Cashflow Loans: A Flexible Financing Solution for UK Businesses

Content

- What Are Cashflow Loans?

- Key Features of Cashflow Loans:

- How Do Cashflow Loans Work?

- Who Benefits from Cashflow Loans?

- Advantages of Cashflow Loans

- Challenges of Cashflow Loans

- Common Uses for Cashflow Loans

- Real-World Example: Cashflow Loans in Action

- How to Choose the Right Cashflow Loan

- Conclusion

- Key Takeaways

Maintaining healthy cashflow is essential for any business, yet it remains one of the most common financial challenges. Whether it’s covering payroll, purchasing stock, or investing in growth opportunities, businesses often need quick access to funding to bridge gaps or seize opportunities. This is where cashflow loans come into play—a flexible, fast, and efficient financing option designed to support businesses in managing their day-to-day operations.

The unsecured lending market has grown significantly in recent years, driven by advancements in financial technology (fintech). In this guide, we explore cashflow loans, how they work, and why they are becoming an essential financial tool for UK businesses.

What Are Cashflow Loans?

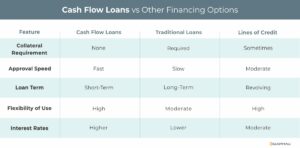

A cashflow loan is an unsecured form of business financing that provides working capital based on projected future cashflow. Unlike traditional bank loans, which require collateral such as property or equipment, cashflow loans focus on a business’s income-generating potential and financial stability.

Key Features of Cashflow Loans:

- Unsecured Lending – Typically does not require physical collateral, as approval is based on cashflow forecasts and business performance.

- Short-Term Borrowing – Designed for immediate operational needs, with repayment periods ranging from a few months to a few years.

- Quick Access to Funds – Faster approval and disbursement than traditional bank loans, with some lenders offering funding within 24–72 hours.

How Do Cashflow Loans Work?

- Application – Businesses provide financial statements, revenue data, and cashflow forecasts.

- Evaluation – Lenders assess the business’s cashflow health, revenue history, and repayment capacity.

- Loan Approval – The approved loan amount is often a multiple of monthly revenue, determined by the lender’s risk assessment.

- Disbursement – Once approved, funds are typically released within a few days.

- Repayment – Businesses repay the loan through fixed instalments, which include interest and fees.

Who Benefits from Cashflow Loans?

This type of financing is ideal for businesses that:

- Have strong cashflow but lack physical assets to secure a loan.

- Require immediate capital to cover operational expenses.

- Experience seasonal fluctuations and need funding to bridge cashflow gaps.

- Want to seize growth opportunities but require quick funding to do so.

Advantages of Cashflow Loans

- Fast Access to Funding

Businesses can access finance within days, making cashflow loans ideal for urgent needs such as payroll, inventory restocking, or unexpected expenses.

- No Need for Collateral

Since approval is based on cashflow, businesses do not need to pledge assets such as property or equipment. This reduces risk, particularly for small and medium-sized enterprises (SMEs) that may not have significant assets.

- Flexible Use of Funds

Businesses can use the funds for a variety of purposes, including operational expenses, marketing campaigns, stock purchases, and supplier payments.

- Simple Application Process

Compared to traditional loans, cashflow loans require less documentation and have a streamlined approval process, making them accessible to more businesses.

- Supports Business Growth

These loans allow businesses to take advantage of time-sensitive opportunities, such as bulk purchasing discounts, expansion into new markets, or investing in new equipment.

Challenges of Cashflow Loans

- Higher Interest Rates

Due to the unsecured nature of these loans, interest rates tend to be higher than secured financing. Businesses must evaluate the cost of borrowing against potential returns.

- Shorter Repayment Terms

Repayment periods are typically shorter than traditional loans, which may put pressure on cashflow if not planned properly.

- Reliance on Strong Cashflow

Lenders focus on a business’s income stability, meaning companies with inconsistent revenue may struggle to qualify.

- Additional Fees

Some cashflow loans come with origination fees, early repayment penalties, or administrative charges, increasing the overall cost of borrowing.

Common Uses for Cashflow Loans

- Managing Payroll

Ensures employees are paid on time during periods of slow revenue or delayed customer payments.

- Purchasing Stock

Allows businesses to stock up on inventory ahead of peak sales periods or take advantage of supplier discounts.

- Bridging Receivables Gaps

Helps businesses cover expenses while waiting for invoices to be paid by customers.

- Funding Expansion

Supports marketing campaigns, hiring staff, or investing in infrastructure to scale the business.

- Covering Emergency Expenses

Provides a financial buffer for unexpected costs, such as equipment repairs, urgent supplier payments, or business disruptions.\

Real-World Example: Cashflow Loans in Action

Scenario:

A UK-based e-commerce business sees a significant spike in orders during the Christmas period. To keep up with demand, the company needs additional funds to purchase stock and hire seasonal staff.

Solution:

The business secures a £50,000 cashflow loan, which is approved and disbursed within three days. The funds allow them to increase stock levels and manage operations effectively.

Outcome:

The company achieves record-breaking seasonal sales, repays the loan within six months, and maintains strong customer satisfaction through timely deliveries.

How to Choose the Right Cashflow Loan

- Evaluate Lenders

Research reputable lenders with transparent terms, competitive interest rates, and strong customer service. Check their website, read case studies, and compare lending criteria.

- Understand Costs

Review the total cost of borrowing, including interest rates, repayment schedules, and any hidden fees.

- Define Your Purpose

Ensure the loan will be used to generate revenue or solve an immediate cashflow issue, making the cost of borrowing worthwhile.

- Assess Your Cashflow

Ensure your business has stable cashflow projections to meet repayments without affecting operations.

Conclusion

Cashflow loans provide a fast, flexible, and efficient financing solution for UK businesses needing short-term financial support. By focusing on a company’s revenue rather than collateral, these loans offer accessible funding to businesses that may struggle to secure traditional financing.

With the rise of fintech lenders and AI-driven assessments, applying for a cashflow loan has never been easier. Businesses can access funding quickly, allowing them to manage operational challenges and capitalise on new opportunities.

If your business requires quick and flexible funding, a cashflow loan could be the ideal solution. With careful planning and management, this type of financing can be a valuable tool to support business growth and maintain financial stability.

Contact us today to explore cashflow loan options tailored to your business needs.

Key Takeaways

- Businesses often need quick access to funds to cover payroll, stock purchases, or operational expenses.

- Cashflow loans are an unsecured financing solution based on a company’s revenue and future cashflow potential.

- These loans offer fast approval, no collateral requirements, and flexible repayment terms.

- Lenders assess cashflow health and financial stability rather than relying on physical assets.

- With fintech advancements, obtaining a cashflow loan is easier than ever for UK businesses.