FUNDING FOR TRANSPORT BUSINESSES

Smarter financing to keep your business moving

Bespoke funding for UK transport, haulage, distribution and logistics sectors – with support from a leading provider of invoice finance.

Bespoke funding for UK transport, haulage, distribution and logistics sectors – with support from a leading provider of invoice finance.

Trusted by the industry

With deep experience supporting UK transport, haulage, distribution and logistics sectors, we understand the pressures of keeping goods and services moving. From unlocking cash tied up in invoices to providing flexible facilities that grow with your contracts, here’s how we help you stay ahead:

Need help figuring out which solutions are best for your business?

Our experts are here to make funding simple, clear, and stress free.

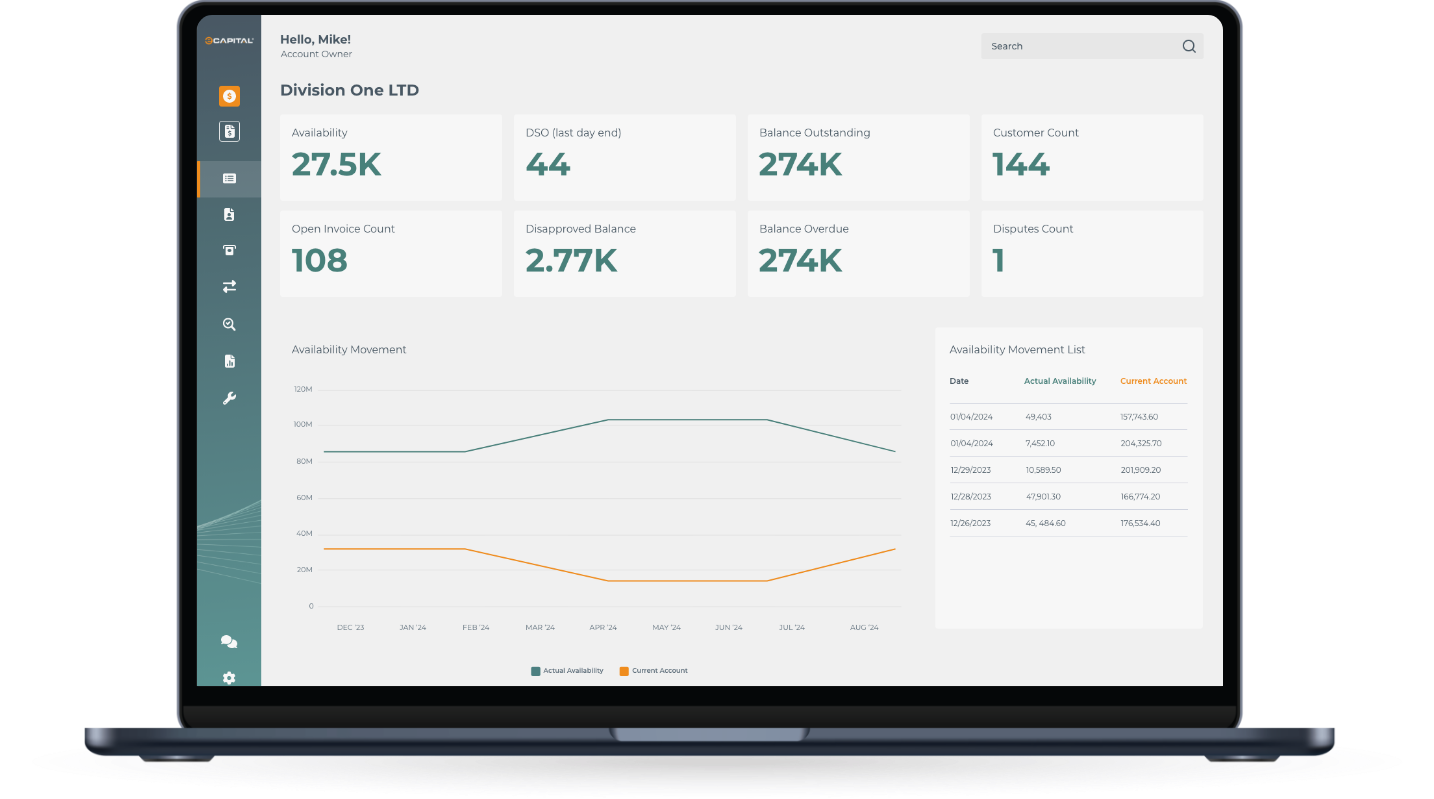

At eCapital, we’re committed to helping UK transport, haulage, distribution and logistics sectors manage cash flow with confidence. Powered by modern technology, sector expertise, and dedicated client support, our solutions deliver a streamlined experience that keeps your business moving forward.

Bespoke facilities with quick access to funds, keeping your operations on track.

Simplify cash flow management and stay in control with solutions built to grow alongside your contracts.

Work with a regional team that knows these sectors inside out, providing guidance to help you tackle challenges and plan for growth.

We understand the pressures of running a business in these sectors because we’ve been supporting them for over two decades. Our philosophy is simple: put business owners first with fast, fair, and flexible funding.

We believe in hard work, honest partnerships, and meaningful support – not just providing finance, but helping businesses stabilise, grow, and achieve long-term success. With a strong commitment to client service, sector expertise, and solutions bespoke to your needs, we’re here to make sure your cash flow gets you from A to B.

"*" indicates required fields

Funding for transport businesses provides funding solutions tailored to the needs of UK transport, haulage, distribution, and logistics businesses. It helps release cash tied up in unpaid invoices, giving operators the working capital to cover fuel, wages, maintenance, and growth opportunities without relying on traditional loans or overdrafts.

For UK transport, logistics, distribution, and haulage companies, common solutions include invoice finance (selective or whole ledger), invoice discounting (confidential or disclosed). These facilities help release cash tied up in customer invoices, providing the working capital needed to cover running costs, take on new contracts, and manage seasonal peaks.

It depends on your needs. Invoice finance is ideal for improving cash flow from slow-paying customers. A lender can help match the right solution to your cash flow and operational goals.

Absolutely. Expansion can be funded through working capital loans, equipment financing, or invoice finance to support new driver onboarding and operational scale.