3 Ways Invoice Factoring Can Improve Your Business’s Credit Score

Content

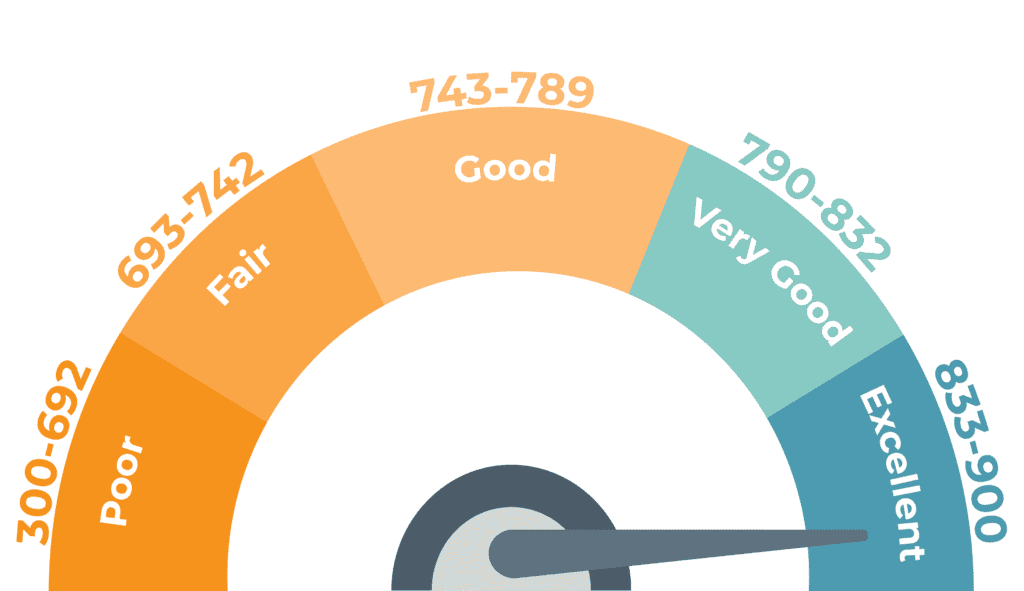

A company’s credit score is key to acquiring business financing, securing favorable loan terms, building credibility, and attracting investors.

In today’s economy of tight credit, it’s not surprising that new and growing businesses, or those navigating financial difficulties, may struggle to get funding without good credit. Acquiring reasonable insurance rates, favorable leasing agreements, and beneficial supplier terms also becomes difficult if your credit rating is less than stellar.

That’s why it’s critical for businesses to monitor their credit score regularly and if needed, take actions to improve their creditworthiness. This can include making all payments on time, paying down debt, and limiting the number of credit applications you submit.

Overcoming poor cash flow is often the key to accomplishing these goals.

Invoice factoring is a business financing solution designed to improve cash flow. It is the selling of invoice receivables at a discount in exchange for immediate payment. It’s become an increasingly popular way for businesses to build and maintain good credit by accelerating their ability to fulfill financial commitments without assuming burdensome loans that can further credit score woes.

Here are three ways invoice factoring can help raise your credit score, paving the way to financial stability and stimulating future growth.

1. Timely payments

Payment history accounts for 35 percent of your company’s FICO credit score. A history of late payments to suppliers and service providers can knock your credit score in the wrong direction. Often, making these payments on time hinges on the ability to collect accounts receivables in a timely fashion.

Here lies the problem – your company may be forced to wait up to 90 days for outstanding invoices to be paid as many large companies with well-established credit adopt a policy of delayed payments to preserve their own cash flow.

As a result of delayed receipt of payments, your company may experience cash flow gaps impacting your ability to make timely payments. Any available credit, such as credit cards, is usually tapped into as a regular spending source to bridge these gaps.

Invoice factoring smooths out cash flow by shortening the time to receive accounts receivable payment to less than 24 hours, freeing up the cash you need to make timely payments without entering another cycle of debt acquisition. Building a history of paying bills on time is key to improving your company’s credit score.

2. Lowering your credit utilization ratio

The credit utilization ratio is a component used by credit reporting agencies in calculating a borrower’s credit score. The credit utilization ratio is the percentage of a borrower’s total available credit that is currently being used. Reducing your use of debt and lowering your credit utilization ratio can help you improve your credit score.

3. Limit loan applications

Credit scoring models typically view a loan application as potentially increasing your risk as a borrower. That means your application, whether approved or not, can negatively affect your credit score. Applying for a business loan or line of credit to access working capital can hurt your credit score even if you aren’t approved. The more loan applications you submit, the more your credit score is impacted.

Factoring differs from traditional financing as it doesn’t require a loan application and a check of your business credit score. Instead, qualification is based on your customer’s creditworthiness. In other words, factoring your invoices gives you the capital you need to grow your business without adding active loan applications to your file.

Non-Recourse Factoring

Another option to consider is is non-recourse factoring. Unlike traditional factoring, in non-recourse factoring, the factor assumes the risk of non-payment by the original debtor. If the debtor doesn’t pay the invoice, the business is not required to repay the factor. This method allows businesses to obtain immediate liquidity without the liability of potential non-payment by their customers. Not all companies that offer non-recourse factoring cover the same liabilities. You can find some things to look out for in our blog Top 8 Things to Understand Before Signing A Non-Recourse Factoring Agreement.

Conclusion

Invoice factoring rapidly connects a new, growing, or established business to the working capital needed to support operations and grow your business without impacting its credit score. Further, utilizing this flexible funding solution smooths out cash flow allowing the ability to pay bills on time – a significant contributing factor to improving credit scores. In addition, by applying available funds efficiently, businesses can implement actions such as debt reduction strategies to improve rather than diminish their credit score.

To improve your company’s credit score, partner with an invoice factoring company offering the personalized factoring services your business needs to build its financial reputation.

ABOUT eCapital

Since 2006, eCapital has been on a mission to change the way small to medium sized businesses access the funding they need to reach their goals. We know that to survive and thrive, businesses need financial flexibility to quickly respond to challenges and take advantage of opportunities, all in real time. Companies today need innovation guided by experience to unlock the potential of their assets to give better, faster access to the capital they require.

We’ve answered the call and have built a team of over 600 experts in asset evaluation, batch processing, customer support and fintech solutions. Together, we have created a funding model that features rapid approvals and processing, 24/7 access to funds and the freedom to use the money wherever and whenever it’s needed. This is the future of business funding, and it’s available today, at eCapital.