Trucking insurance is one of your most significant monthly expenses as an independent owner-operator or small fleet owner. Premiums rank as a top-5 operating expense: not as large as labor and fuel, but big enough that premium swings can materially change a fleet’s breakeven rate – especially for smaller carriers or those with recent losses. Unfortunately, rates have been increasing for five consecutive years with insurance costs per mile reaching record levels. This trend continues, fueled by higher litigation exposure and large jury verdicts.

Rising insurance premiums strain cash flow with increased renewal down payments and higher monthly bills while freight revenue is collected on delayed payment terms of net 30 to 60+ days. This raises cost-per-mile and breakeven, reduces flexibility during soft demand periods, and widens cash flow gaps. The result is tighter liquidity that can force reactive decisions, such as taking lower-margin freight to keep trucks hauling, delaying maintenance, and stretching payables, even when the business appears profitable on paper.

Financial stability and efficient cash flow management are essential to every successful trucking business. This article is part of a guide designed to provide fleet owners and managers with actionable financial strategies to enhance operational reliability and profitability.

About the guide: A Trucker’s Guide to Cash Flow Management is a strategy blueprint and best-practice resource designed to help fleet owners and managers optimize working capital, control costs, and build financially resilient operations that keep trucks moving and business profitable.

Most truck insurance mistakes come from trying to cut upfront costs that can lead to catastrophic long-term consequences. Coverage gaps, denied claims, and compliance failures expose a carrier to massive accident liabilities, from six-figure settlements to “nuclear verdicts” in the tens of millions or more. Choosing the right policy is essential, but so too is controlling costs. This article focuses on eleven tips to help reduce your company’s semi truck insurance costs without compromising risk protection.

The best coverage at the lowest possible cost

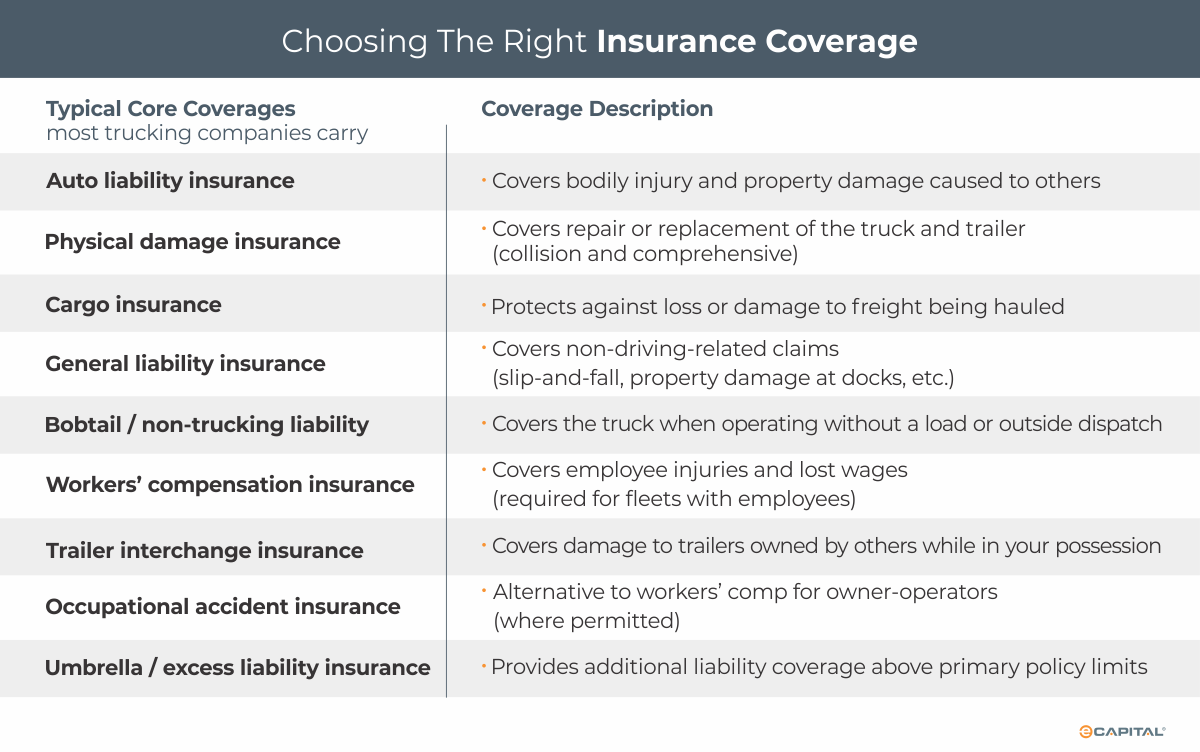

Choosing the right insurance coverage isn’t about saving money – it’s about protecting the business from risks it can’t absorb. The goal isn’t to buy the cheapest, bare-minimum policy, but to secure the right coverage and then lower premiums through disciplined safety, compliance, and smart policy structure.

Consider the 11 tips below to get the best trucking insurance coverage at the lowest possible cost.

Tips to lower insurance costs

- Employ Experienced Drivers

Years of driving experience is one of the key factors insurance providers use to determine truck insurance premiums. Having more experienced truck drivers implies that your drivers can better deal with inclement weather, along with other less-than-ideal operating conditions.

Pro Tip: Hire drivers with at least 2 years of CDL experience.

- Consider the Age of Your Drivers to Lower Semi Truck Insurance Cost

Truck drivers who are very young or very old tend to be involved in more accidents than average. Employing these higher risk demographics will result in higher trucking driver insurance costs.

Pro Tip: Hire drivers between 30 and 62 years of age.

- Hire Drivers with Clean Driving Records to Qualify for Low Cost Truck Insurance

Drivers who have been involved in fewer accidents are less likely to be involved in further accidents in the future. To qualify for low cost truck insurance, consider drivers with fewer accidents and violations.

Pro Tip: Hire drivers with no more than 2 minor moving violations in 3 years.

- Verify Driver Employment History to Get the Best Truck Insurance Rates

The number of years a driver has worked with different companies is a key factor in determining the best commercial truck insurance rates. The chance of an accident is reduced if the driver is experienced with specific routes and equipment.

Pro Tip: Verify each prospective driver’s employment history and references.

- Your Routes Determine Your Insurance Costs

The different routes on which your trucks operate can impact your commercial truck driver insurance premium. Factors include population density, frequency of inclement weather, and so on.

Pro Tip: Avoid high-population metro areas like New York, Chicago, Houston, and Los Angeles.

- Use Newer Trucks

The age, condition, and value of your company’s vehicles are a factor in determining trucking insurance premiums. Upkeep of trucking fleets and recently installed equipment is also a factor.

Pro Tip: Utilize newer trucks (10 years or newer) with modern equipment whenever possible.

- Staying In Business Lowers Your Truck Insurance Rates

Simply staying in business under the same name and maintaining your operating authority will result in lower semi truck insurance costs because new trucking operations are considered riskier to insure.

Pro Tip: Stay in business and don’t change or revoke your operating authority.

- Keep a Clean DOT Safety Record

Your DOT safety record includes your owner-operator or fleet DOT safety rating, Safestat and Inspection, Selection (ISS-2) scores, violations, and so on.

Pro Tip: Monitor your DOT safety record and maintain good standing.

- Employ Other Safety Features/Programs

Employing safety features like warning stickers, company safety programs and driver safety training shows insurance providers that safety is important to your organization.

Pro Tip: Periodically evaluate the safety features your trucking operation employs.

- Consider a Higher Deductible

If you’ve addressed the factors above and are still seeking lower premiums, adjusting your policy is the next place to consider. A higher deductible will result in a lower semi truck insurance costs, but you’ll incur a higher upfront cost in the event of an accident.

Pro Tip: Use a deductible of at least $1,000 – consider a higher deductible such as $2,500.

- Choose the Right Commercial Trucking Insurance Agent

Last but not least: not all insurance agents are created equally. Consider an agent with access to many insurance carriers and specializing in trucking insurance in particular. Choosing a trucking insurance specialist is critical both to getting the right coverage and getting the most value for your dollar.

A liquidity buffer to manage insurance costs

Rising premium costs are adding to cash flow pressures – but that’s just the beginning. Even with strong safety practices, precautions, and proper coverage, accidents remain a real financial risk in trucking. During a podcast interview, Claudia Catlett, an insurance and claims specialist, explains that a single cargo or liability claim can freeze all of a carrier’s payables from a broker, sometimes holding up tens of thousands of dollars while the claim is investigated.

Fleets need a proactive cash flow plan and liquidity buffer to manage insurance costs and stay operational while claims are investigated, and payments are temporarily held. Forward-thinking trucking companies arrange flexible working-capital solutions in advance to keep operations moving and protect cash flow during short-term constraints. Freight factoring and asset-based lending (ABL) are two mainstream tools commonly used in the industry to bridge payment delays, stabilize liquidity, and fund essential expenses without taking on restrictive long-term debt.

Conclusion

Truck insurance is too important, and too expensive, to treat as a once-a-year renewal decision. The right coverage protects your business from risks you can’t absorb, while disciplined safety, smart policy structure, and strong compliance help keep premiums in check over time. Pairing that approach with a proactive cash flow plan keeps your operation resilient through claims, rate volatility, and unexpected disruptions so your trucks keep moving and your business keeps growing.

Contact us to learn how flexible working-capital solutions can help your fleet manage rising insurance costs, protect cash flow, and stay on the road with confidence.

Next in the series

Equipment Acquisition – Used vs New and Leasing vs Ownership

- Managing trucks and trailers is as much a financial challenge as an operational one.

- Keeping equipment road-ready, compliant, and cost-efficient in an industry where expenses are high, and margins are tight is a constant challenge for most trucking companies.

- Delayed maintenance often leads to breakdowns, higher costs, safety risks, and lost revenue. Yet, when freight volumes surge or cash flow tightens, it’s tempting for operators to delay maintenance, trading short-term savings for long-term costs.

- Tailored financial strategies provide the working capital needed to stay operational, safe, and profitable.

View the complete Table of Contents.

Key Takeaways

- Most truck insurance mistakes come from trying to cut upfront costs that can lead to catastrophic long-term consequences.

- Choosing the right insurance coverage isn’t about saving money – it’s about protecting the business from risks it can’t absorb.

- The goal isn’t to buy the cheapest, bare-minimum policy, but to secure the right coverage and then lower premiums through disciplined safety, compliance, and smart policy structure.

- This article focuses on eleven tips to help reduce your company’s semi truck insurance costs without compromising risk protection.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.