For businesses that rely heavily on inventory—such as retailers, wholesalers, and manufacturers—having the right stock at the right time is essential to meeting customer demand and driving revenue. However, maintaining inventory levels often tie up significant capital, limiting flexibility for other operational needs. Stock financing provides a solution by leveraging inventory as a financial asset to secure funding.

In this blog, we’ll explore stock financing, how it works, its benefits, and how businesses can use it strategically to optimize cash flow and grow.

What Is Stock Financing?

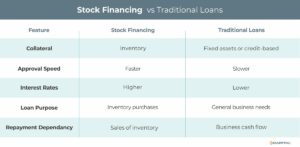

Stock financing, also known as inventory financing, is a type of funding that uses a business’s inventory as collateral to secure a loan or line of credit. This financing option enables businesses to access the capital needed to purchase, maintain, or expand inventory levels without depleting cash reserves.

Key Features of Stock Financing:

- Inventory-Based: Loans are secured against the value of current or future inventory.

- Flexible Use: Funds can be used to purchase stock, cover operational costs, or address cash flow gaps.

- Short-Term Focus: Ideal for seasonal businesses or those with fluctuating inventory needs.

How Does Stock Financing Work?

- Inventory Valuation: The lender evaluates the current or projected value of the business’s inventory.

- Loan Approval: Based on the valuation, the lender provides a loan or line of credit, typically covering a percentage (50%-80%) of the inventory’s value.

- Inventory as Collateral: The financed inventory serves as collateral for the loan.

- Repayment: Businesses repay the loan, often aligning with sales revenue generated from the financed inventory.

Who Can Benefit from Stock Financing?

Stock financing is particularly beneficial for:

- Retailers: To stock up for peak seasons or manage supply chain delays.

- Wholesalers: To purchase bulk inventory and meet large customer orders.

- Manufacturers: To acquire raw materials and maintain production schedules.

- E-Commerce Businesses: To manage high-volume inventory requirements and online demand.

Benefits of Stock Financing

- Improved Cash Flow

Access working capital tied up in inventory, enabling businesses to cover operational expenses and invest in growth opportunities.

- Flexible Financing

Aligns with inventory cycles, allowing businesses to borrow based on current or projected stock needs.

- Faster Access to Funds

Approval processes are often quicker than traditional loans, providing timely support for urgent inventory needs.

- Increased Purchasing Power

Enables businesses to buy larger quantities of inventory at discounted rates or secure supplies during high-demand periods.

- Seasonal Support

Helps seasonal businesses manage cash flow during slower periods or ramp up inventory for busy seasons.

Challenges of Stock Financing

- Inventory Valuation Risks

Lenders rely on the accuracy of inventory valuations, which can fluctuate due to market conditions or obsolescence. - Higher Interest Rates

Stock financing may come with higher interest rates compared to traditional loans, reflecting the lender’s risk. - Repayment Dependency

Repayment often hinges on the timely sale of inventory, making it unsuitable for businesses with slow-moving stock. - Collateral Risk

If the business defaults, the lender may seize the inventory used as collateral.

How to Use Stock Financing Strategically

- Plan for Seasonal Demand

Use financing to build inventory ahead of peak seasons to maximize sales opportunities. - Negotiate Better Terms

Purchase larger stock quantities at discounted rates using the additional capital from stock financing. - Bridge Supply Chain Gaps

Ensure inventory availability during supplier delays or disruptions. - Diversify Product Offerings

Use financing to introduce new products or expand your inventory range. - Monitor Inventory Turnover

Ensure that financed inventory moves quickly to avoid storage costs and repayment challenges.

Industries That Rely on Stock Financing

- Retail

Stock up for major shopping seasons like holidays or back-to-school sales. - Wholesale

Maintain sufficient inventory to meet bulk orders and customer demand. - Manufacturing

Secure raw materials needed for production schedules. - E-Commerce

Address fluctuating demand and ensure inventory availability during promotional campaigns. - Food and Beverage

Manage perishable inventory to ensure consistent supply and reduce waste.

Real-World Example: Stock Financing in Action

Scenario: A clothing retailer experiences increased demand during the holiday season but lacks the funds to purchase enough inventory from suppliers.

Solution: The retailer secures stock financing, using its current inventory as collateral to access $50,000. This enables them to purchase additional stock and meet holiday demand.

Outcome: The retailer generates $120,000 in holiday sales, repays the loan, and achieves a significant profit, ensuring financial stability into the new year.

Tips for Choosing a Stock Financing Provider

- Evaluate Lender Experience

Choose lenders familiar with your industry and inventory cycles. Create a shortlist of potential lenders and conduct a thorough research. Visit their websites to evaluate their service offerings, and check client reviews to gauge satisfaction levels. Reach out to conduct a phone interview. - Understand Terms

Review interest rates, fees, and repayment schedules to ensure they align with your cash flow. - Monitor Inventory Performance

Ensure your inventory has high turnover to minimize risks associated with slow-moving stock. - Prepare Accurate Valuations

Work with professionals to assess the true value of your inventory for accurate financing terms. - Compare Options

Research multiple providers to find the most competitive rates and terms.

Conclusion

Stock financing is a powerful tool for businesses looking to optimize cash flow, manage inventory cycles, and seize growth opportunities. By leveraging the value of their inventory, businesses can access the capital needed to operate efficiently and maintain a competitive edge in their industry.

Stock financing could be the solution if your business needs flexible, inventory-based funding. Evaluate your inventory needs, choose a reputable lender, and use this strategic financing option to take your business to the next level.

Contact us to learn more about our flexible business financing options to maximize access to capital with flexible business financing options aligned with your company needs and repayment capabilities.

Key Takeaways

- Having the right stock at the right time is essential to meeting customer demand and driving revenue for businesses that rely heavily on inventory.

- Stock financing is a type of funding that uses a business’s inventory as collateral to secure a loan or line of credit.

- This financing option enables businesses to access the capital needed to purchase, maintain, or expand inventory levels without depleting cash reserves.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.