Businesses in 2023 continue to face reduced revenues and increased costs as the economy weathers a period of high inflation and possible recession.

They’re likely to continue encountering restricted business financing in Q2 and Q3 as banks intensify credit scrutiny due to current market conditions. In these situations, it can be a challenge to stabilize finances, especially if the company can’t qualify for a bank loan, has its lending terms restructured, or had its line of credit recalled.

To navigate difficult financial conditions, businesses need a comprehensive understanding of effective business financing options that can quickly balance their pocketbook.

Fortunately, companies in financial distress that are unable to acquire bank financing, or need more flexible lending terms, now have a selection of alternative funding options specifically designed to provide the money they need when they need it. Over the past two decades, these alternative finance companies have changed the lending landscape with significant advancements in fintech to loosen credit access and accelerate the speed of funding.

This article explores the best and fastest alternative financing solutions for companies facing financial distress in 2023. Learn what business owners need to know about readily available business financing without a bank loan to stabilize finances or navigate financial challenges.

Why are alternative business financing options a smarter solution for businesses in distress?

Banks typically use the five Cs of credit to assess lending qualifications. Banks analyze the borrower’s credit history, financial performance, collateral, and cash flow. This narrow scope typically restricts credit to businesses in financial distress.

Alternative finance companies use different criteria to qualify borrowers. That includes various underwriting criteria, may use different types of assets as collateral, and are not subject to extensive scrutiny by government regulators. Using advanced fintech capabilities, alternative finance companies quickly access and analyze hundreds of credit-related data points inaccessible to conventional lenders. By uncovering untapped borrower credit strengths and under-leveraged assets, tech-enabled alternative finance companies can qualify, onboard, and start first funding to new business financing accounts in a matter of a few days. This flexibility enables alternative finance companies to deliver more money in more ways to businesses in financial distress faster and with less lender oversight than conventional banks.

More money in more ways

Leading alternative finance companies leverage one or more financial solutions and services to offer tailored bespoke business financing. This flexibility allows these alternative finance companies to provide business financing with few loan covenants and expand credit limits to support business stability and growth.

The two most powerful funding options alternative finance companies provide to stabilize companies in financial distress are:

Faster speed of funding

When companies in financial distress need business financing, they typically need immediate funding. Unfortunately, banks can be slow to approve or reject a borrower’s request for a bank loan or line of credit. Instead, alternative finance companies can complete approvals and account setup and start first funding within a few days. Once the financing accounts are set up, funding requests are processed within hours. For example, eCapital’s invoice factoring clients can have funds transferred directly into their cash accounts immediately after invoices have been received and approved. For transportation fleets, staffing companies, and other businesses needing regular access to working capital, enhanced speed of funding can be critical to reducing financial stress.

Best lender qualifications to look for

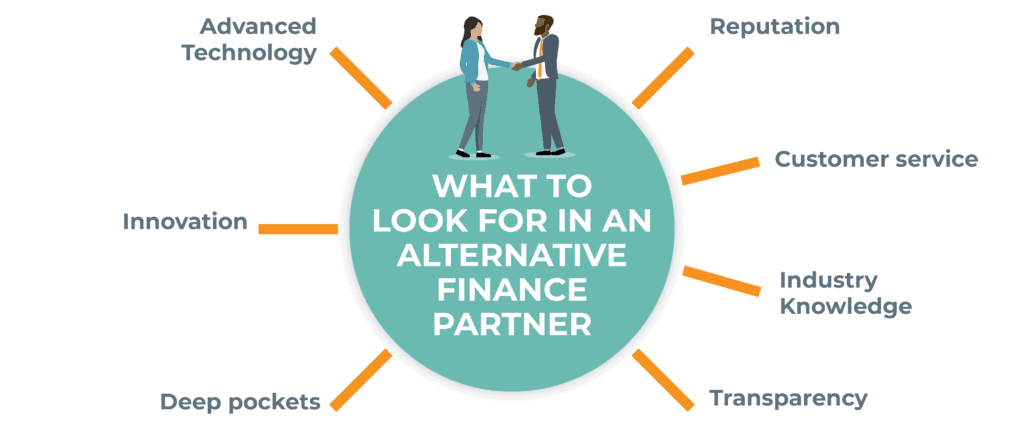

So, if alternative lenders commonly provide easy qualification and fast business financing, how can you distinguish between available providers and choose the best lender to partner with? The answer lies in compatibility. If your business is going through financial distress, you’ll need to ensure the finance company and its team is reputable, dedicated to world-class customer service, and has easy-to-use tools, systems, and work practices.

The best lender qualifications to look for include the following:

- Advanced technology: Does the lender use advanced technology to ensure fast and easy funding to distressed companies?

- Reputation: Is the lender recognized for reliable funding that companies can depend on? Check the lender’s reviews and client testimonials to confirm customer satisfaction.

- Customer service: Companies in distress often face urgent financial obligations that require immediate resolution. Does the lender assign a dedicated account manager to streamline processes and respond expediently to meet customer needs?

- Industry Knowledge: Ensure the lender has experienced staff, knowledge in the industries they serve, and the expertise to help solve complex financial issues when they arise.

- Transparency: Access to information is critical! Does the lender have a robust online account management portal to monitor balances, transactions, and credit limits in real-time?

- Deep pockets: Does the lender have the financial resources to ensure continuous, uninterrupted funding throughout the crisis and support ongoing funding as financial stability leads to business growth?

- Innovation: Is the company solution-focused and capable of solving challenges in even the most complicated scenarios?

Conclusion

When businesses in distress need business financing, they need it now! As economic conditions continue to batter companies’ stability, alternative financing has become a mainstream strategy to fund businesses unable to acquire conventional bank loans or lines of credit. But as the economy continues to struggle and more companies face financial distress alternative funding options, such as invoice factoring and asset-based lending, are becoming even more popular as flexible business financing solutions.

Alternative business financing options feature fast funding, few covenants, and expanding credit limits that keep pace with business growth. These features empower companies to stabilize finances in a chaotic economy, support recovery or transition, and fuel growth when opportunities arise.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.