Business agility is essential in an uncertain economy, enabling companies to quickly adapt to changing market conditions, mitigate risks, and seize new opportunities for growth. Effective cash flow management and easy access to capital are critical, especially when dealing with seasonal fluctuations, unexpected expenses, or growth opportunities.

A business line of credit offers a flexible financing option that allows businesses to access funds as needed rather than borrowing a lump sum. This “revolving” credit structure provides financial stability and agility, making it an indispensable tool for modern businesses.

In this blog, we’ll dive into business lines of credit, how they work, and why it’s a smart choice for businesses aiming to stay competitive and prepared.

What Is a Business Line of Credit?

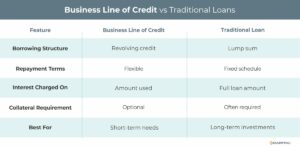

A business line of credit is a revolving loan that gives businesses access to a predetermined amount of funds. Unlike traditional loans, where the borrower receives a lump sum upfront, a line of credit allows businesses to draw money as needed, up to a credit limit. Interest is charged only on the amount borrowed, and once repaid, the credit becomes available again for future use.

Key Features of a Business Line of Credit:

- Revolving Credit: Borrow, repay, and borrow again within the credit limit.

- Flexible Usage: Funds can be used for various business needs, such as inventory, payroll, or emergency expenses.

- Interest on Usage: Interest is applied only to the amount borrowed, not the total credit limit.

- Renewable Terms: Often renewed annually, depending on the lender.

How Does a Business Line of Credit Work?

- Application and Approval: Businesses apply for a line of credit by providing financial statements, tax returns, and credit history.

- Credit Limit Assignment: Lenders evaluate the business’s financial health to determine the credit limit.

- Drawing Funds: The business can withdraw funds as needed, either in full or in smaller amounts.

- Repayment: Borrowers repay the funds with interest, either through scheduled payments or lump sums.

- Revolving Credit: Once repaid, the funds become available for reuse, ensuring ongoing access to capital.

Types of Business Lines of Credit

- Secured Line of Credit

- Backed by collateral, such as inventory, accounts receivable, or real estate. Offers higher credit limits and lower interest rates.

- Unsecured Line of Credit

- No collateral is required, but it typically comes with lower credit limits and higher interest rates. Best for businesses with strong credit histories.

Benefits of a Business Line of Credit

- Flexibility

- Borrow only what you need, when you need it, making it ideal for covering unexpected expenses or short-term cash flow gaps.

- Cost Efficiency

- Interest is charged only on the amount borrowed, saving money compared to lump-sum loans with unused funds.

- Improved Cash Flow

- Ensures liquidity to manage payroll, supplier payments, or seasonal inventory purchases.

- Builds Creditworthiness

- Regular use and timely repayment can enhance your business credit profile, making it easier to secure larger financing in the future.

- Accessible Funds

- Acts as a financial safety net, providing peace of mind during emergencies or market downturns.

Challenges of a Business Line of Credit

- Variable Interest Rates

- Rates may fluctuate, potentially increasing borrowing costs over time.

- Annual Fees

- Some lenders charge maintenance or renewal fees, even if the credit isn’t used.

- Qualification Barriers

- New or smaller businesses may face difficulty qualifying for unsecured lines of credit without a strong credit history.

- Discipline Required

- Mismanagement of borrowed funds can lead to financial strain or overleveraging.

Common Uses for a Business Line of Credit

- Managing Seasonal Fluctuations

- Covering operational expenses during slower months and ramping up production for peak seasons.

- Emergency Expenses

- Handling unexpected costs like equipment repairs or urgent supplier payments.

- Short-Term Opportunities

- Seizing growth opportunities, such as bulk-purchasing inventory at discount rates or funding marketing campaigns.

- Bridging Receivables Gaps

- Maintaining cash flow while waiting for customer payments.

- Payroll and Operational Costs

- Ensuring employee wages and day-to-day expenses are covered during temporary cash shortages.

Tips for Securing and Managing a Business Line of Credit

- Maintain Good Credit

- Strong business and personal credit scores improve your chances of approval and better terms.

- Prepare Financial Documentation

- Ensure your financial statements, tax returns, and cash flow projections are accurate and up-to-date.

- Compare Lenders

-

- Shop around to find competitive interest rates, fees, and terms that align with your business needs. Examine the company’s website and customer reviews before interviewing the lender to ensure alignment with your company goals.

- Use Wisely

- Treat your line of credit as a backup or tool for strategic use, not as a regular funding source.

- Monitor Cash Flow

- Regularly track your usage and repayment to avoid overleveraging or incurring unnecessary interest.

Real-World Example: Business Line of Credit in Action

Scenario: A rowing manufacturing company that produces custom furniture experiences high demand as lowering interest rates stimulate the real estate market. As new home buyers enter the market furniture demand surges.

Solution: The company secures a $500,000 business line of credit. As production ramps up, they use $250,000 to cover payroll and raw material expenses. Once customer payments are received, the company repays a portion of the loan, replenishing the available balance for future expenses.

Outcome: The business sustains operations during surges in demand and maintains financial stability, ensuring steady growth.

Conclusion

A business line of credit is a versatile and reliable financing tool for businesses looking to manage cash flow, seize opportunities, and navigate challenges with confidence. Its flexibility, cost efficiency, and revolving nature make it ideal for addressing short-term financial needs while maintaining operational stability.

If your business needs a financial safety net or a flexible way to manage working capital, consider a business line of credit. Consult with lenders, review your options, and choose a solution that aligns with your business goals. With proper management, a line of credit can be the key to long-term success and growth.

Contact us to arrange a business line of credit aligned with your company’s needs and goals.

Key Takeaways

- Effective cash flow management and easy access to capital are critical for business agility in an uncertain economy.

- A business line of credit allows businesses to draw money as needed, up to a credit limit. Interest is charged only on the amount borrowed, and once repaid, the credit becomes available again for future use.

- This type of financing is flexible, cost efficient, and the revolving nature makes it ideal for addressing short-term financial needs while maintaining operational stability.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.