INVOICE FINANCE

Accelerate cash flow from your outstanding invoices

Flexible invoice finance solutions that turn unpaid invoices into working capital—fast

Flexible invoice finance solutions that turn unpaid invoices into working capital—fast

Built for businesses waiting on customer payments, this financing solution unlocks working capital from unpaid invoices—keeping your cash flow strong and your operations running without delay.

Convert unpaid invoices into immediate working capital to cover expenses, invest in growth, and maintain smooth operations.

Strengthen financial stability without taking on debt, ensuring consistent cash flow.

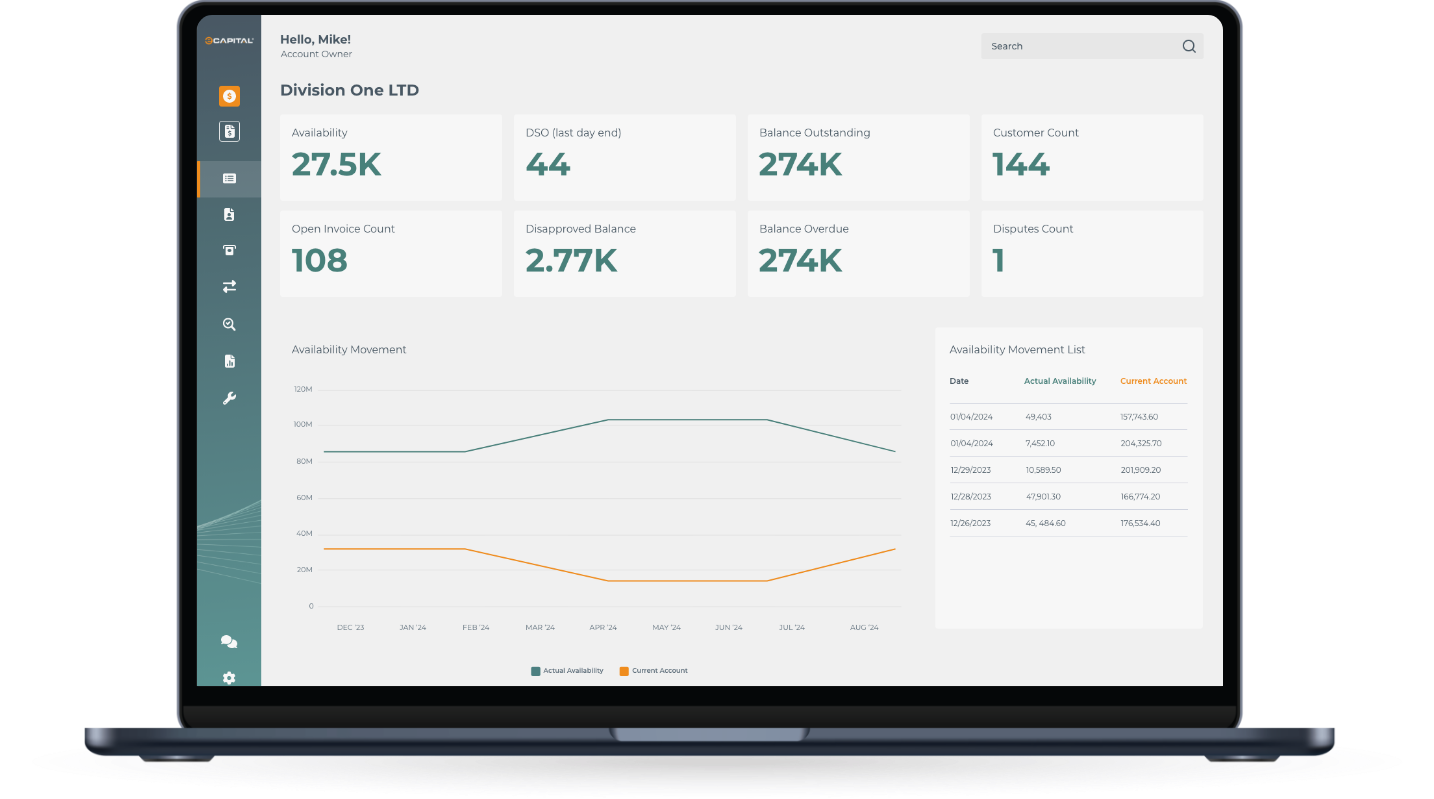

Our clients have 24/7 control to effortlessly manage their funds. Transfer money quickly to traditional bank accounts or third parties with just a few taps.

Clients choose eCapital when they need an engaged, solutions-oriented, long-term funding partner with proven capacity, creativity, and continuity. Our expertise lies in bespoke funding — from small and mid-market facilities to large, complex solutions — delivered with meticulous, hands-on strategies that adapt to meet the unique needs of UK businesses.

Our regional experts are agile and client-focused, supported by the resources to handle complex challenges. We’re a reliable funding partner through every business cycle — flexible, patient, and proven. Our track record speaks for itself.

"*" indicates required fields

Invoice finance is a funding solution that allows businesses to unlock cash tied up in unpaid customer invoices. Instead of waiting 30, 60, or even 90 days for clients to pay, a finance provider advances most of the invoice value upfront, giving you immediate access to working capital.

Invoice Finance: eCapital handles your sales ledger and collections, giving you time back to focus on the core business.

Invoice Discounting: Keep collections in-house; customers remain unaware of the financing arrangement.

Selective Invoice Finance: Finance specific invoices—for added control and flexibility, without committing your entire ledger. eCapital offers up to 80% funding on chosen invoices.

Bad Debt Protection: Safeguard your business against non-payment or customer insolvency.

Immediate cash flow to cover expenses, payroll, suppliers, and growth activities—no longer waiting weeks or months for customer payments.

Scalable funding: Invoice finance flexes in line with your turnover, ensuring that as demand increases, the funding available to you increases too – keeping growth ambitions fully supported.

Non-debt solution: Because invoice finance unlocks cash from invoices already owed, it strengthens cash flow without adding debt – giving you flexibility and financial resilience.

Time savings and expertise: By handling your credit control and sales ledger administration, invoice finance removes the burden of chasing invoices – giving you back the time and headspace to drive your business forward.

Yes—eCapital supports a broad range of UK SMEs, from startups to established companies, across sectors like logistics, recruitment, wholesale, and manufacturing.

In a traditional environment, a company or small business owner will borrow money in the form of a cash advance from a lending institution and pledge collateral to secure the bank loan. Over time, the company or individual will work to pay this loan back with interest. Depending on the loan structure, payments may be due monthly, starting immediately, or the full principal and interest will be due at some specified date in the future.

Invoice finance, by contrast, uses your existing invoices as collateral. If you have outstanding invoices due from your customers, you can sell those invoices to a third party for a discount. You’ll get an immediate injection of cash, and your customers will pay their invoices directly to the third party for goods and services.

Look for:

Industry experience

Transparent fee structure

Flexible agreements (e.g., not locked into long-term contracts)

Fast, clear communication and strong client support