Business Line of Credit: A Flexible Finance Solution for Business Growth and Agility

Content

- What Is a Business Line of Credit?

- Key Features of a Business Line of Credit

- How Does a Business Line of Credit Work?

- Types of Business Lines of Credit

- Benefits of a Business Line of Credit

- Challenges of a Business Line of Credit

- Common Uses for a Business Line of Credit

- Tips for Securing & Managing a Business Line of Credit

- Real-World Example: Business Line of Credit in Action

- Conclusion

- Key Takeaways

In today’s uncertain economy, business agility is more important than ever. Companies must be able to adapt quickly to changing market conditions, mitigate financial risks, and seize new growth opportunities. Managing cash flow effectively and securing easy access to capital are critical—particularly when facing seasonal fluctuations, unexpected costs, or expansion opportunities.

A business line of credit offers a flexible financing solution, allowing businesses to access funds as needed rather than borrowing a fixed lump sum. This revolving credit facility ensures financial stability and flexibility, making it an essential tool for UK businesses.

This guide explores business lines of credit, how they work, and why they are a smart choice for companies looking to maintain resilience and competitiveness.

What Is a Business Line of Credit?

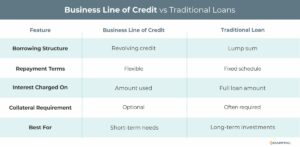

A business line of credit is a revolving form of borrowing that provides businesses with access to a pre-approved credit limit. Unlike a traditional business loan, where a company receives a lump sum, a line of credit allows businesses to draw funds as required, only paying interest on the amount borrowed. Once repaid, the credit becomes available again for future use.

Key Features of a Business Line of Credit

- Revolving Credit – Borrow, repay, and borrow again within the credit limit.

- Flexible Usage – Use funds for various business expenses, such as inventory, payroll, or unexpected costs.

- Interest on Usage – Interest is only charged on the amount withdrawn, not the total credit limit.

- Renewable Terms – Lines of credit are often reviewed annually, with renewals based on financial performance.

How Does a Business Line of Credit Work?

- Application & Approval – Businesses apply by submitting financial statements, tax returns, and credit history for assessment.

- Credit Limit Assignment – Lenders evaluate the business’s financial strength and determine the borrowing limit.

- Withdrawing Funds – Businesses withdraw funds as needed, either in full or in smaller amounts.

- Repayment – Borrowers repay the loan, either through structured repayments or lump sums.

- Revolving Facility – Once repaid, the funds are available again for future use, providing ongoing financial flexibility.

Types of Business Lines of Credit

- Secured Business Line of Credit

- Backed by collateral, such as property, accounts receivable, or inventory.

- Offers higher credit limits and lower interest rates.

- Unsecured Business Line of Credit

- No collateral is required but generally comes with higher interest rates and lower credit limits.

- Best suited for businesses with strong financials and good credit histories.

Benefits of a Business Line of Credit

- Financial Flexibility

- Borrow only what is needed, ensuring efficient use of capital.

- Ideal for covering short-term cash flow gaps or unforeseen expenses.

- Cost-Effective Borrowing

- Interest is charged only on the borrowed amount, saving money compared to lump-sum loans.

- Strengthened Cash Flow

- Ensures liquidity for payroll, supplier payments, or seasonal stock purchases.

- Builds Business Credit

- Responsible borrowing and timely repayments can boost credit scores, making it easier to secure larger loans in the future.

- Acts as a Financial Safety Net

- Provides businesses with a contingency fund for emergencies, safeguarding operations during uncertain periods.

Challenges of a Business Line of Credit

- Variable Interest Rates

- Many credit lines have floating interest rates, which could increase over time.

- Annual Fees

- Some lenders charge maintenance or renewal fees, even if the credit facility is unused.

- Strict Qualification Criteria

- New or small businesses may struggle to qualify for unsecured credit without strong financial records.

- Discipline Required

- Without careful management, businesses may overextend borrowing, leading to financial strain.

Common Uses for a Business Line of Credit

- Managing Seasonal Cash Flow Fluctuations

- Cover operational costs during slower months and prepare for peak seasons.

- Handling Emergency Expenses

- Fund urgent equipment repairs, supplier payments, or unexpected costs.

- Funding Short-Term Growth Opportunities

- Take advantage of time-sensitive bulk purchasing discounts or marketing campaigns.

- Bridging Gaps in Receivables

- Maintain steady cash flow while waiting for customer payments.

- Supporting Payroll & Operations

- Ensure staff wages and overheads are covered during temporary financial gaps.

Tips for Securing & Managing a Business Line of Credit

- Maintain a Strong Credit Profile

- Businesses with higher credit scores qualify for better terms and interest rates.

- Keep Financial Records Up-to-Date

- Accurate financial statements, tax returns, and cash flow projections improve approval chances.

- Compare Lenders Carefully

- Assess interest rates, fees, repayment terms, and customer service quality before choosing a lender. Examine the company’s website and check case studies before interviewing the lender to ensure alignment with your company goals.

- Use Credit Wisely

- Treat the facility as a backup rather than a regular funding source.

- Monitor Cash Flow & Repayments

- Avoid unnecessary interest by tracking usage and repaying promptly.

Real-World Example: Business Line of Credit in Action

Scenario: A mid-sized manufacturing company experiences a sudden surge in demand due to increased home purchases. The company needs £150,000 to secure raw materials and increase production before customer payments arrive.

Solution: The business secures a £200,000 line of credit, withdrawing £150,000 to cover immediate payroll and materials. Once customer invoices are settled, the company repays a portion of the loan, replenishing its available credit for future use.

Outcome: The company sustains operations, meets demand, and maintains financial stability, ensuring steady growth.

Conclusion

A business line of credit is a versatile and essential financial tool for businesses looking to manage cash flow, seize opportunities, and navigate economic uncertainties. Its flexibility, revolving nature, and cost-effectiveness make it an excellent solution for handling short-term financial needs while maintaining operational stability.

If your business requires financial agility, a line of credit could be the right solution. Consult with lenders, assess your financial position, and choose an option that aligns with your business goals. With responsible management, a business line of credit can support long-term success and growth.

Contact us today to arrange a business line of credit tailored to your company’s needs and growth ambitions.

Key Takeaways

- Access to capital is critical for business agility in uncertain economic conditions.

- A business line of credit allows businesses to borrow and repay flexibly, only paying interest on the used amount.

- This revolving credit facility helps manage cash flow, emergency expenses, and short-term growth opportunities efficiently.