Purchase Order (PO) Financing: Fulfilling Large Customer Orders Without Financial Strain

Content

- What Is Purchase Order Financing?

- Key Features of PO Financing:

- How Does PO Financing Work?

- Who Can Benefit from PO Financing?

- Benefits of PO Financing

- Challenges of PO Financing

- Industries That Benefit from PO Financing

- Real-World Example: PO Financing in Action

- How to Use PO Financing Strategically

- Tips for Choosing a PO Financing Provider

- Conclusion

- Key Takeaways

For UK businesses that receive large customer orders but lack the immediate capital to fulfil them, Purchase Order (PO) financing provides a valuable solution. This financing option helps businesses cover the cost of goods or services needed to complete orders, ensuring they can meet customer demand without disrupting cash flow.

This article explores PO financing, how it works, its benefits, and why it’s a crucial tool for growing businesses.

What Is Purchase Order Financing?

Purchase Order (PO) financing is a short-term financing solution that provides businesses with the capital needed to pay suppliers and fulfil customer orders. Rather than requiring businesses to front the costs of raw materials or finished goods, PO financing bridges the gap, enabling them to complete sales and deliver on commitments.

Key Features of PO Financing:

- Order-Based: Financing is tied to specific customer purchase orders.

- Supplier Payments: Funds are often paid directly to the supplier.

- Short-Term Focus: Loans are repaid once the customer pays for the order.

How Does PO Financing Work?

- Order Submission: A business receives a purchase order from a customer.

- Application: The business applies for PO financing, presenting the customer order and supplier details to the financing provider.

- Approval: The provider evaluates the order and the customer’s creditworthiness before approving funding.

- Supplier Payment: Funds are disbursed directly to the supplier to produce or deliver the goods.

- Order Fulfilment: The business fulfils the order, and the customer pays the invoice.

- Repayment: The financing provider is repaid from the proceeds of the customer payment minus fees.

Who Can Benefit from PO Financing?

PO financing is ideal for businesses that:

- Experience cash flow constraints but have strong customer demand.

- Operate in industries with long production or delivery timelines.

- Receive large or unexpected purchase orders that exceed their available working capital.

- Seek to scale operations without taking on long-term debt or giving up equity.

Benefits of PO Financing

- Enables Business Growth

- Allows businesses to take on larger orders and new customers without financial strain.

- Improves Cash Flow

- Bridges the gap between paying suppliers and receiving customer payments.

- Supports Supplier Relationships

- Ensures suppliers are paid promptly, strengthening partnerships.

- Quick Access to Funds

- Offers a faster approval process compared to traditional loans, enabling businesses to meet tight deadlines.

- Preserves Ownership

- Unlike equity financing, PO financing doesn’t require business owners to give up a stake in their company.

- Enhances Credibility

- Successfully meeting large orders on time enhances reputation and customer trust.

Challenges of PO Financing

- Higher Costs

- PO financing fees can be higher than traditional bank loan interest rates.

- Customer Credit Risk

- Approval is often based on the customer’s creditworthiness, not just the business’s.

- Order Limitations

- Not all types of orders or industries qualify for this type of financing.

- Short-Term Solution

- Designed for immediate cash flow needs, not long-term capital investments.

- Risk of Non-Payment

- If the customer fails to pay, the business remains responsible for repaying the financing.

Industries That Benefit from PO Financing

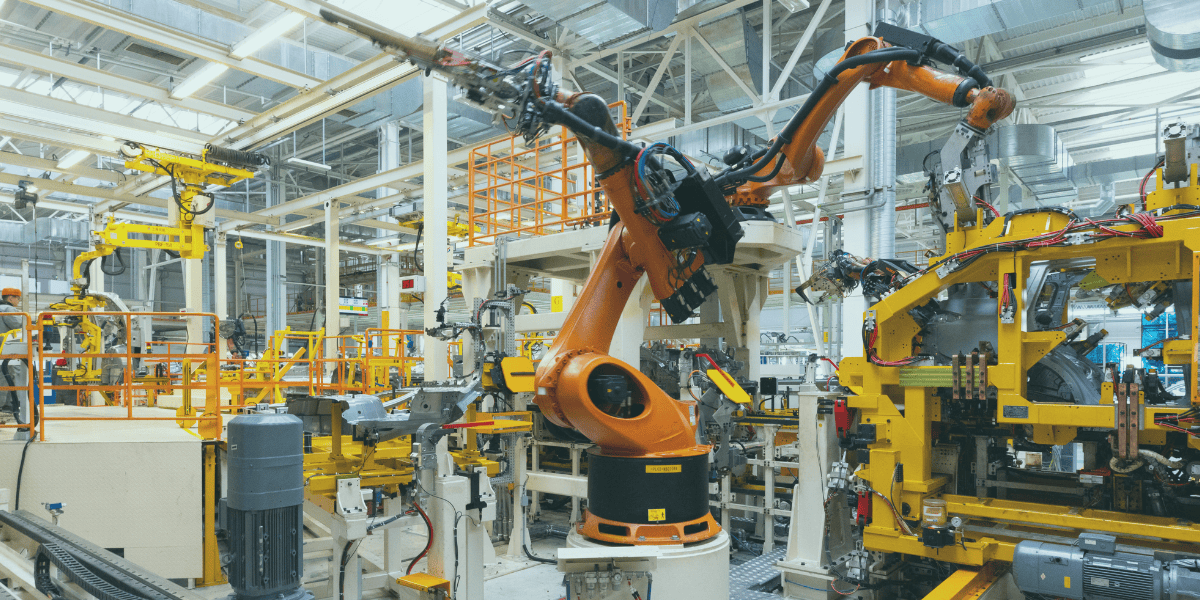

- Manufacturing

- Cover raw material costs to fulfil large production orders.

- Retail and Wholesale

- Fund bulk orders from major retailers or distributors.

- Technology

- Finance the production of hardware or software for client contracts.

- E-Commerce

- Manage seasonal demand or large-scale online sales.

- Apparel and Fashion

- Purchase fabrics or finished goods to meet retailer demands.

Real-World Example: PO Financing in Action

Scenario: A UK-based clothing manufacturer receives a £2 million purchase order from a major retailer but lacks the funds to produce the required inventory.

Solution: The manufacturer secures PO financing, with the provider covering 75% of the production costs upfront by paying the supplier directly.

Outcome: The manufacturer delivers the order on time, receives payment from the retailer, and repays the financing provider while retaining profits for reinvestment and growth.

How to Use PO Financing Strategically

- Focus on Reliable Customers

- Apply for financing against purchase orders from creditworthy customers to reduce risk.

- Plan for Seasonal Demand

- Use PO financing to fulfil large orders during peak trading periods without depleting cash reserves.

- Partner with Trusted Suppliers

- Ensure suppliers can deliver quality goods on time to maintain customer satisfaction.

- Monitor Cash Flow

- Align financing repayment with customer payment schedules to avoid cash flow disruptions.

- Diversify Funding Sources

- Combine PO financing with other funding options, such as invoice financing or trade financing, for comprehensive financial support.

Tips for Choosing a PO Financing Provider

- Evaluate Costs

- Understand fees, interest rates, and repayment terms to assess the total cost of financing.

- Check Customer Credit Criteria

- Ensure your provider assesses customer creditworthiness effectively.

- Review Speed of Approval

- Choose a provider that offers quick approval and disbursement to meet deadlines.

- Assess Flexibility

- Look for providers that offer scalable financing options for growing businesses.

- Verify Reputation

- Partner with reputable providers experienced in your industry. Conduct thorough research, check client case studies, and reach out for direct consultations.

Conclusion

Purchase Order financing is an essential tool for UK businesses looking to fulfil large orders, manage cash flow constraints, and scale their operations. By providing the capital needed to pay suppliers and deliver products on time, PO financing empowers businesses to seize opportunities, build credibility, and grow sustainably.

If your business is facing cash flow challenges but has strong customer demand, PO financing could be the solution you need. Evaluate your needs, partner with a trusted provider, and leverage this funding option to achieve your growth objectives and strengthen your market position.

Contact us today to consult our experienced financial specialists and explore tailored financing solutions to support your company’s expansion.

Key Takeaways

- UK businesses that receive large customer orders but face cash flow constraints often struggle to cover the cost of goods or services required to complete orders.

- Purchase Order (PO) financing is a crucial funding tool for businesses looking to fulfil large orders, manage cash flow challenges, and scale their operations.

- This type of financing leverages purchase orders to secure flexible funding, enabling businesses to cover upfront costs for raw materials or finished goods needed to fulfil sales commitments and deliver on promises.