Mastering Reverse Factoring: A Win-Win Solution for Buyers and Suppliers

Content

- What Is Reverse Factoring?

- Key Features:

- How Reverse Factoring Works

- Benefits of Reverse Factoring

- Industries That Benefit from Reverse Factoring

- Challenges of Reverse Factoring

- Real-World Example: Reverse Factoring in Action

- How to Implement Reverse Factoring

- The Future of Reverse Factoring

- Conclusion

- Key Takeaways

Ongoing challenges continue for supply chains, with geopolitical tensions, weather-related disasters, and labour strikes contributing to disruptions. These frequent interruptions underscore the growing need for greater agility among buyers and suppliers to navigate an increasingly unpredictable environment. As companies adapt, solutions like reverse factoring and supply chain optimisation will play a key role in maintaining smooth operations and mitigating the impact of these disruptions.

Efficient cash flow management is critical for businesses, especially those operating within complex supply chains. Reverse factoring, also known as supply chain financing, is a financial solution that benefits both buyers and suppliers by optimising payment terms, improving liquidity, and accelerating cash flow. It enables businesses to strengthen supplier relationships while ensuring smooth operations.

What Is Reverse Factoring?

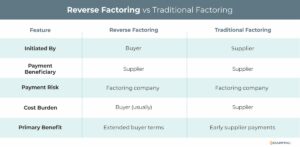

Reverse factoring is a form of invoice financing, but it differs in terms of who initiates the process and who benefits from it. In traditional invoice factoring, a supplier sells its invoices to a third-party financial institution (a factor) at a discount in exchange for immediate payment. The factor then collects the full amount from the buyer, and the supplier typically bears the cost and risk associated with the financing.

In contrast, reverse factoring (or supply chain financing) is initiated by the buyer rather than the supplier. The buyer works with a factoring company to pay the supplier early, and the buyer extends their own payment terms. This allows the supplier to receive faster payment while the buyer benefits from extended terms for repayment to the financial institution. It is a win-win solution that enhances cash flow for all parties involved.

Key Features:

- Buyer-Led: The buyer initiates the arrangement with the factoring company.

- Early Supplier Payment: Suppliers get paid earlier than the agreed payment terms.

- Extended Buyer Terms: Buyers can negotiate longer payment terms with the factoring company.

How Reverse Factoring Works

- Agreement Setup: The buyer enters an agreement with a factoring company to provide a cash flow solution for its suppliers.

- Invoice Approval: The buyer approves supplier invoices, confirming their validity.

- Factor Pays Supplier: The factoring company pays the supplier, typically within 24 hours of invoice approval.

- Buyer Repayment: The buyer repays the factoring company according to the agreed extended payment terms.

Benefits of Reverse Factoring

For Buyers:

- Extended Payment Terms

- Buyers can negotiate longer repayment periods with the factoring company, freeing up working capital.

- Strengthened Supply Chain

- Ensuring suppliers receive timely payments helps maintain stable and reliable supply chains.

- Improved Supplier Relationships

- Buyers build stronger, more collaborative relationships with suppliers by facilitating early payments.

- Enhanced Financial Health

- Buyers can improve liquidity without drawing on traditional credit lines or affecting their cash reserves.

For Suppliers:

- Early Access to Cash

- Suppliers receive payments earlier, reducing cash flow constraints (cash crunch) and enabling timely investments in operations.

- Reduced Credit Risk

- Payment is guaranteed by the factoring company, reducing the risk of buyer default.

- Competitive Advantage

- Suppliers can focus on production and service delivery without worrying about claiming interest and debt recovery costs due to delayed payments.

- Lower Financing Costs

- This type of factoring often provides better rates than traditional factoring or supplier-led financing.

Industries That Benefit from Reverse Factoring

- Retail

- Used by large retailers to pay suppliers early, ensuring shelves remain stocked while extending their own payment terms.

- Manufacturing

- Manufacturers leverage this financial strategy to maintain strong supplier relationships, especially in industries with complex, multi-tiered supply chains.

- Automotive

- The automotive sector relies on reverse factoring to manage large volumes of suppliers, ensuring timely delivery of components.

- FMCG (Fast-Moving Consumer Goods)

- This factoring arrangement supports FMCG companies in maintaining high-volume production cycles by optimising supplier payments.

Challenges of Reverse Factoring

- Setup Complexity

- Establishing this type of factoring arrangement requires coordination between buyers, suppliers, and a factoring company.

- Supplier Participation

- Some suppliers may be hesitant to participate, especially if they already have access to affordable financing options.

- Administrative Effort

- Implementing and managing a reverse factoring system involves ongoing administrative work, including invoice approvals and payment tracking.

- Costs

- While beneficial, this factoring arrangement may involve fees or interest charges for both buyers and suppliers.

Real-World Example: Reverse Factoring in Action

Scenario: A global electronics company relies on a network of small suppliers to produce components. Suppliers often face cash flow challenges due to the company’s extended payment terms.

Solution: The company implements a reverse factoring programme with a factoring company. Approved invoices are paid to suppliers within 24 hours, while the company enjoys a 90-day repayment term.

Outcome: Suppliers maintain strong cash flow and can scale production to meet growing demand. The electronics company strengthens its supply chain and avoids disruptions.

How to Implement Reverse Factoring

- Identify Key Suppliers

- Focus on suppliers critical to your supply chain who may benefit from improved cash flow.

- Choose a Financial Partner

- Work with a reputable invoice financing company experienced in reverse factoring. Review the company’s website and customer case studies prior to interviewing the factor to ensure alignment with your company goals.

- Communicate Benefits

- Educate suppliers about the advantages of this factoring arrangement to encourage participation.

- Monitor and Adjust

- Continuously evaluate the programme’s impact on your supply chain and make necessary adjustments.

The Future of Reverse Factoring

With advancements in financial technology, reverse factoring is becoming more accessible and efficient. Automated platforms and blockchain-based systems streamline the process, reduce administrative burdens, and enhance transparency. These innovations will likely drive further adoption across industries, making factoring arrangements an integral part of supply chain management.

Conclusion

Reverse factoring is more than just a financial tool—it’s a strategic advantage for businesses navigating complex supply chains. It is a buyer-led process focused on optimising payment terms to improve cash flow for both buyer and supplier. By improving cash flow for suppliers and buyers alike, this factoring arrangement fosters collaboration, strengthens relationships, and enhances operational efficiency.

If your business is looking to optimise its supply chain and improve financial health, reverse factoring could be the solution. Partner with a trusted factoring company to explore how this innovative financing method can work for your organisation.

Contact us to learn more about easy-to-acquire cash flow solutions to support operations, fuel growth, fortify resilience, and strengthen supply chains.

Key Takeaways

- Ongoing challenges continue for supply chains, with geopolitical tensions, weather-related disasters, and labour strikes contributing to disruptions.

- Greater agility among buyers and suppliers is needed to navigate an increasingly unpredictable environment.

- Reverse factoring is a financial solution that benefits both buyers and suppliers by optimising payment terms, improving liquidity, and accelerating cash flow.