Understanding Margin Loans: A Strategic Tool for Investment Growth

Content

For investors looking to increase their purchasing power and take advantage of market opportunities, margin loans can be an effective strategy, offering a flexible way to amplify investments. By borrowing funds against the value of an investment portfolio, margin loans enable investors to buy more assets and potentially boost returns. However, with greater potential rewards come higher risks.

This guide explores margin loans, how they work, their advantages, and the risks involved, helping investors make informed decisions before leveraging this financing strategy.

What Is a Margin Loan?

A margin loan is a type of business financing provided by a brokerage, allowing investors to borrow money to invest in securities. The loan is secured by the investor’s portfolio, with the purchased securities or existing assets serving as collateral.

Key Features of Margin Loans:

- Collateral-Based Lending – The value of the investment portfolio is used as security for the loan.

- Leverage – Enables investors to purchase more securities than they could with cash alone.

- Variable Interest Rates – Interest is charged on the borrowed amount, often at a variable rate.

- Margin Requirements – Investors must maintain a minimum percentage of equity in their portfolio to avoid margin calls.

How Does a Margin Loan Work?

- Open a Margin Account – Investors set up a margin account with their brokerage, allowing them to borrow funds.

- Borrowing Limit – The maximum loan amount is typically capped at a percentage of the portfolio’s value, often up to 50%.

- Investment and Usage – Borrowed funds can be used to purchase additional securities, diversify a portfolio, or cover financial obligations.

- Repayment – Investors repay the loan at their convenience, subject to interest charges and minimum margin requirements.

What Is a Margin Call?

A margin call occurs when the value of an investor’s portfolio drops below the brokerage’s required minimum equity level, known as the maintenance margin. If this happens, the investor must:

- Deposit additional funds or securities to restore the required margin level.

- Sell existing securities to cover the shortfall.

If an investor fails to meet a margin call, the broker has the right to sell investments without prior notice, often at an unfavourable time.

Benefits of Margin Loans

- Increased Buying Power

- Enables investors to make larger investments, potentially increasing returns if markets perform well.

- Flexibility

- Margin loans can be used for various financial needs, including portfolio expansion and short-term liquidity.

- No Fixed Repayment Schedule

- Unlike traditional loans, margin loans offer flexible repayment terms as long as margin requirements are met.

- Potential Tax Benefits

- In some cases, interest payments on margin loans may be tax-deductible when used for investment purposes (consult a tax adviser for specific guidance).

- Opportunity to Capitalise on Market Movements

- Provides immediate access to funds, allowing investors to take advantage of timely investment opportunities.

Risks of Margin Loans

- Amplified Losses

- Just as margin loans can enhance profits, they can magnify losses, potentially exceeding the initial investment.

- Margin Calls

- A drop in asset value may require an investor to deposit additional funds or sell securities at short notice.

- Interest Costs

- Ongoing interest charges can erode overall returns, particularly in a stagnant or declining market.

- Market Volatility

- Increased exposure to fluctuations in the market can lead to greater financial stress.

- Forced Liquidation

- Brokers can sell assets without prior notice if margin requirements are not met, potentially resulting in significant losses.

Margin Loan Example

Scenario:

An investor has £50,000 in a brokerage account and takes out a margin loan of £25,000 to purchase additional shares.

- Total Investment: £75,000 (£50,000 cash + £25,000 margin loan).

- Potential Gain: If the stock price increases by 20%, the portfolio value rises to £90,000, yielding a £15,000 profit (30% return on the original £50,000 investment).

- Potential Loss: If the stock price declines by 20%, the portfolio value falls to £60,000, and the investor still owes £25,000, leaving only £35,000 in equity (30% loss).

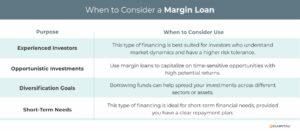

When to Consider a Margin Loan

- Experienced Investors

- Best suited for investors who understand market risks and have a high tolerance for volatility.

- Opportunistic Investments

- Useful for seizing time-sensitive investment opportunities with high growth potential.

- Diversification Strategies

- Helps investors spread their capital across different sectors or asset classes.

- Short-Term Financial Needs

- Can be used as a short-term liquidity solution, provided the investor has a solid repayment plan.

Best Practices for Managing Margin Loans

- Monitor Your Portfolio Regularly

- Keep track of investment performance and margin requirements to avoid unexpected calls.

- Use Leverage Cautiously

- Avoid borrowing the maximum amount available; maintaining a buffer can help prevent forced sell-offs.

- Diversify Your Investments

- Reduce exposure to risk by investing in a mix of asset classes.

- Have a Clear Repayment Strategy

- Plan for loan repayment in the event of market downturns.

- Stay Informed About Interest Rates

- Rising rates can increase borrowing costs, affecting overall investment returns.

Conclusion

Margin loans can be a powerful tool for investors looking to enhance their market position and optimise returns. However, they come with inherent risks that require careful management and a strong understanding of investment strategies. By leveraging margin loans prudently and maintaining a disciplined approach, investors can take advantage of market opportunities while minimising potential downsides.

Before taking out a margin loan, investors should assess their risk tolerance, financial goals, and the current market environment. Consulting with a financial adviser can help determine whether margin investing aligns with their broader investment strategy.

With the right approach, margin loans can be an effective addition to an investor’s financial toolkit, providing greater flexibility and the potential for enhanced returns.

Contact us today to explore margin loan options and learn how to optimise your investment strategy.

Key Takeaways

- Borrowing funds against the value of an existing investment portfolio allows investors to make larger investments, potentially boosting returns.

- A margin loan allows investors to borrow money to buy securities or other investments.

- The loan is secured by the investor’s portfolio, with the purchased securities or existing investments serving as collateral.

- By using margin loans strategically and maintaining a disciplined approach, investors can unlock new opportunities while mitigating potential downsides.