WORKING CAPITAL SOLUTIONS FOR FINANCIAL SPONSORS AND THEIR PORTFOLIO COMPANIES

At eCapital, we make it easy to reach yours goals with the right financial solutions.

At eCapital, we make it easy to reach yours goals with the right financial solutions.

Our flexible working capital finance solutions support the cash flow needs of private equity firms, family offices, independent sponsors and portfolio companies. Working capital financing is a valuable tool to optimize your investments, support growth, manage distressed assets, and enhance the financial health of the businesses within your portfolio.

Our customized financing will help you strategically navigate every step of the fund life cycle in any economy and ultimately maximize the value of your investments.

We specialize in the provision of working capital solutions to businesses across North America and the UK. You can rely on our industry experts to get your client’s business back on track and set up for future success.

In today’s ever-evolving business environment, unique challenges demand innovative and customized financial strategies. Our expertise in collaboration brings diverse perspectives and expertise to the table, fostering a richer understanding of the situation and facilitating the design of more effective and tailored solutions.

Advance rates on collateral:

Facilities up to $50 million. Flexible and covenant light.

Advance rates on the value of accounts receivable:

Notified or confidential.

Recourse, Non-Recourse and Off-Balance Sheet structures.

90 days outstanding, up to 120 days in some cases.

Visa Commercial Cards, InstaPay and self-directed funding.

Credit amounts based on collateral values. Seamless integration and online account management.

eCapital is an award-winning, industry-leader in the working capital funding space. Here are a few reasons why businesses choose eCapital as their financing partner:

We understand the unique challenges of turnaround situations and work with you to find creative solutions.

We provide industry-leading valuations on assets with up to 85% Net Orderly Liquidation Value (NOLV).

We offer the highest asset valuations at competitive Annual Percentage Rates (APR).

Due to our extensive years of experience in 80+ industries, we’re able to quickly provide your business with a tailor-made solution.

You can count on our team to be a valued consultant for the life of your financing and beyond. Your success is our success.

Applications are received, reviewed, and qualified within days and we pride ourselves on quick, easy & honest service.

We contribute our financial expertise and industry experience to support the success of your investment. Our bespoke solutions are designed to meet your working capital needs as part of your overall investment strategy.

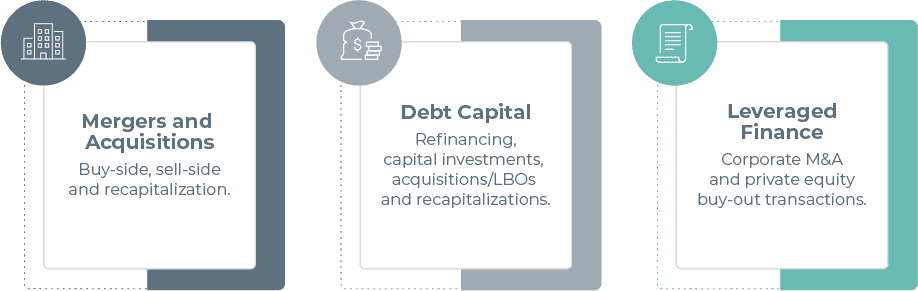

Our financial sponsor coverage includes:

There are many factors that impact the time it takes to fund a transaction. Generally, a factoring facility can be completed in less than 30 days and an asset-based lending facility within 30 to 45 days.

Our knowledgeable team has extensive experience working with financial sponsors including private equity firms, family offices, independent firms and their portfolio companies. With forty years of experience in financing, we have a deep understanding of the private investment process.

Reach out to us expressing your interest in becoming a partner by filling out the form above or giving us a call. Our partner team will be happy to assist you.