How to Evaluate and Improve Your Payroll Funding Solution

Content

Making payroll accurately and on time is one of the most significant responsibilities of a staffing company. Clients and employees depend on your ability to meet this obligation without issue! Ensuring your staffing company is prepared to meet financial obligations as the market faces continuing economic uncertainty is essential to your continued success. Evaluating your payroll funding solution is the first step to identifying problem areas you can address to bulletproof your business financing.

An efficient payroll funding solution will meet your staffing company’s specific financial needs through changing conditions and all phases of its business’s life cycle. From start-up to growth, through the peaks and valleys of economic cycles, funding needs to be accurate, reliable, and on time. Equally as important is the need for flexibility! A great payroll funding solution will ensure your staffing company retains access to the working capital it needs when it needs it, no matter the circumstance. The big question is, “does your funding solution measure up?”

To get an expert’s opinion on the subject, we spoke with Dale Busbee, SVP, Business Development Officer at eCapital. Dale shared his 25+ years of executive-level leadership and sales experience to offer valuable advice to staffing company owners. We’ve used this information to develop a scoring system for evaluation purposes.

Learn how to use scorecards to evaluate your current payroll funding solution to ensure it has the legs to provide uninterrupted funding through adversity and growth. Download the scorecards for easy use. Follow the examples shown to help guide how to input data in each scorecard.

Six key assessments to evaluate your payroll funding solution

We asked Dale to describe the key factors to consider when evaluating your payroll funding solution. The following evaluations and recommended actions are based on the information Dale shared.

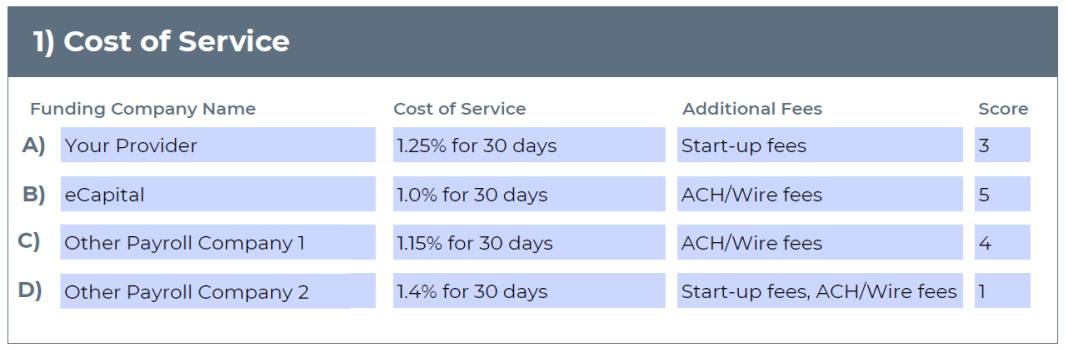

No.1 – Evaluating Cost:

The cost of service is a critical factor, but it must be stressed that cost is not the ultimate consideration. Nonetheless, it is one of the top-of-mind thoughts for business owners, especially in low-growth, high-cost business environments such as the one we’re currently experiencing. For that reason, let’s address this as the first issue.

Most payroll funding companies operating in the same market and industry face similar operating costs and overhead. If a payroll funding company offers a lower than competitive rate for their service, it typically indicates the lender is competing on price, not value. Beware of funding relationships based on the lowest cost, as it often results in service failures that can negatively impact your business credibility. The cheapest solution is often the least reliable.

How to Evaluate:

- The first row of the scorecard (shown below) should contain the information of your current funding company.

- Shop other payroll funding companies to compare rates and additional

- Disregard any pricing that seems excessively low or high to eliminate outliers*.

Assign a score from 1 to 5 for each remaining company (5 is high, 1 is low). Assign the highest score to the provider offering the best combination of cost and additional fees. Score the remaining companies appropriately.

* Outliers are values within a dataset that vary significantly from the other data indicating possible variables in measurement, such as reduced service quality or higher profit margins.

Actions to take:

- The pricing information you gather will give an overview of competitive costs. You don’t necessarily want the lowest cost as it is likely representative of the level of service you will receive. And you probably don’t want the highest cost for obvious reasons.

- Disregard outlining costs and look for a reasonable competitive price with the best quality service features (See No. 2).

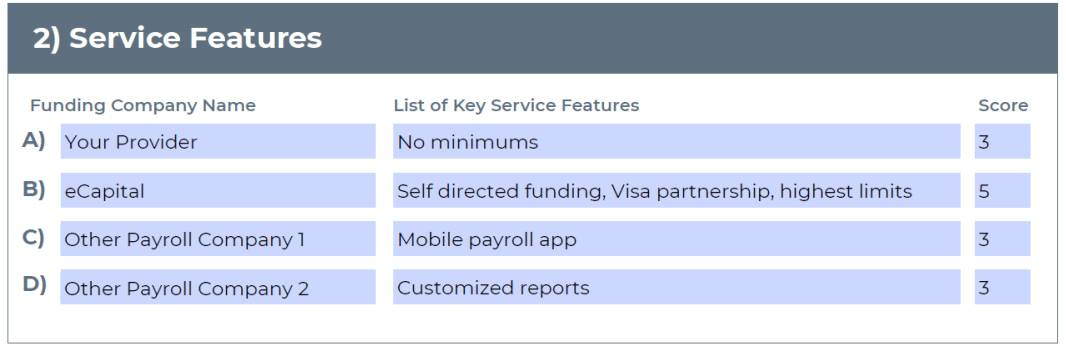

No. 2 – Evaluating Service Features:

The features offered by your payroll funding solution should be tailored to meet the specific needs of your business. The most essential service feature is ensuring that each funding is accurate and on time. No savings in cost will justify service failures such as inaccurate or late paychecks or the inability to increase funding to match growth opportunities.

How to Evaluate:

- Create a separate list of key features you expect from your payroll funding provider.

- Use the scorecard to list the key service features provided by your current provider and each company you interview.

Assign a score from 1 to 5 for each company. 4 represents a high score for a company that provides the services you expect and have recorded on your separate list. 5 represents a company that provides the services you expect and more.

Actions to take:

- A lender can offer excellent service, but customer reviews will tell you if they deliver as promised. Check the lender’s client testimonials and reviews when researching features.

- Adjust your score up or down based on these reviews.

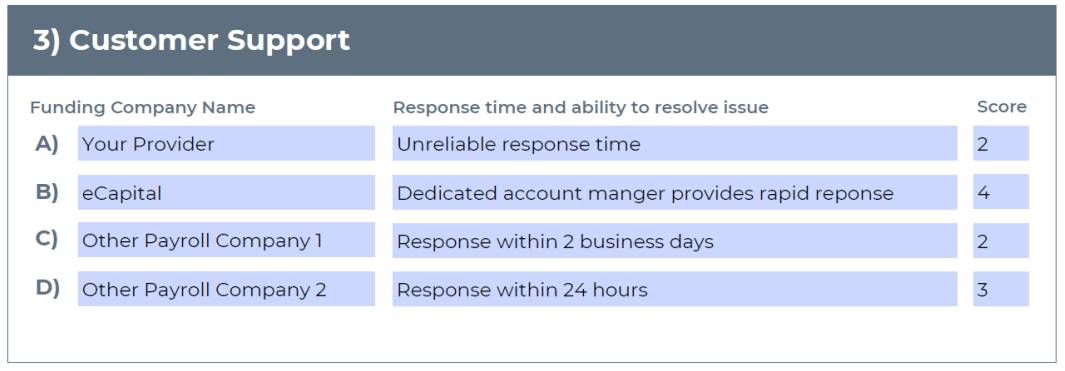

No. 3 – Evaluating Customer Support:

Dedicated customer support from the lender is crucial for the smooth operation of your payroll funding solution. Ensure the provider offers multiple support channels, including phone, email, and online support. Also, consider the hours of support and response times provided. If funding issues arise, they must be dealt with quickly and efficiently to appear seamless to your staffing company’s clients.

How to Evaluate:

- Question the staff members on your team that regularly interface with your lender. Use their input to score your current funding company.

- When interviewing the other payroll funding companies, assess their expertise, technologies, and problem-solving capabilities to manage financial challenges. Pose worst-case scenarios to test their resources and approach to managing unexpected financial challenges. Check online reviews and consider the comments made regarding each company’s service record. Record the information you receive as notes on your scorecard.

Assign a score from 1 to 5 for each company. 5 represents a lender with a dedicated customer service representative, an expressed commitment to respond quickly and resourcefully to any issues impacting your client accounts, plus positive comments in their customer reviews.

Actions to take:

- Continuously monitor your current lender’s response time and ability to resolve any issues impacting your client accounts quickly.

- Whether you change service providers or stick with your current lender, insist on having a fast response to funding issues. Your staffing company’s success largely depends on meeting your customers’ payroll on time and without problems.

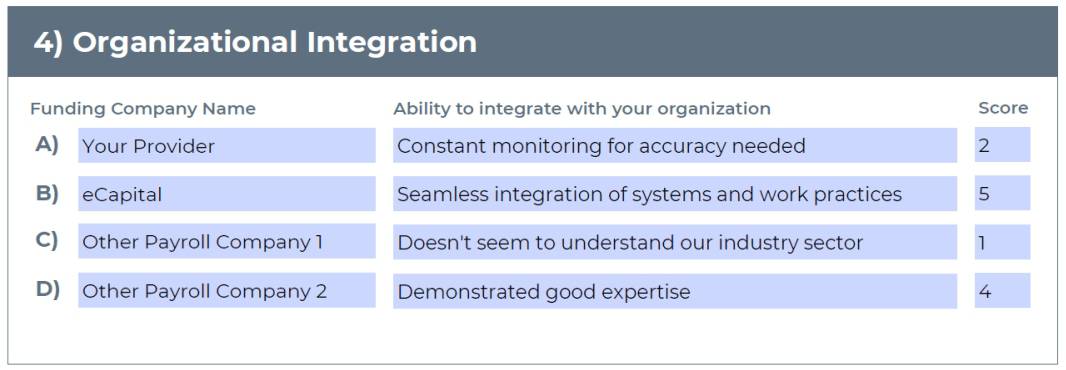

No. 4 – Evaluate Integration:

A payroll funding solution needs to fit well with your business operations. Their team must work well with your team. Infrastructure, such as accounting and HR systems, must integrate seamlessly. These efficiencies save you time and money, increasing productivity and profits.

How to Evaluate:

- Survey the staff members on your team that work with your current payroll funding company. Ask them to comment on the level of cooperative effort. Does your team work well with their team? Do systems integrate well? Record notes on your scorecard.

- When interviewing other payroll funding companies, ask questions to determine What systems, tools, work practices, and communication channels do they employ? Will these elements integrate well with your organization? Record notes on your scorecard.

Assign a score from 1 to 5 for each company. 5 represents a lender with the best ability to integrate well with your company.

Actions to take:

- Assessing the integration capabilities of other payroll funding companies will establish a baseline of what you can expect from a quality lender. Use this baseline to assign scores.

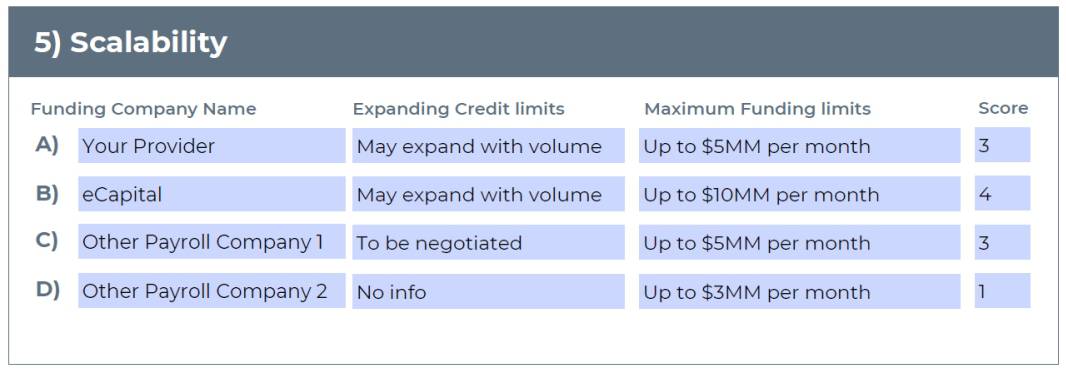

No. 5 – Evaluate Scalability:

Your business may grow and change over time, so choosing a payroll funding solution that can grow with you is essential. Look for a solution that can be scaled up or down as your business changes without requiring a complete overhaul of your financial structure.

How to Evaluate:

- Review your current payroll funding agreement to determine if credit limits expand as your AR volumes increase. Verify what the maximum funding limit for your company is. Can these limits support your business a year from now when your business has grown?

- When interviewing other lenders, gather and record credit and funding limits information.

- Assign a score from 1 to 5

Actions to take:

- Score each company based on your judgment of how well they will keep up with funding as your business grows. The highest score goes to the company with the most flexibility (the highest credit and funding limits).

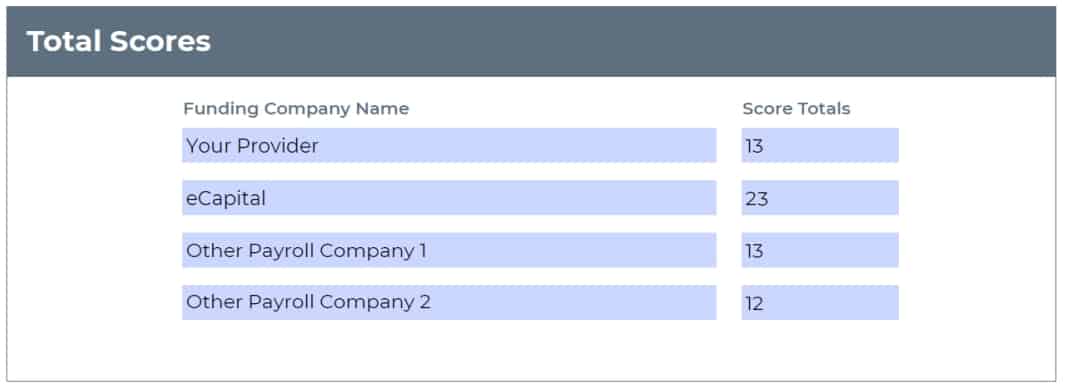

No. 6 – Evaluate overall service value:

Use the results of each scorecard to compare providers by category. Use the total scores to compare the overall service value of the payroll funding companies you investigated.

Conclusion

How well did your current payroll funding provider score? Did they perform well compared to others? If you see other lenders scoring a “5” in a category and your provider scored a “2” it’s time to call your lender and discuss their performance! If your provider has an overall score less than “15”, you need to switch to a new lender.

When asked to comment on the importance of an efficient and trusted payroll funding solution, Dale Busbee responded very clearly. “Never become complacent about your payroll funding solution! It is one of the essential services needed to support the success of your staffing company.” Dale continued, “The cost of funding significantly impacts your bottom line, but service failure in funding will create immeasurable damage to your reputation as a trusted staffing company. If your workforce is not anchored by a reliable paycheck, employees and customers will abandon your staffing company no matter the cost benefits you’ve arranged.”

Suppose you are unsatisfied with your current lender, and the results of your scorecards indicate that another provider will improve your access to reliable service at a competitive price. In that case, it’s time to take corrective action. Reference your scorecard results to demand improved services from your current provider or make plans to transition to a higher-quality service.

Dale wrapped up his advice with one final thought. “If your current payroll funding solution is less than reliable – change it! An experienced and reputable payroll funding company can facilitate a seamless transition to reliable funding without interruption or inconvenience to you or your customers.”

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.