Businesses that need fast and flexible funding but can not qualify for traditional loans may be able to leverage hard money loans, an alternative solution offered by leading independent funders. Often used in property investments and urgent financial situations, this type of short-term financing allows borrowers to secure funding quickly using real estate or other high-value assets as collateral.

This article explores hard money loans, how they work, and when they may be the right financing option.

What Is a Hard Money Loan?

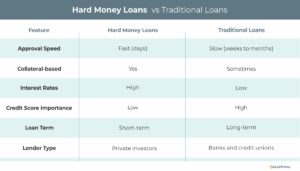

A hard money loan is a short-term lending solution secured against real estate or another high-value asset. Unlike traditional loans, which rely heavily on the borrower’s creditworthiness, hard money loans are asset-based, meaning the primary factor for approval is the value of the collateral rather than the borrower’s financial history.

These loans are typically provided by specialist lenders, private investors, or alternative finance providers rather than high street banks.

Key Features of Hard Money Loans

- Asset-Based Lending – The loan is secured against property or another tangible asset.

- Short-Term Duration – Loan terms generally range from six months to three years.

- Higher Interest Rates – Due to the increased risk for lenders, interest rates are higher than those of conventional loans.

- Rapid Approval and Funding – Loans can be approved and funded within days, making them ideal for time-sensitive transactions.

How Do Hard Money Loans Work?

- Application – Borrowers apply by presenting details about the asset being used as security.

- Asset Valuation – The lender assesses the property’s market value to determine the loan amount, typically up to 70-80% of the asset’s worth.

- Approval and Disbursement – Once approved, the loan is issued quickly, often within a few days.

- Repayment – Borrowers make regular interest payments, with a balloon payment due at the end of the loan term, often through property sale or refinancing.

Who Uses Hard Money Loans?

This type of financing is commonly used by:

- Property Developers – To fund construction projects or renovations before selling or refinancing.

- Buy-to-Let Investors – To quickly purchase properties in competitive markets.

- Business Owners – Who need urgent capital secured against commercial property.

- Individuals with Poor Credit Histories – Who have valuable assets but may not qualify for traditional finance.

- Auction Buyers – Who need quick financing to secure property purchases at auction.

Advantages of Hard Money Loans

- Speed of Funding

- Loan approvals are processed quickly, making them ideal for urgent opportunities.

- Flexible Lending Criteria

- Borrowers with poor credit histories may still qualify based on asset value.

- Short-Term Financing Solution

- Suitable for bridging finance, property flippers, or other short-term needs while awaiting long-term funding or property sales.

- Customised Loan Structures

- Specialist lenders can offer flexible terms to suit different borrower needs.

- Opportunity for High Returns

- Investors can leverage this financing to capitalise on profitable property deals.

Challenges of Hard Money Loans

- Higher Interest Rates

- Interest rates are significantly higher than those of traditional mortgages.

- Short Repayment Periods

-

- Lo The loan must be repaid quickly, which can be challenging without a clear exit strategy.

- Risk of Property Repossession

- If the borrower defaults, the lender may take ownership of the secured asset.

- Variable Lending Terms

- Terms and conditions can vary widely among different lenders.

When to Consider a Hard Money Loan

- Property Flipping – Investors who need quick funding to buy, renovate, and sell properties.

- Bridge Financing – To cover short-term funding gaps while waiting for long-term finance.

- Auction Purchases – Buyers needing fast access to funds to meet tight deadlines.

- Development Projects – Property developers requiring finance for construction or refurbishment.

- Credit Issues – Borrowers who struggle to secure funding due to credit issues but have valuable collateral.

Example: Hard Money Loan in Action

Scenario: A property investor finds an undervalued property for £2.5 million but needs immediate funding to secure the purchase and begin renovations.

Solution: The investor obtains a hard money loan covering 75% of the property’s value (£1.875 million) and invests £625,000 of their own funds for the purchase and renovations. Six months later, the property is sold for £3.5 million.

Outcome: After repaying the loan and interest, the investor secures a profit of £600,000.

Tips for Using Hard Money Loans Wisely

- Have a Clear Exit Strategy – Plan how and when you will repay the loan, whether through refinancing or property sale.

- Understand the Costs – Review interest rates, fees, and repayment terms to ensure affordability.

- Choose a Reputable Lender – Work with experienced lenders who offer transparent terms and fair pricing.

- Use for High-ROI Projects – Hard money loans are best suited for investments with strong returns.

- Monitor Market Conditions – Ensure property market trends align with your investment strategy.

Conclusion

Hard money loans offer a valuable alternative for those who need fast, flexible financing and have high-value assets to secure funding. While they carry higher costs, they provide a crucial lifeline for property investors, developers, and businesses requiring short-term funding solutions.

If you are considering a hard money loan, evaluate your financial needs, assess the risks, and partner with a trusted lender. With the right approach, this financing option can help unlock opportunities and drive business growth.

Contact us to learn more about our tailored financing solutions designed to help businesses and property investors achieve their goals.

Key Takeaways

- Hard money loans provide fast, flexible financing for borrowers who may not qualify for traditional loans.

- This type of lending is secured against real estate or other high-value assets.

- While this funding option comes with higher costs, it can be ideal for time-sensitive investments and short-term funding needs.