Asset-Based Financing: Unlocking Capital Through Your Business Assets

Content

- What Is Asset-Based Financing?

- Key Features of Asset-Based Financing:

- How Does Asset-Based Financing Work?

- Types of Assets Used in Asset-Based Financing

- Who Can Benefit from Asset-Based Financing?

- Benefits of Asset-Based Financing

- Challenges of Asset-Based Financing

- Industries That Benefit from Asset-Based Financing

- Real-World Example: Asset-Based Financing in Action

- How to Use Asset-Based Financing Strategically

- Tips for Choosing an Asset-Based Financing Provider

- Conclusion

- Key Takeaways

The global economic outlook has become muddied – uncertainty is certain! Companies must focus on resilience and adaptability in the face of changing market conditions to survive and thrive. Managing cash flow and securing funding is critical for maintaining financial stability and operational agility, especially during growth or financial challenges.

Asset-based financing provides a flexible and efficient solution to achieving stability and adaptability by allowing businesses to borrow against the value of their assets. This type of financing empowers companies to access capital quickly, often without the constraints of traditional loans.

This blog explores what asset-based financing is, how it works, its benefits, and why it’s an ideal choice for businesses looking to optimize liquidity and financial stability.

What Is Asset-Based Financing?

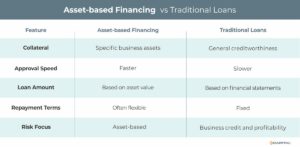

Asset-based financing is a form of secured lending where businesses use their tangible and intangible assets as collateral to secure a loan or line of credit. These assets can include accounts receivable, inventory, equipment, or real estate. The amount of funding provided depends on the value of the pledged assets.

Key Features of Asset-Based Financing:

- Collateral-Driven: Secured by business assets rather than credit history alone.

- Flexible Usage: Funds can be used for working capital, expansion, debt consolidation, or other needs.

- Quick Access to Capital: Often faster to secure compared to traditional loans.

How Does Asset-Based Financing Work?

- Asset Evaluation: The lender assesses the value of the business’s assets to determine the loan amount.

- Loan Approval: The lender approves financing based on the asset valuation and the business’s financial health.

- Collateral Agreement: The assets are pledged as collateral for the loan or line of credit.

- Fund Disbursement: The lender provides funding, typically as a percentage of the asset’s value (e.g., 70%-85% for receivables, 50%-75% for inventory).

- Repayment: The borrower repays the loan or draws and repays funds under a line of credit, often aligned with cash flow cycles.

Types of Assets Used in Asset-Based Financing

- Accounts Receivable

- Invoices owed by customers are a common form of collateral.

- Inventory

- Stock held by the business can be leveraged for funding.

- Equipment

- Machinery, vehicles, and other fixed assets can serve as collateral.

- Real Estate

- Commercial property can back larger loans.

- Intangible Assets

- Intellectual property or patents may qualify in certain cases.

Who Can Benefit from Asset-Based Financing?

Asset-based financing is ideal for:

- Small and Medium Enterprises (SMEs): Needing liquidity for growth or operations.

- Seasonal Businesses: Managing cash flow fluctuations during off-peak periods.

- Manufacturers and Wholesalers: Leveraging inventory and receivables to fund production.

- Businesses with Limited Credit History: Securing funds without strong credit profiles.

- Companies in Turnaround Situations: Restoring stability and operations through accessible funding.

Benefits of Asset-Based Financing

- Quick Access to Funds

- Securing funding based on assets is faster than traditional loan approvals.

- Preserves Equity

- Unlike equity financing, it doesn’t dilute ownership stakes.

- Flexible Use of Funds

- Provides working capital for a variety of business needs, from payroll to inventory replenishment.

- Scalable Financing

- Borrowing capacity grows as the value of assets increases.

- Improves Cash Flow

- Converts assets into liquid capital to address immediate financial needs.

- Easier Qualification

- Approval focuses on asset value rather than stringent credit requirements.

Challenges of Asset-Based Financing

- Valuation Dependency

- Loan amounts are limited to a percentage of the asset’s appraised value.

- Collateral Risk

- Assets may be repossessed if the business defaults on repayment.

- Higher Interest Rates

- Costs can be higher than traditional loans due to perceived risks.

- Monitoring Requirements

- Lenders may require ongoing assessments or audits of pledged assets.

- Not Suitable for All Businesses

- Companies with limited or low-value assets may not qualify.

Industries That Benefit from Asset-Based Financing

- Manufacturing

- Secures funding for raw materials and production cycles.

- Retail and E-Commerce

- Manages seasonal inventory demands and fluctuating sales.

- Construction

- Funds equipment purchases or project-based cash flow needs.

- Transportation and Logistics

- Leverages fleet and receivables to maintain operations.

- Wholesale and Distribution

- Covers bulk inventory purchases and supplier payments.

Real-World Example: Asset-Based Financing in Action

Scenario: A mid-sized manufacturer has $2 million in accounts receivable but faces a cash flow crunch due to slow-paying customers. The company needs $1.5 million to cover payroll and purchase raw materials.

Solution: The manufacturer secures an asset-based line of credit using its accounts receivable as collateral. The lender provides a line of credit, based on 85% of the company’s asset value, to provide $1.6 million in funding, disbursed quickly.

Outcome: The manufacturer fulfills its financial obligations, continues production without disruption, and repays the loan as receivables are collected.

How to Use Asset-Based Financing Strategically

- Evaluate Financial Needs

- Determine whether your assets align with the funding amount required.

- Partner with Reputable Lenders

- Choose experienced lenders specializing in asset-based financing and your industry.

- Monitor Asset Performance

- Keep accurate records of receivables, inventory, or other pledged assets.

- Align Repayments with Cash Flow

- Structure repayments to coincide with cash inflows for minimal disruption.

- Avoid Overleveraging

- Use asset-based financing as part of a balanced financial strategy.

Tips for Choosing an Asset-Based Financing Provider

- Industry Experience

- Select lenders familiar with your sector and asset types.

- Transparent Terms

- Ensure clear communication about loan-to-value ratios, fees, and repayment schedules.

- Flexibility

- Look for customizable solutions that adapt to your business’s evolving needs.

- Reputation

- Check client reviews and testimonials to ensure reliability.

- Speed and Support

- Choose providers that offer quick funding and responsive customer service.

Conclusion

Asset-based financing is a powerful tool for businesses seeking quick, flexible funding without relying on traditional credit requirements. By leveraging the value of their assets, businesses can address cash flow challenges, fuel growth, and maintain financial stability.

If your business has valuable assets and needs accessible capital, asset-based financing could be the ideal solution. Evaluate your assets, partner with a trusted provider, and use this financing option strategically to achieve your business goals.

Contact us to consult our experienced financial specialists to strengthen your company’s financial structure and fuel growth opportunities with flexible financing solutions, such as asset-based financing.

Key Takeaways

- As the global economic outlook becomes more uncertain, companies must prioritize resilience and adaptability to survive and thrive.

- Asset-based financing provides a flexible and efficient solution to achieving stability and adaptability by allowing businesses to borrow against the value of their assets.

- This type of financing is a powerful tool for businesses seeking quick, flexible funding without relying on traditional credit requirements.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.

Fact-checked by:

Fact-checked by: