How to Qualify for Invoice Factoring and Expedite Funding

Content

Businesses need steady and reliable cash flow to support operations, successfully navigate declining performance levels, meet unexpected challenges, or capitalize on growth opportunities. As traditional lenders grow increasingly cautious they are elevating credit restrictions and enforcing restrictive loan covenants to.

That’s why a growing number of businesses are embracing invoice factoring. Invoice factoring is a flexible alternative financing solution that creates reliable cash flow and unlocks working capital. It’s easy to qualify for and delivers fast funding with minimal lender oversight.

In this article, you’ll learn the basics of invoice factoring, how a business qualifies for this flexible funding option, and a step-by-step guide to expedite funding.

Invoice factoring: the basics

Invoice Factoring (also referred to as accounts receivable factoring) is a financial transaction in which a business sells its accounts receivable (invoices) to a third party (called a factor) at a discount in exchange for immediate cash. Businesses of various sizes typically factor their invoice receivables to create the reliable funding needed to meet ongoing financial obligations. A company might favor invoice factoring over debt financing solutions since invoice factoring agreements don’t impact credit scores or result in debt.

Do you need a clean credit history to qualify for invoice factoring?

No. Because the factoring company is purchasing your invoice receivables, they are mainly concerned about your customers’ ability to pay. The decision to factor your company’s invoices is based on the credit strength of your customers, not your company’s credit history.

If your credit score has suffered, invoice factoring is an excellent way to balance your books, maintain operations, and rebuild credit strength by meeting financial obligations on time.

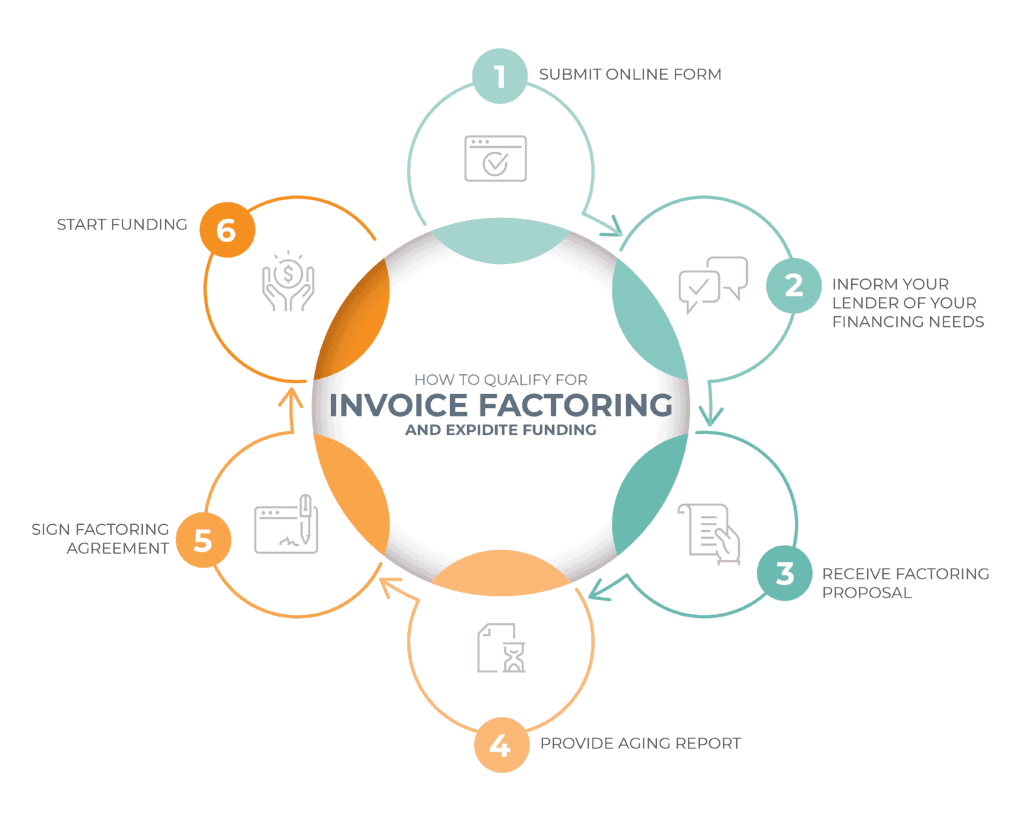

Steps to qualify for invoice factoring

If your business has creditworthy customers, qualifying for invoice factoring is simple and fast. Industry-leading invoice factoring companies provide simple online forms to kick off the process. Once you submit the form, reputable factoring companies respond very quickly by contacting you to learn more about your business and your funding requirements. Proposed terms are discussed, and then the company will send you a factoring proposal.

Here are the documents you’ll be required to provide next:

- Aging AR report.

- Tax ID Number.

- Articles of incorporation.

Once the factoring company conducts its due diligence, a factoring agreement is provided to you based on the terms discussed. It’s now a matter of signing the agreement and returning it to the factoring company to complete the qualification process.

A reputable invoice factoring company will then set up your factoring account and schedule an onboarding session. As soon as the onboarding is complete, you’re ready to start 1st funding.

Expedited funding

The best invoice factoring companies expedite funding by offering same-day funding if requests are submitted early enough in the day to allow processing.

The following is a step-by-step guide to fast funding:

-

- Invoicing and documentation submission.

Once the goods or services have been delivered, invoice the customer and send a copy of the invoice and PO confirmation to the factoring company. Send early in the day for same-day funding, otherwise funding is typically within 24 hours. - Invoice verification.

The factoring company will verify that the services or goods have been delivered as per the PO. A good factoring company will do this quickly and professionally, protecting the client’s integrity and expediting the verification process. - Receive funding on approved invoices.

Once the factoring company approves an invoice, advanced funds will be immediately transferred to the client’s cash account. The advance rates from the best invoice factoring companies are , usually ranging up to 95% of the value of the invoice. This amount (minus a small fee) can be deposited on the same day the invoice is verified. The remaining percentage is reserved until the customer pays the invoice’s full amount to the factoring company. - Final remittance

Once the company’s customer pays the invoice in full, the factoring company will release the reserve amount and deposit it directly into the company’s cash account. With this transaction, the funding request is completed. - Deliver services, invoice customer, repeat.

This process (steps 1-4) repeats with each invoice that is submitted to the factoring company, ensuring steady, reliable funding. The more invoices you generate, the more funding becomes available.

- Invoicing and documentation submission.

TIP

For a deep dive into invoice factoring, read this comprehensive guide.

Non-Recourse Factoring

Another option to consider when shopping for invoice factoring is non-recourse factoring. Unlike traditional factoring, in non-recourse factoring, the factor assumes the risk of non-payment by the original debtor. If the debtor doesn’t pay the invoice, the business is not required to repay the factor. This method allows businesses to obtain immediate liquidity without the liability of potential non-payment by their customers. Not all companies that offer non-recourse factoring cover the same liabilities. You can find some things to look out for in our blog Top 8 Things to Understand Before Signing A Non-Recourse Factoring Agreement.

Conclusion

For businesses looking for financial flexibility, invoice factoring offers accelerated access to cash without the restrictive loan covenants of traditional lenders. Qualification is quick and simple, with experienced alternative lenders able to provide tailored factoring services to suit your business needs.

No matter if your business is looking to solve cash flow issues or capitalize on growth opportunities, invoice factoring quickly releases working capital from your outstanding invoices, so you have the money you need when you need it.

ABOUT eCapital

At eCapital, we accelerate business growth by delivering fast, flexible access to capital through cutting-edge technology and deep industry insight.

Across North America and the U.K., we’ve redefined how small and medium-sized businesses access funding—eliminating friction, speeding approvals, and empowering clients with access to the capital they need to move forward. With the capacity to fund facilities from $5 million to $250 million, we support a wide range of business needs at every stage.

With a powerful blend of innovation, scalability, and personalized service, we’re not just a funding provider, we’re a strategic partner built for what’s next.