Recent data reveals that nearly half of the nation’s small and medium-sized businesses (SMBs) plan to start or increase credit utilization over the next 12 months to support operations and fuel growth. Unfortunately, many of these businesses may find it harder to get loan approvals from traditional sources as banks have tightened access to the credit market. Small business loan approval rates at big banks have fallen steadily since July 2022.

In sharp contrast, non-bank lenders continue to rise in popularity as reliable sources of capital. The loan approval rates from these lenders have increased for nine consecutive months as borrowers have turned to them for money while bank lending remains tight.

Learn why loan approval rates from traditional lending sources continue to drop. Discover how you can increase your access to credit through alternative lenders. And find out why they can approve fast, flexible working capital solutions to cash-starved businesses, whether in financial distress or aggressive growth mode.

The narrowing of traditional lending

What’s caused the big banks to pull back on lending?

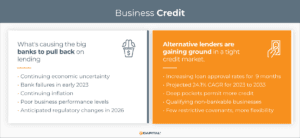

Continuing economic uncertainty and anticipation of GDP growth slowing to 0.5% in the first half of 2024 keeps traditional lenders overly cautious. The state of the economy, recent bank failures, continuing inflation, and poor business performance are drivers of lender fatigue. In addition, banks are recalibrating their lending strategies in anticipation of regulatory changes in 2026, including increased and more stringent capital requirements. In this environment, traditional lenders are narrowing the field of opportunity for businesses to qualify for conventional credit solutions.

Alternative lenders to the rescue

Yet, not all is grim in the world of lending and finance. For decades, alternative lenders have been increasing the volume of credit they extend to businesses, and the trend is not changing. The alternative lending segment has a projected Compound Annual Growth Rate (CAGR) of 24.1% for the period 2023 to 2033. For credit-seeking SMBs, this means the alternative lending segment is well-positioned to ease the bottleneck of unapproved traditional loans. As traditional lenders narrow the field of opportunity, alternative lenders are increasing access to credit with flexible and tailored funding solutions.

Why are alternative lenders gaining ground in a tight credit market?

The growing appeal of alternative lending lies in its distinct departure from the rigid guidelines of traditional financial channels. The pillars supporting their increasing popularity include:

- Deep pockets: Investors looking for better yields funnel capital into alternative lenders, providing the financial resources to approve more credit requests from small businesses. With investor support, alternative lenders have deep pockets and can fund quickly – usually within days of applying.

- Alternative credit analysis: Alternative lenders have evolved past the antiquated metrics of credit score-based assessments used by traditional lenders. Instead, they have integrated technology-driven methodologies to quickly access vast databases and thousands of credit-related data points to discover untapped collateral value and credit strengths. This provides a more equitable analysis, helping to qualify even companies with underperforming business levels and less-than-perfect credit records.

- Fewer restrictive covenants: Alternative lenders require minimal lending covenants. Business owners can use funds however they choose and, depending on the type of business financing they choose, can operate without monthly or quarterly reporting.

Decoding alternative financial options

Moving away from traditional fixed-term business loans offered by conventional banks, alternative lenders provide a variety of funding options, including:

- Asset-based lending (ABL): ABL provides loans secured by the business’s assets as collateral. These assets can include accounts receivables, inventory, and machinery. ABL can provide quick and substantial cash inflow for companies with significant physical assets, such as freight carriers with a fleet of working equipment or staffing agencies with regular and predictable invoice receivables. The amount of credit extended is directly proportional to the value of the pledged assets, offering businesses the flexibility to get loans without heavy reliance on their credit score.

- Invoice factoring: This allows businesses to sell their outstanding invoices to the alternative lender at a discount in exchange for immediate cash. There’s no need to wait 30-90 days for your client to pay. Invoice factoring is an instant remedy for cash flow constraints without incurring debt.

- Lines of credit: Unlike traditional loans, a line of credit offers businesses access to a pool of funds they can draw as needed. It’s similar to a credit card in that companies can tap into financial resources without needing to reapply, and interest is charged only on the amount used. It offers businesses flexibility and assurance, knowing they have a financial cushion to lean on during uncertain times.

Conclusion

With its rapid shifts and turns, the nation’s financial climate requires businesses to be agile and adaptive. Harnessing the resources of the alternative lending sector can make the difference between mere survival and robust growth. Whether through asset-based lending, invoice factoring, or flexible lines of credit, alternative lenders are charting a new course in business financing.

The message is clear for those facing financial uncertainty – think beyond the conventional. Alternative lenders stand ready to partner, guide, and propel businesses forward with easy qualification requirements and fast, flexible business financing solutions.

Key Takeaways

- Recent data reveals that nearly half of the nation’s SMBs plan to start or increase credit utilization over the next 12 months.

- Many businesses may find it harder to get loan approvals from traditional sources such as banks. Small business loan approval rates at big banks have fallen steadily since July 2022.

- In sharp contrast, the loan approval rates from alternative lenders have increased for nine consecutive months.

- Alternative lenders stand ready to partner, guide, and propel businesses forward with easy qualification requirements and fast, flexible business financing solutions.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.