Bad Debt Protection – Financing Safe Business Growth

Content

The UK economy has rebounded from last year’s mild recession. David Bharier, Head of Research at the British Chambers of Commerce, commented, “The UK economy has grown at a higher than expected rate in the first half of this year, following a short technical recession in 2023, and our upward GDP revision for 2024 reflects that.” Although headwinds are tailing off, the economy is not out of the woods yet. Mr. Bharier continued, “However, widespread uncertainty could weigh down on growth expectations for 2025 and 2026. Major global conflicts, trade tensions, and an impending US election could all feed into a climate of hesitation for firms, particularly those involved in global trade.”

As we approach the end of the year, UK economic growth has slowed after leading the G7 in the first half of 2024. Manufacturers are uncertain about output, and consumer confidence has declined, despite higher summer sales compared to last year. The Bank of England has maintained interest rates at 5% to prevent a resurgence of inflation, particularly in services.

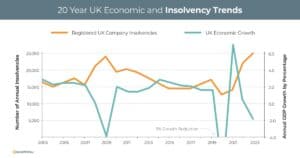

Amongst this uncertainty, UK firms must seek flexible financing options with enhanced risk management features as they push to grow output. The number of registered company insolvencies in England and Wales was 1,953 in August 2024. This represents a better performance than August of 2023, a year that produced more than 25,000 company insolvencies, but much higher than during the COVID-19 pandemic. In this environment, bad debtor protection is a growing risk management strategy many businesses employ to safeguard against the financial losses incurred from customer non-payment.

Learn to grow your business while still affording the comfort of sleeping easily at night. Keep reading to learn how bad debt protection is the ideal financing solution to help grow your business with the added peace of mind that your customers are credit protected.

The problem – prolonged exposure to bad debt

Business growth can amplify the dangers of customer bad debt, as increasing sales often leads to extended credit terms and a larger pool of customers, heightening the risk of defaults. If not managed carefully, this can strain cash flow and jeopardize the company’s financial stability.

Last year marked a 30-year high for registered commercial bankruptcies. Although 2024 is registering fewer insolvencies, the concern over bad debt remains high as the negative impact on your business cashflow could have severe consequences. Prolonged exposure to bad debt can ultimately push a business toward cash flow constraints and insolvency.

Bad debt protection gives you the confidence of knowing that you will receive payment for invoices due from your customer in the event of their non-payment, thus protecting your longer-term cashflow.

The solution – bad debt protection

Bad debt protection is a vital solution that complements invoice financing. This flexible financing option provides fast funding and quick access to working capital to support growth. Add to this bad debt protection and a business has a safeguard against the financial losses incurred from non-payment by customers.

Here’s how bad debt protection works:

- Financing: The business delivers products or services to its customers, issues an invoice, and sends a copy of the invoice to the funder for financing. The funding company buys the invoice at a discount and immediately advances up to 90% of the invoice’s face value to the company. The remaining balance is held in reserve until the customer pays the invoice amount to the funding company. A transaction fee is taken for the funding.

- Coverage: If a customer (debtor) becomes insolvent or fails to pay an invoice, the funding company assumes the risk. This means the business won’t be liable for that unpaid invoice, protecting its cashflow.

- Assessment: The funding company typically assesses the creditworthiness of a business’s customers before providing bad debtor protection. They may decline to protect invoices for customers deemed high-risk.

- Cost: This protection often comes at an additional cost. The funding company may charge higher fees than invoice factoring for this service, as it assumes more risk.

Overall, bad debt protection is a valuable tool for businesses wanting to manage credit risk while maintaining liquidity through a form of invoice financing. By utilizing bad debt protection, companies can operate with greater confidence, knowing that customer defaults won’t severely impact their cash flow.

The benefits of bad debt protection

Financing with bad debt protection allows businesses to pursue growth confidently in an uncertain economy. This protection enables companies to extend credit to new customers or increase sales without fearing significant financial losses, facilitating expansion while maintaining stability and liquidity.

Here’s a breakdown of the principal features and benefits of bad debt protection:

- Immediate Cash Flow

- Features: Businesses can access funds within 24 hrs by selling their invoices. Fast access to funds allows businesses to invest in inventory, marketing, or new projects without delay.

- Benefits: Immediate access to funds enhances cashflow. This enables timely payments to suppliers, supports operational stability, and fuels growth.

- Flexible Financing

- Features: Minimal loan covenants and expanding credit limits that can grow with sales volumes.

- Benefits: Businesses can invest in growth opportunities and extend credit to more customers, potentially boosting sales and market share without fear of bad debt.

- Non-Debt Financing

- Features: Unlike loans, invoice financing doesn’t add to the company’s debt burden.

- Benefits: Business growth without incurring debt allows companies to expand and invest in opportunities while maintaining financial stability and reducing the risk of insolvency.

Businesses should work with an experienced independent funder when utilizing bad debt protection to maximize efficiency and ease of use.

Why work with an experienced independent funder?

Working with an experienced independent funder provides tailored financing solutions and expert guidance on credit management. Additionally, it offers a more personalized approach that can enhance cashflow while effectively mitigating risks associated with customer defaults.

It’s essential to conduct thorough due diligence when considering a lender. Seek recommendations and review client feedback on lenders’ websites. Look for key indicators of trustworthiness, including experience, reputation, industry knowledge, and technological innovation. Advanced technology enhances account management and tracking, ensuring full transparency with real-time transaction monitoring and reporting. Partnering with a well-regarded independent funding company to implement a bad debt protection arrangement can significantly ease financial burdens without additional debt or fear of loss from insolvent customers.

Conclusion

As the UK economy navigates a complex landscape of growth and uncertainty, bad debt protection emerges as a crucial tool for businesses seeking to safeguard their financial health. With the rate of customer defaults being a constant concern, having this solution, alongside invoice finance can empower companies to expand confidently. By providing immediate cash flow, flexibility, and a non-debt financing option, invoice finance and bad debt protection enables businesses to seize growth opportunities without worrying about financial losses from non-payment.

Partnering with an experienced independent funder enhances the effectiveness of this strategy and ensures that businesses have access to tailored solutions and expert guidance in managing credit risks. In an environment where uncertainty is prevalent, adopting robust risk management strategies like bad debt protection is essential for sustaining growth, maintaining stability, and ultimately thriving in the competitive landscape.

Contact us today to request a free financing consultation and see how we can help maximize your company’s cashflow efficiency.

Key Takeaways

- Widespread uncertainty could weigh down on growth expectations for the UK economy in 2025 and 2026.

- Amongst this uncertainty, UK firms must seek flexible financing options with enhanced risk management features as they push to grow output.

- Bad debt protection can be built into an invoice financing funding solution. This flexible form of financing provides fast funding and quick access to working capital while safeguarding against potential financial losses incurred from non-payment by customers.

- Partnering with an experienced independent funder enhances the effectiveness of this strategy and ensures that businesses have access to tailored solutions and expert guidance in managing credit risks.