With the Spring budget only a few weeks away there are calls for the Chancellor to extend the Treasury’s financial help to families and businesses despite the explosion of government borrowing caused by the pandemic.

The Institute of Fiscal studies has advised caution ahead of measures to be announce on March 3rd, warning the Chancellor against trying to fix this but instead to offer more targeted help and to set out a plan to phase the assistance out. Use the event to secure a recovery rather than fix the public finances.

One of the big questions must be around whether the furlough scheme, scheduled to finish at the end of April should be extended? One would argue that it is important that the scheme should be phased out as the economy does need to adjust to a new “normal”, whatever that may be. However particular attention and scrutiny must be placed on certain sectors that will need the furlough scheme to go on a bit longer and it is here that the Chancellor needs to target. For example, should the aviation sector be continued to be kept under wraps for several more months, stifling its own recovery then a case to continue the furlough scheme for affected workers could be argued.

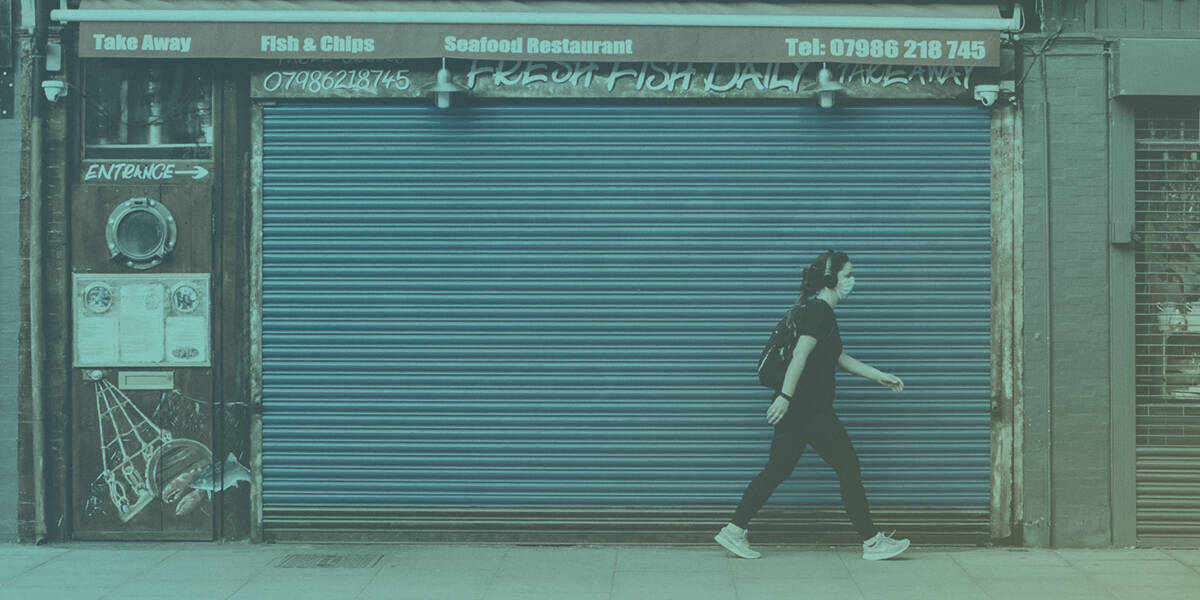

When the furlough scheme does end, what is the likely impact on unemployment levels? It is thought around 4-5m workers are currently furloughed and analysts agree that there are probably circa 2m that have been furloughed all the way back since last March and some of these are within industries that are not in lockdown and will need to stop. The B2C sector has been hardest hit and hospitality and retail, notable sufferers but in reality, the effect has been felt across all sectors. So, can the economy look to recover while there are still elements of state support?

Some elements such as the higher level of universal credit can obviously remain but to keep paying the furlough scheme to support jobs that are not viable even after lockdown begins easing is going to have an effect on the economy adjusting to whatever the new normal is.

The portability of the furlough scheme thus far has demonstrated that if there is another lockdown further down the road then it can be re-introduced but as the PM has hinted this is to be the last one then the Chancellor can try again to gradually reduce the scheme as he attempted to do last summer. However, with borrowing this year expected at £400bn, over eight times what was anticipated and representing a proportion of national income not seen since the last two world wars, it is highly likely that is set to continue as the economy begins the road back to adjustment. Whilst this is happening and certainly for the next couple of years, the Treasury does not want to tighten its fiscal screws until we know the economic situation and a recovery has begun.