you can take to address and avoid negative working capital requirements:

- Analyze the Situation

- Identify the specific factors contributing to the negative working capital requirement, such as high accounts payable, low accounts receivable turnover, or excessive inventory levels.

- Determine whether the higher working capital need is a short-term or a systemic problem requiring more comprehensive solutions.

- Improve Accounts Receivable Management

- Implement more effective credit and collection policies to accelerate the collection of outstanding invoices from customers.

- Offer discounts or incentives for early payments to encourage prompt settlements.

- Implement an invoice factoring program to accelerate cash flow.

- Optimize Inventory Management

- Streamline inventory management practices and implement just-in-time (JIT) inventory systems to reduce excess inventory levels and associated carrying costs.

- Identify slow-moving or obsolete inventory and consider strategies to liquidate or repurpose it.

- Negotiate with Suppliers

- Work with suppliers to negotiate more favorable payment terms, such as extended payment deadlines or discounts for early payments.

- Consider forming strategic partnerships with key suppliers to enhance collaboration and flexibility.

- Improve Operational Efficiency

- Focus on improving operational efficiency to reduce costs and enhance cash flow.

- Rework Pricing Strategies

- Review and adjust pricing strategies to reflect the company’s costs, market conditions, and desired profit margins.

- Consider whether price adjustments can improve cash flow without negatively impacting sales.

- Explore Financing Options

- Explore alternative financing options, such as revolving lines of credit or asset-based loans, to bridge cash flow gaps.

Continuously monitor your cash flow and working capital position and progress toward resolving negative working capital requirement results. Be prepared to adjust and adapt strategies as needed based on changing circumstances.

If the company’s cash flow requirements are consistently negative, it can be a severe and possibly complex situation. Consider seeking guidance from financial consultants, accountants, or business advisors specializing in turnaround management. To explore alternative financing options, consult with non-bank lenders experienced in financing the industry your company serves.

Accessing working capital to bridge the gap

Businesses struggling with persistent negative working capital requirement results need fast, flexible financing from reliable funding sources to invest in efficiencies. In today’s tight credit market, these businesses face arduous qualification requirements from traditional lenders, limiting their chances of credit approval.

Fortunately, non-bank lenders are forging new avenues to fast, flexible financing to meet the capital needs of businesses requiring a rapid funding solution. Non-bank lenders have gained significant market share over the past two decades as flexible lending alternatives to conventional means. Qualification is fast and easy for lending facilities, and funding often includes minimal loan covenants and expandable credit limits.

Let’s look at several commonly used and effective funding strategies non-bank lenders provide to businesses in need of working capital solutions to bridge funding gaps, rebuild financial stability, and fuel growth:

Leverage the value of your invoices

On average, it takes business customers over 40 days to settle outstanding invoices. This pattern of delayed payments stagnates cash flow and creates funding gaps, limiting access to working capital.

Invoice factoring is the selling of accounts receivable invoices at a discount in exchange for immediate payment. This funding process is supported by advanced technology to swiftly verify invoices, approve funding requests, and transfer funds within hours. Invoice factoring maximizes cash flow to provide easy access to working capital.

Unlock the value of your assets

Asset-based lending (ABL) unlocks the value tied up in your business assets to provide a flexible line of credit with few covenants. Your business’s AR, equipment, inventory, and more hold untapped value that can be utilized to gain financial stability.

ABL is growing as a preferred funding source for businesses needing fast, easy access to working capital. This type of lending is formula-driven against the value of the business’s assets. For example, a company may have an ABL credit facility that allows it to borrow up to 85% of its accounts receivable, 75% of its inventory, and 75% of the appraised value of its equipment.

ABL supports businesses in all stages, from young, growing companies to long-standing businesses that may be facing financial challenges or rapid growth.

Access flexible lines of credit

Lines of credit are essential for managing short-term cash flow needs. Compared to traditional lenders, non-bank lenders are often more willing to provide lines of credit to businesses with lower credit scores or less established credit histories. These lines of credit come with flexible underwriting standards, faster funding times, higher credit limits, and require less collateral. They allow businesses to draw funds as needed, with minimal reporting requirements and covenants. Companies can qualify quickly to access the cash they need to cover shortfalls in working capital requirements.

Conclusion

For business owners, understanding working capital requirement is more than just knowing a financial metric—it’s about ensuring the heart of your business, its daily operations, keeps beating. Regularly assess your working capital requirement, especially before major financial decisions, to gain valuable insights and help prevent unforeseen liquidity challenges.

If your business is experiencing persistent negative working capital requirement results, take immediate action to adjust operational efficiencies and, or correct cash flow issues. Businesses with complex or severe issues should seek guidance from financial professionals who specialize in turnaround management and non-bank lenders experienced in your company’s industry.

Key Takeaways

- Calculating working capital requirement tells your business how much capital is needed to support day-to-day operations and maintain business activities.

- Regular monitoring will help develop a forward-looking view and assist in planning to adjust strategies, optimize resource allocation, and mitigate risks to ensure financial health and continuity.

- Businesses struggling with persistent negative working capital requirement results need fast, flexible financing from reliable funding sources to invest in efficiencies.

- Non-bank lenders are forging new avenues to fast, flexible financing to meet the capital needs of businesses requiring rapid funding solutions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.