For small to medium-sized enterprises (SMEs) with frequent credit card transactions, such as retailers, hospitality businesses, and service providers, Merchant Cash Advances (MCAs) are a commonly used financing option. Designed to provide immediate capital based on future revenue, MCAs offer a lifeline to businesses needing quick cash flow solutions without the lengthy approval processes of traditional loans.

In this blog, we’ll explore MCAs, how they work, and why they might be the right choice for your business.

What Is a Merchant Cash Advance?

A Merchant Cash Advance is not a traditional loan. Instead, it’s an advance on a business’s future revenue. MCA providers offer a lump sum of cash in exchange for a percentage of future sales, typically deducted daily or weekly from the business’s revenue.

Key Features of MCAs:

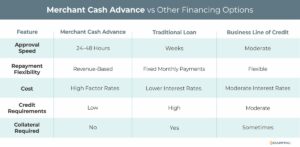

- Fast Approval and Funding: Businesses can receive funds within days of applying.

- Revenue-Based Repayment: Payments fluctuate with sales volume, easing the burden during slower months.

- No Collateral Required: MCAs are unsecured, making them accessible to businesses without significant assets.

How Merchant Cash Advances Work

- Application and Evaluation: Businesses submit an application, providing financial documents such as bank statements or credit card processing statements.

- Funding Amount: The MCA provider evaluates the business’s average revenue and offers an advance, typically ranging from £5,000 to £500,000.

- Factor Rate: Instead of an interest rate, MCAs use a factor rate (e.g., 1.2 or 1.5), which determines the total repayment amount. For example, an advance of £50,000 with a 1.3 factor rate means the business must repay £65,000.

- Repayment: The MCA provider collects a percentage of daily or weekly sales until the total repayment amount is met.

Advantages of Merchant Cash Advances

- Speed and Simplicity

- Approval processes are fast, often requiring minimal paperwork, and funding can be disbursed in as little as 24-48 hours.

- Flexible Repayment Terms

- Payments are tied to revenue, so businesses pay more during high-sales periods and less during slow periods.

- No Impact on Credit Lines

- MCAs do not affect a business’s existing credit lines, allowing for additional financial flexibility.

- No Collateral Required

- Businesses don’t need to pledge assets, making MCAs accessible for those without significant resources.

- Accessible to Low Credit Businesses

- MCA approvals are based more on revenue potential than credit scores, making them an option for businesses with less-than-perfect credit.

Challenges of Merchant Cash Advances

- High Cost of Capital

- Factor rates can make MCAs expensive compared to traditional financing options. For example, a factor rate of 1.5 translates to a 50% premium on the amount advanced.

- Frequent Repayments

- Daily or weekly deductions can strain cash flow, especially for businesses with inconsistent revenue streams.

- Limited Regulation

- MCAs are not regulated like traditional loans, which can lead to predatory practices by some providers. It’s crucial to partner with reputable MCA providers.

- No Early Repayment Benefits

- Unlike loans, paying off an MCA early typically does not reduce the repayment amount, as it’s tied to the factor rate.

Industries That Benefit Most from MCAs

Merchant Cash Advances are especially popular in industries with steady revenue streams and significant daily transactions, such as:

- Retail: To stock up on inventory for peak seasons.

- Restaurants: To cover unexpected expenses, renovations, or menu expansions.

- E-Commerce: To invest in marketing or technology upgrades.

- Service-Based Businesses: To cover payroll or purchasing equipment.

How to Choose the Right MCA Provider

When considering an MCA, selecting a trustworthy provider is essential. Here’s what to look for:

- Transparent Terms

- Ensure clarity on the factor rate, repayment terms, and any additional fees.

- Reputation

- Research reviews, testimonials, and industry reputation to find reliable providers.

- Customized Solutions

- Choose a provider that tailors advances to your business’s unique needs and revenue cycles.

- Supportive Customer Service

- Look for providers with responsive and helpful customer support to address any issues during the repayment period.

Real-World Example of MCA Success

Scenario: A small café needed £25,000 to renovate its space ahead of the holiday season. Traditional loans were not an option due to a low credit score and tight deadlines. The café secured an MCA with a 1.3 factor rate, receiving funds in two days.

Outcome: The renovations led to a 40% increase in holiday revenue, allowing the café to repay the advance within six months while enjoying sustained growth.

Is a Merchant Cash Advance Right for Your Business?

An MCA can be a powerful tool for businesses needing immediate capital and flexible repayment terms. However, the high cost and frequent payments mean they should be used strategically and primarily for short-term needs that drive significant returns on investment.

Conclusion

Merchant Cash Advances offers an innovative, fast, and flexible way for small businesses to access funding. While they may not be the best option for every situation, they can be invaluable for businesses with steady revenue streams and urgent capital needs. Contacting an experienced and reputable independent funder to discuss alternative financing options such as invoice financing or invoice discounting is a prudent action. By understanding the costs, benefits, and selecting a reputable provider, businesses can determine if MCAs are their best option to fuel growth and navigate cash flow challenges effectively.

Contact us today to learn about our bespoke financing solutions to support companies in overcoming financial challenges and foster long-term success.

Key Takeaways

- Merchant Cash Advances (MCAs) provide immediate capital based on future revenue, offering quick cash flow solutions without the lengthy approval processes of traditional loans.

- MCA providers offer a lump sum of cash in exchange for a percentage of future sales, typically deducted daily or weekly from the business’s revenue.

- Merchant Cash Advances are especially popular in industries with steady revenue streams and significant daily transactions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.