Many supply chain networks are under pressure due to suppliers facing cash flow challenges and rising insolvencies. Economic uncertainty and ongoing global market disruptions have weakened financial structures, reducing business resilience and agility. Cash-strapped suppliers struggling to maintain operations can cause disruptions across the entire supply chain, ultimately impacting buyers’ bottom lines.

Supply chains are deeply interconnected—delays or financial instability at one supplier can create widespread bottlenecks, shortages, and operational setbacks. Helping suppliers maintain a healthy cash flow through accelerated payments can reduce these risks, fostering stronger, more reliable supply chains.

Quick Pay is a payment strategy that allows businesses to pay suppliers earlier than standard invoice terms. This benefits both parties by improving supplier liquidity, securing better contract terms, and enhancing supply chain efficiency. By offering early payments, businesses can also strengthen supplier relationships and prioritise their orders.

This article explores Quick Pay, how it works, its benefits, and how businesses can afford to offer this financial solution to their suppliers.

What Is Quick Pay?

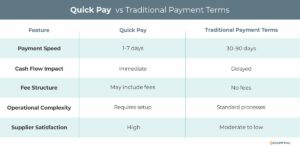

This financial arrangement refers to structured payment agreements that enable businesses to pay suppliers, vendors, or contractors faster than standard payment terms. While traditional payment cycles often range from 30 to 90 days, Quick Pay agreements typically ensure suppliers are paid within a much shorter timeframe, often between 1 and 7 days.

Key Features of Quick Pay:

- Accelerated Payments – Reduces waiting times for supplier payments.

- Mutually Agreed Terms – Requires an agreement between buyers and suppliers to establish payment schedules.

- Nominal Fees – Some Quick Pay arrangements involve fees, either absorbed by the buyer or shared between both parties.

Quick Pay agreements are typically arranged between buyers and sellers to facilitate faster payments. Alternatively, suppliers can arrange their own independent financing solutions—such as invoice financing—to expedite payments without buyer cooperation.

How Does Quick Pay Work?

- Agreement Setup – Buyers and suppliers negotiate terms, specifying payment timelines and any associated costs.

- Invoice Submission – Suppliers submit invoices as usual, often through digital platforms for efficiency.

- Payment Processing – The buyer processes payments within the agreed timeframe.

- Funds Transfer – The supplier receives payment quickly, improving cash flow and liquidity.

Benefits of Quick Pay

- Improves Supplier Cash Flow

- Enables suppliers to receive payments sooner, reducing reliance on credit and helping to meet financial obligations.

- Strengthens Supplier Relationships

- Buyers offering fast payment to suppliers foster stronger partnerships, leading to improved collaboration and trust.

- Enhances Supply Chain Stability

- Suppliers with better cash flow can operate more efficiently, reducing delays and ensuring a steady supply of goods and services.

- Increases Supplier Incentives

- Early payment often encourages suppliers to offer discounts, prioritise orders, or provide favourable contract terms.

- Reduces Financial Strain on Suppliers

- Suppliers avoid cash flow bottlenecks, reducing the need for short-term loans or high-interest financing.

- Automates and Streamlines Payments

- Digital Quick Pay systems reduce administrative burdens, making payments more efficient and reducing processing delays.

Challenges of Quick Pay

- Potential Additional Costs

- Buyers may face additional costs when offering accelerated payment options, either through nominal fees or by absorbing early payment expenses.

- Buyer Cash Flow Considerations

- Businesses must ensure they have sufficient cash flow to sustain accelerated payment terms without disrupting their own operations.

- Supplier Dependency Risks

- Over-reliance on early payments can make suppliers financially dependent on special arrangements, leading to challenges if payment terms revert to normal.

- Implementation Costs

- Setting up automated Quick Pay systems requires investment in financial technology and staff training.

Industries Benefiting from Quick Pay

- Transport and Logistics

- Enables freight carriers and hauliers to cover fuel costs, wages, and vehicle maintenance without waiting for standard payment terms.

- Construction

- Contractors and subcontractors can secure funding for materials and labour costs promptly.

- Retail and E-Commerce

- Suppliers can restock inventory faster, reducing the risk of shortages during peak demand periods.

- Healthcare and Pharmaceuticals

- Medical suppliers benefit from quicker reimbursements, improving financial stability.

- Freelancing and the Gig Economy

- Self-employed professionals gain greater financial security with faster payment for their work.

How to Implement Quick Pay

- Assess Financial Position

- Ensure the business has sufficient cash flow to support accelerated supplier payments.

- Negotiate Supplier Terms

- Work with suppliers to establish mutually beneficial agreements and potential early payment discounts.

- Leverage Digital Payment Solutions

- Automate payments using digital platforms to ensure efficient and error-free processing.

- Monitor Cash Flow Impact

- Regularly review the effect of quick payment options on financial stability, supply chain efficiency, and operational budgets.

- Educate Internal Teams

- Train accounts payable teams on best practices for managing accelerated payments.

Real-World Example: Quick Pay in Action

Scenario: A mid-sized UK-based logistics company faces rising fuel costs while waiting 60 days for client payments.

Solution: The company partners with a freight broker offering Quick Pay. This arrangement allows the haulier to receive payments within 5 days of submitting an invoice, ensuring cash flow stability for a nominal fee.

Outcome: The company maintains financial stability, reduces reliance on credit, and continues to operate efficiently without cash flow interruptions.

How to Fund Quick Pay Solutions for Suppliers

Buyers can enhance their own cash flow and afford to offer expedited payment solutions to suppliers by utilising flexible financing options, such as invoice financing.

Invoice financing enables businesses to unlock the value of their accounts receivable as collateral to access short-term working capital. This funding solution allows businesses to offer early supplier payments without disrupting cash reserves or waiting for customer payments.

Partnering with specialist lenders who understand your industry can help businesses arrange flexible financing solutions to support quick payment options to suppliers.

Conclusion

Quick Pay is an effective strategy for businesses looking to improve supply chain reliability, strengthen supplier relationships, and enhance financial stability. Offering faster payments can increase supplier trust, secure better contract terms, and ensure a more seamless flow of goods and services.

Businesses that need to manage their own cash flow while implementing expedited payment options can explore tailored inventory financing or invoice financing options to ensure a sustainable approach to early supplier payments.

Alternatively, suppliers who require faster payments can independently use invoice factoring or invoice financing to accelerate their cash flow without buyer involvement.

Whether you’re a buyer looking to strengthen supplier relationships or a supplier seeking to stabilise cash flow, early payment solutions can be a key competitive advantage. Evaluate your financial needs, explore bespoke funding options, and implement Quick Pay to create a more resilient and efficient supply chain.

Contact us today to explore the best cash flow solutions for your business, strengthen supplier resilience, and optimise your supply chain.

Key Takeaways

- Accelerating supplier payments helps strengthen supply chains, ensuring stability and efficiency.

- Businesses can use Quick Pay options to improve supplier cash flow, securing better contract terms and prioritised order fulfilment.

- Buyers can use invoice financing, inventory financing or other flexible funding solutions to afford expediated payment to suppliers without straining their own working capital.