Business Invoice Finance: What is it? And How Does It Work? - An Essential Guide for UK Businesses

Content

Managing cashflow effectively is crucial for survival and growth in today’s fast-paced business world. This is where business invoice finance can help, offering an immediate working capital boost to businesses waiting on unpaid sales invoices. In this essential guide, we will explore what business invoice finance is, how it works, and why it might be the cashflow solution that your business needs.

What is Business Invoice Finance?

This flexible cashflow solution is a financial arrangement that allows businesses to unlock the value of their unpaid invoices whilst offering their trade customers credit terms.

It is a way of monetising invoices due in 30, 60, or even 90 days. This finance method can be particularly beneficial for small to medium-sized enterprises (SMEs) that face cashflow challenges due to delayed payments.

Types of Business Invoice Finance

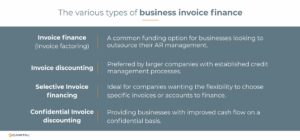

There are four main types of business invoice finance available in the UK:

- Invoice Finance (aka Invoice Factoring): This involves a business selling its invoices to a specialty finance provider (a business invoice finance company), who then advances a significant portion of the invoice value (up to 90%) immediately to the business. The finance provider will also provide sales ledger management to the business, which includes collecting payments from its customers when due, making it a suitable option for smaller businesses or those looking to outsource their accounts receivable management.

- Invoice Discounting: In this arrangement, the finance provider advances a percentage of the value of the outstanding invoices, in the same way as invoice finance. However, the business retains control over its sales ledger and continues to manage customer payments. Since the business maintains control over the collection process, larger companies with established credit management processes often prefer invoice discounting.

- Selective Invoice Financing: Selective invoice finance is a type of invoice financing where a business has the flexibility to choose specific invoices or accounts to finance rather than having to finance their entire sales ledger. Selective invoice finance can be preferred by larger companies with established credit management processes.

- Confidential Invoice Discounting: Confidential invoice discounting is a version of invoice finance where businesses can borrow money against their unpaid invoices without their customers being aware of this kind of secured funding arrangement. It is a discreet financial solution that provides businesses with the benefits of improved cashflow on a confidential basis.

How Does Business Invoice Finance Work?

The Process:

- Sales Invoice Created: Once you have provided goods or services, you issue an invoice to your customer in the normal course of business.

- Invoice Assignment: You then “assign” the invoice to a finance provider under a debt purchase “invoice finance” agreement.

- Upfront Payment: The finance provider advances you an agreed percentage of the invoice’s total value within a brief period (either immediately or within 24 hours)

- Payment Collection: Depending on whether you have chosen an invoice finance or invoice discounting solution will determine whether you or the finance provider will undertake credit control to collect the payment of the invoice from your customer when it falls due.

- Receipt of Balance: Once the customer pays, you receive the remaining balance of the invoice minus any fees or charges.

Benefits of Business Invoice Finance

- Improved Cashflow: Immediate access to funds tied up in invoices.

- Growth and Stability: Provides the financial stability and cashflow necessary to grow your business.

- Timesaving: With invoice finance, the funder will undertake your sales ledger administration, saving you time and resources to allow you to focus on other aspects of your business.

- Flexibility: Adapts to your business’s changing needs and funding requirements.

Considerations for UK Businesses

- Costs: As with any financial commitment, be aware of any contractual fees and interest costs of money advanced.

- Customer Relationships: Consider how a “third party” provider might impact the relationships that you have successfully built with your customers.

- Eligibility: Ensure that your business and the nature and composition of your invoices meet the underwriting criteria set by finance providers.

Frequently Asked Questions about Business Invoice Finance

What is a business invoice finance company?

These specialty finance providers enable businesses to unlock immediate cash from their outstanding invoices. Rather than waiting for clients or customers to pay their bills, businesses can convert their unpaid invoices into immediate cash for a small fee.

This flexible solution empowers businesses by accelerating the speed of funding. Fast access to cash is crucial for managing working capital and daily operations, meeting weekly and monthly wage bills, and covering essential trade creditors. Invoice finance companies can also provide complete sales ledger management to the business, including professional credit control and administration.

Is business invoice finance in the UK suitable for small businesses?

Yes, business invoice finance can be suitable for small businesses in the UK, offering many benefits from a funding and growth perspective.

- Improved Cashflow: Small businesses often face cashflow challenges due to delayed customer payments. Business invoice finance provides an immediate funding injection that can stem, alleviate, and boost cashflow.

- Growth and Expansion: Access to immediate and continued cashflow gives small businesses the peace of mind to embrace growth opportunities, like taking on larger orders or expanding their operations, without the cash constraints typically caused by slow-paying customers.

- Reduced Credit Risk: Some forms of business invoice finance, such as non-recourse, come with the added benefit of credit protection against the non-payment of debt due to customer insolvency or protracted default.

- Timesaving: Managing customer payments can be time-consuming. Invoice finance transfers the responsibility of chasing and collecting payments to the finance provider, freeing up valuable time for small business owners to focus on core activities.

- No Need for Collateral: Unlike traditional bank loans, which often require hard collateral, business invoice finance is secured against the company’s invoices (“the debt”). This feature makes it more accessible for small businesses that may not have significant tangible assets to offer as security.

- Flexibility: Business invoice finance is typically more flexible than traditional loans and grows in line with sales turnover.

- Ease of Qualification: It can often be easier for small businesses to qualify for business invoice finance than traditional bank loans, as the key underwriting focus is on the “debt” being offered and the creditworthiness of their customers, not on their own credit history or financial standing.

Are business invoice finance brokers regulated in the UK?

Business invoice finance services are not currently regulated by the FCA (Financial Conduct Authority). However, to ensure integrity and fair service, UK Finance, its governing body, has an industry-wide accredited code of conduct.

What charges can I expect with business invoice finance?

As with any form of external funding, there are costs associated with business invoice finance, which can differ from one provider to the next. Standard charges include:

- Service Fee: This is a charge for administering the business invoice finance facility and is often calculated as a percentage of your turnover.

- Discount Charge or Interest Rate: Similar to interest on a loan, this charge is applied to the money advanced to you and is typically calculated as a percentage over the Bank of England base rate.

- Set-Up Fee: Some providers may charge an initial fee to set up the funding arrangement.

- Credit Protection Fee: An additional cost will be applied if you opt for a facility that includes the benefit of debtor protection (to safeguard against non-paying customers).

- Facility Charges: Other fees may be applied throughout its term depending on the type of facility offered and the agreement that governs it. These can include audit fees, operational fees, and fees for early termination of the contract.

It is, therefore, advisable to thoroughly review the terms and conditions of any business invoice finance agreement with the provider to ensure clear transparency and to understand its fee structure before deciding to move forward.

Why should I use business invoice finance instead of my bank overdraft?

Business invoice finance is very flexible. As your turnover grows, so does your access to funds. You do not need to negotiate new terms with a business invoice finance provider, as the facility is sales-led. We know that our underwriting and onboarding journey is much quicker than a bank, injecting cash into your business almost immediately instead of having to wait days or even weeks.

What if I do not want my customers to know that I am using business invoice finance?

Business invoice finance companies can offer a service known as confidential invoice discounting. This enables you to preserve your trusted customer relationships, as an invoice funder’s involvement remains undisclosed to them.

Conclusion

Business invoice finance can be an extremely portable and flexible solution for healthy cashflow and for supporting business growth.

The key to successful use of business invoice finance is choosing the right provider and understanding the terms of the funding arrangement. With the correct solution, business invoice finance can help your business navigate through its cashflow challenges and provide you with the funding peace of mind to take advantage of growth opportunities.

For over two decades, eCapital has evolved to become a leading provider of business invoice finance.

Contact us today to request a free financing consultation and see how we can help maximize cashflow efficiency and support your business growth plans.

Key Takeaways

- Managing cash flow effectively is crucial for survival and growth.

- Fast access to cash enables efficient management of working capital and daily operations, meeting weekly and monthly wage bills, and covering essential trade creditors.

- Rather than waiting for clients or customers to pay their bills, businesses can convert their unpaid invoices into immediate cash to navigate cashflow challenges.

- Business invoice finance is a flexible cashflow solution that allows businesses to immediately unlock the value of their unpaid invoices whilst offering their trade customers credit terms.