Choose a High-Value Lender to Help Capitalize on Business Loan Broker Opportunities

Content

Relationship building and collaboration with experienced lenders are vital to thriving as a commercial loan broker. Establishing credibility and confidently projecting your ability to streamline flexible and affordable financing is the key to gaining traction and capitalizing on business loan broker opportunities.

Success lies in prioritizing mutually beneficial connections over hasty deal-making. Rather than prematurely pursuing new business loan broker opportunities, focus on nurturing relationships with lenders committed to your brokerage’s success. These partnerships provide access to diverse financing options, enhancing your ability to serve clients efficiently. By aligning with reputable lenders, brokers can secure attractive financing solutions and position their businesses for growth. Choose lenders wisely, prioritizing those dedicated to supporting your brokerage’s growth and ensuring a steady pipeline of opportunities.

This article discusses how to choose high-value lenders to help convert business loan broker opportunities into closed deals and help build your business.

Building Mutually Beneficial Relationships

For brokers, mutually beneficial relationships involve a lender, the broker, and the borrowing company (the client). Establishing solid lender/broker relationships sets the stage for building a succession of broker/client relationships that will grow your business. Time devoted to sourcing a network of high-value lenders committed to capitalizing on your business loan broker opportunities will reap huge benefits. Here are a few guidelines to follow:

- Identify a niche market on which to focus your business growth. Developing expertise in a specific industry narrows competition and brands your brokerage as a specialist.

- Identify high-value lenders experienced in your chosen field of expertise. Look for those who can close deals with fast, flexible solutions, offer high commissions, and have the knowledge and dedication to help convert business loan broker opportunities into profitable revenue streams.

- Be prepared to offer a marketing plan to lenders. You want to profit from their lending solutions – they want to profit from your referrals.

- Contact, interview, and select lenders with the intension of formalizing mutually beneficial relationships. The agreements should be short, clearly defined, and straightforward.

What to Look for in a High-Value Lender

A high-value lender can meet your clients’ financial needs and service expectations, offer varied commission opportunities, and manage your business loan broker opportunities according to your preference. Choose your level of involvement, whether hands-on or hands-off, with clear communication and customizable reporting. Look for lenders that offer advantages, such as tailored account management, flexibility, and the following benefits:

Responsive action.

Leveraging experience, financial technology, flexible products, and a solution-based approach to solving problems, a high-valued lender will respond quickly to capitalize on new business loan broker opportunities and evolving client needs.

Fast funding.

New business loan broker opportunities often require fast funding solutions to solve a financial crisis or meet a growth opportunity. High-value lenders can assess the opportunity, offer solutions, and qualify the client in a few days to provide fast funding solutions.

Lucrative commissions.

A high-value lender will formalize a lucrative commission structure in writing, regularly pay commissions, and provide account activity and commission reporting.

While interviewing lenders, look for evidence of their integrity, agility, accountability, and innovation. These characteristics will form a secure, trusting relationship.

Your Lender Should Offer Multiple Products

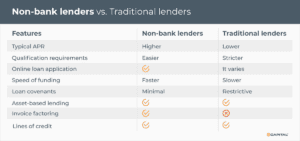

There are two types of commercial lenders – non-bank and traditional. Typically, non-bank lenders offer more flexibility with tailored financing options and easy qualification requirements to provide more money, in more ways, to more prospects. Tailored products and services mean more solutions to convert more business loan broker opportunities and more revenue to grow your business. Here are some of the products provided by non-bank lenders:

Asset-based lending:

An increasingly popular business financing option is Asset-based lending. Asset-based lending enables companies to receive loans or lines of credit based on the assessed value of their assets. These assets, such as accounts receivable, inventory, equipment, and occasionally real estate, act as collateral for the loan. Typically, the loan amount is a percentage of the appraised value of these assets.

Commissions are typically 0.5% of the first funding round, creating a significant revenue influx from converted business loan broker opportunities.

Invoice factoring:

Businesses needing fast access to working capital utilize invoice factoring to sell their accounts receivables at a discount in exchange for immediate cash. This alternative strategy is popular with transportation companies, staffing companies, and businesses that can’t qualify for bank loans but have creditworthy customers. Commissions are typically paid monthly, creating regular revenue streams from converted business loan broker opportunities.

The most progressive high-value lenders, such as eCapital, provide additional services to their factoring clients. For example, factoring clients in transportation are pre-approved for a revolving line of credit. Additional services create more revenue streams from converted business loan broker opportunities which can grow your broker business.

Visa commercial cards:

A commercial card program allows your clients to receive and spend approved funds whenever needed and wherever Visa is accepted. Customized spending options with daily limits and enhanced reporting provide your clients with extensive expense control and transparency. This easy-to-sell service generates ongoing revenue from converted business loan broker opportunities.

Lenders that provide a selection of lending products create a better experience for your clients and multiple revenue opportunities for you to build a steady referral income. Often, a borrowing company will start with one funding service and need additional capital management services as its business develops. A lender that values you as a referral partner will continue to pay commissions throughout the length of the relationship on both initial and additional lending products. Imagine the rewards gained from a referral that grows to multiple products, and all that is required from you is the initial contact.

Overall, matching business loan broker opportunities with high-value lenders provides client businesses access to the financing they need, creates solid revenue streams, and builds your reputation for getting the deal done.

Conclusion

Your success as a commercial loan broker is based on building relationships – and the first relationships you need are with high-value lenders. Having the right lenders in place is like having a high-powered engine under the hood of your race car. Without it, you’ll go nowhere – with it, you’ll accelerate business right off the starting line. Leverage lenders’ experience and product solutions to elevate your brand as a “go-to” contact for SMBs wanting to work with a business loan broker. Once you have trusted lenders in place to convert business loan broker opportunities into solid deals, concentrate on prospecting. Let the lender win the business and perform the daily grunt work of managing the client – your job is to refer prospects, monitor accounts to whatever level suits you, and watch your revenues grow.

Partnering with high-value lenders to capitalize on business loan broker opportunities puts you in the driver’s seat, picking up speed in cruise control. Their range of funding solutions, experience, and expertise, help increase closing ratios as you focus on seeking new avenues to more business.

Contact us today to learn about our approach to help convert business loan broker opportunities into substantial revenue streams and help build your business.

Key Takeaways

- Aligning with reputable and high-value lenders enable brokers to secure flexible financing solutions and position their businesses for growth with lucrative revenue streams.

- High-value lenders experience, multiple financing solutions, and easy qualification requirements to help convert business loan broker opportunities into closed deals.

- Look for lenders that can convert your opportunities into solid deals with account management customized to your preference.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.

Fact-checked by:

Fact-checked by: