Leveraging investments can be an effective strategy for investors to maximize potential returns, increase buying power, diversify portfolios, and access capital for new investments. For this purpose, margin loans offer an enticing option. By borrowing funds against the value of an existing investment portfolio, this type of financing allows investors to make larger investments, potentially boosting returns.

However, investors must clearly understand the benefits and disadvantages of leveraging because margin trading involves the potential for significant returns and the risk of substantial losses. Without a solid understanding of how margin loans work, investors may inadvertently expose themselves to risks they are not prepared for.

In this blog, we’ll explore margin loans, how they work, their benefits, and the risks investors must consider before diving into this financing strategy.

What Is a Margin Loan?

This type of business financing allows investors to borrow money to buy securities or other investments. It is typically offered by financial institutions such as banks or alternative lenders specializing in investment and brokerage services. The loan is secured by the investor’s portfolio, with the purchased securities or existing investments serving as collateral.

Key Features:

- Collateral-Based: Your investment portfolio serves as collateral for the loan.

- Leverage: Allows you to buy more securities than you could with just your cash.

- Variable Interest Rates: Interest is charged on the borrowed amount, often at a variable rate.

- Margin Requirement: A minimum percentage of the portfolio’s value must be maintained as equity.

How Does a Margin Loan Work?

- Qualification: Investors must meet a combination of financial requirements, experience, and risk awareness to qualify for this type of financing. This includes having a sufficient initial deposit, a good credit history, the ability to manage the loan’s risks, and agreeing to the terms of the margin agreement.

- Borrowing Limit: Once an account is set up, the amount an investor can borrow is based on the value of their investment portfolio, typically up to 50% of the portfolio’s value.

- Using the Funds: The borrowed funds can be used to purchase additional securities, diversify investments, or meet other financial needs.

- Repayment: This type of financing usually does not have a set repayment schedule. Instead, investors are expected to repay the loan in full when they liquidate their positions or when certain conditions trigger a repayment, such as a margin call.

What Is a Margin Call?

A margin call occurs when the value of your portfolio falls below the broker’s required minimum equity percentage, known as the maintenance margin. If this happens, you must either:

- Deposit additional funds or securities to meet the margin requirement.

- Sell securities in your account to cover the shortfall.

Failing to meet a margin call can result in the broker selling your investments, often at a less-than-ideal time.

Benefits of Margin Loans

- Increased Buying Power

- Allows you to invest more capital, potentially increasing your returns if the market performs well.

- Flexibility

- This type of financing can be used for a variety of purposes, including portfolio diversification or funding personal expenses.

- No Fixed Repayment Schedule

- Unlike traditional loans, margin loans often allow for flexible repayment terms, provided you meet margin requirements.

- Potential Tax Advantages

- In some jurisdictions, the interest on margin loans may be tax-deductible if used for investment purposes. Consult a tax advisor for specific guidance.

- Seizing Market Opportunities

- Provides immediate access to funds, enabling you to capitalize on timely investment opportunities.

Risks of Margin Loans

- Amplified Losses

- Just as leveraging investments can amplify gains, this strategy can magnify losses, potentially resulting in a loss greater than your initial investment.

- Margin Calls

- Falling asset values may trigger a margin call, forcing you to sell investments or deposit additional funds at short notice.

- Interest Costs

- Ongoing interest charges can reduce the overall profitability of your investments, especially in a stagnant or declining market.

- Market Volatility

- This type of financing is sensitive to market fluctuations, which can add stress during volatile periods.

- Forced Liquidation

- Brokers have the right to sell your securities without notice if you fail to meet margin requirements, often at unfavorable prices.

Margin Loan Example

Scenario: An investor has $500,000 in a brokerage account and takes out a margin loan of $250,000 to purchase additional shares of a promising stock.

- Investment: $750,000 worth of stock ($500,000 cash + $250,000 loan).

- Potential Gain: If the stock price increases by 20%, the portfolio value rises to $900,000, resulting in a $150,000 profit (30% return on the original $500,000 investment).

- Potential Loss: If the stock price drops by 20%, the portfolio value falls to $600,000, and the investor still owes $250,000, leaving only $350,000 in equity, representing a $150,000 loss (30% loss).

Best Practices for Managing Margin Loans

- Monitor Your Portfolio

- Regularly review your investments to ensure you meet margin requirements and avoid surprises.

- Use Leverage Wisely

- Avoid borrowing the maximum amount available; maintain a buffer to reduce the risk of margin calls.

- Diversify Investments

- Spread your investments to minimize risk and reduce exposure to market volatility.

- Have a Repayment Plan

- Ensure you have a strategy to repay the loan, especially in case of market downturns.

- Stay Informed

- Keep an eye on interest rates, as rising rates can increase borrowing costs.

Conclusion

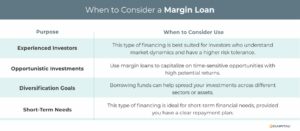

Margin loans are a powerful tool for investors seeking to leverage their portfolios and maximize returns. However, they come with significant risks that require careful management and a thorough understanding of market conditions. By using margin loans strategically and maintaining a disciplined approach, investors can unlock new opportunities while mitigating potential downsides.

Before taking out a margin loan, assess your risk tolerance, financial goals, and the market environment. Consult with your broker or financial advisor to ensure that margin investing aligns with your investment strategy. With the right approach, margin loans can be an effective addition to your financial toolkit.

Contact us to learn about our flexible business financing options to maximize potential returns with a margin loan.

Key Takeaways

- Borrowing funds against the value of an existing investment portfolio allows investors to make larger investments, potentially boosting returns.

- A margin loan allows investors to borrow money to buy securities or other investments.

- The loan is secured by the investor’s portfolio, with the purchased securities or existing investments serving as collateral.

- By using margin loans strategically and maintaining a disciplined approach, investors can unlock new opportunities while mitigating potential downsides.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.