Debt and equity financing are two primary ways businesses can raise capital. The choice of using debt financing vs equity financing generally depends on factors such as the business’s financial needs, its risk tolerance, and long-term objectives.

Both methods of financing involve raising funds to support a business, and investors’ expectation of a return. Beyond these basic similarities, little else is common. Each has its own characteristics and implications. A comprehensive understanding of the differences between these two financing options is essential when making a choice to recapitalize your business.

In this article, we explore the advantages, disadvantages, costs, and duration associated with debt financing vs equity financing to help decision-makers choose the best financing solution that’s right for your business.

Debt financing vs equity financing – what’s the difference?

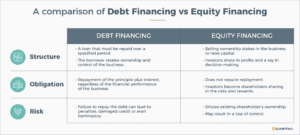

Debt financing involves borrowing funds that must be repaid with interest, while equity financing involves selling ownership stakes in the business in exchange for capital without a repayment obligation. The choice between debt financing vs equity financing depends on various factors, including the stage of the business, its financial health, growth prospects, risk tolerance, and the preferences of the owners and investors.

The choice of using debt financing vs equity financing should be made with a thorough understanding of their differences.

Debt financing vs equity financing – what are the advantages?

Debt Financing:

- Ownership: With debt financing, stakeholders retain ownership, control, and decision-making freedom. Losses are what is owed in payment for each month. Once your debt-financed loan is paid back, there is no further liability.

- Costs: Choosing debt financing vs equity financing can save you money with lower long-term costs. While you must pay the loan back, unlike equity financing, once the debt is repaid, there is no further liability on your part. Depending on the conditions of the loan, you might even be eligible to claim deductions on your taxes. That’s bonus savings for you!

- Obligations: Debit is very much like dating – it can be as short-term as you want. If it works out, it’s a relationship that completely enriches your life. If it doesn’t work out, it’s easy to unwind and kiss it goodbye. Financial obligations to the lenders cease after the repayment of the debt, making exit strategies easy to arrange when comparing debt financing vs equity financing.

Equity Financing:

- No repayment obligation: This type of financing doesn’t require regular repayments to pay off the loan. Instead, equity financing involves selling ownership stakes (equity) in the business in exchange for capital.

- New management guidance: Equity investors often bring expertise, networks, and strategic guidance, which may enhance the business’s growth prospects beyond financial support.

Debt financing vs equity financing – what are the disadvantages?

Debt Financing:

- Regular payments: With debt financing, the company is obligated to make payments on time and without issues throughout the life of their loan. Failure to do so would likely incur penalties and credit rating downgrades.

- Financial risk: Lenders may be less willing to extend their exposure to risk during the term of the facility when comparing debt financing vs equity financing. Because creditors of debt are dependent on the borrower to repay the loan in a timely fashion, they are less likely to tolerate financial distress within the business. If the business fails to meet the terms of the loan, it could face credit restrictions or a loan recall, which could increase the level of distress and potentially lead to insolvency or bankruptcy.

However, it is essential to recognize that non-bank lenders are more flexible and willing to work with their debtors to align the business’s ability to pay with repayment schedules. Asset-based lending and invoice factoring are two popular financing solutions designed to increase access to capital with tailored terms and risk-mitigating measures to protect the lender and borrower.

Equity Financing:

- Dilution of control: With equity financing, you are surrendering some ownership of your business. As a result, strategic choices are not as easy to manage on your terms.

- Speed of funding: Equity financing often requires negotiating ownership stakes, valuation, shareholder agreements, and potentially complex legal structures, making it a more involved process that can take longer to finalize when comparing debt financing vs equity financing.

- Higher capital costs: Equity financing often involves higher costs in the long run due to a redistribution of profit among shareholders, and the investors’ expectations of higher returns throughout the lifetime of their shareholding.

When deciding between debt financing vs equity financing, a business should weigh factors such as its current financial situation, risk tolerance, growth objectives, and desired ownership structure. Another critical consideration is the overall cost of capital.

Debt financing vs equity financing – cost example

The cost of debt financing versus equity financing is a significant factor in decision-making. Consider, for example, a debt-financed loan amount of $1MM for a company generating $4MM in sales. A $1MM line of credit may cost the company 9 percent per year (or $90K annually). Over two years, the deal winds up costing the company $180K. On the other hand – with equity financing – if the company surrenders 25 percent of its business for $1MM, then sells for three-times its revenue, it brings the equity costs to $3MM.

While debt financing offers tax benefits and doesn’t dilute ownership, equity financing provides flexibility and shared risk. Ultimately, the decision to use debt financing vs equity financing involves balancing these factors to determine the most suitable option for your business.

Debt financing vs equity financing – duration

Perhaps the most significant factor to consider is the duration of obligation to investors.

Debt is relatively simple to unwind as it involves contractual obligations with straightforward repayment terms. This simplicity enables businesses to repay the principal and interest to lenders and terminate the financial arrangement without significant complications or disruptions to ownership structures. Equity is a far more complex relationship. You are partnered in a long-term “set-in-stone” commitment that’s tough to dissolve should there be trouble or difficulty.

Does it always come down to a choice?

In practice, many businesses use a combination of debt and equity financing to meet their financing needs while balancing risk and return considerations. The relative proportion of debt financing vs equity financing may vary depending on factors such as industry norms, regulatory requirements, market conditions, and the business’s specific circumstances. Consult with professionals such as accountants, financial officers, and experienced lenders to help determine the best financing mix to optimize your financial structure.

Conclusion

When assessing the suitability of debt financing vs equity financing to meet the financing needs of your business, it is critical to recognize the distinct advantages, disadvantages, risks, and obligations associated with each option.

Debt financing involves borrowing funds from lenders, typically with regular repayment terms and interest obligations. While it provides immediate access to capital without diluting ownership, it entails the risk of default if repayment obligations cannot be met. On the other hand, equity financing involves selling ownership stakes in the business to investors in exchange for capital with no obligation for repayment. However, it dilutes ownership and profits among shareholders, obligating the business to share decision-making authority and potentially reducing the returns available to existing owners.

Ultimately, the choice between debt financing vs equity financing depends on factors such as risk tolerance, financial objectives, and the desired balance between ownership control and financial flexibility.

For more information, insights, and advice for businesses assessing the right financing mix to best serve your capital needs, contact eCapital for a no-obligation consultation.

Key Takeaways

- Debt and equity financing are two primary ways businesses can raise capital. Each has its own characteristics and implications.

- A comprehensive understanding of the differences between these two financing options is essential when making a choice to recapitalize your business.

- Ultimately, the choice between debt financing vs equity financing depends on factors such as risk tolerance, financial objectives, and the desired balance between ownership control and financial flexibility.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.