OUR SOLUTIONS

Accelerating your business with alternative financing solutions that maximise working capital

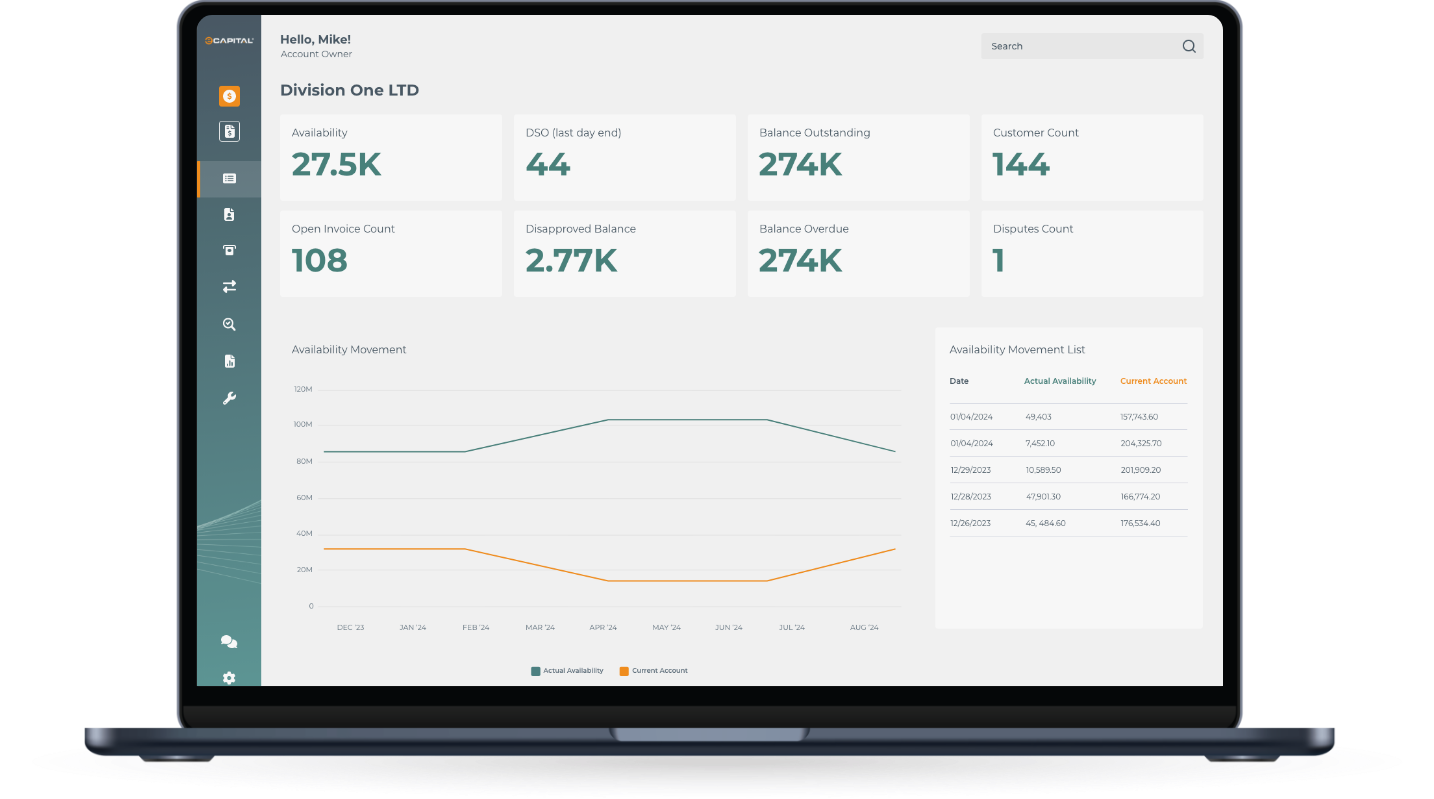

At eCapital, we deliver alternative funding solutions designed to unlock the full potential of your working capital. Whether you need to bridge cash flow gaps, fund growth initiatives, or navigate seasonal demands, our fast, flexible, products are built to keep your business moving forward—quickly, efficiently, and with confidence.

Bad Debt Protection

With flexible cover, seamless integration into your funding facility, and real-time credit monitoring, we help you trade with confidence—without the risk of bad debt holding you back.

Cash Flow Finance

Flexible cash flow finance solutions to bridge funding gaps, support day-to-day operations, and keep your business moving—without the delays.

Cross-Border Finance (UK-US)

Flexible cross-border finance solutions designed to support UK businesses with links to the US—bridging currency gaps, smoothing international cash flow, and enabling global growth.

Invoice Discounting

Invoice discounting solutions designed to release working capital quickly, helping you manage operations smoothly while keeping client relationships intact.

Invoice Finance

Flexible invoice finance solutions that turn unpaid invoices into working capital—fast

Recruitment Financing

Flexible recruitment financing solutions that turn outstanding invoices into immediate funding, so you can pay your team without waiting on client payments

Selective Invoice Finance

With fast approvals and the freedom to choose which customers to finance, we give you flexible access to working capital—without tying up your entire sales ledger.

LATEST TRANSACTIONS

Have a look at some clients we’ve helped in our latest transactions

BUSINESS FUNDING GUIDANCE

Find your dedicated funding partner in the world of alternative finance

We are proud to have an exceptional team of professionals who share in our mission to accelerate access to working capital for small to medium businesses. Our partnerships extend beyond mere associations; they are strategic alliances built on trust and a shared vision to support companies with the capital they need, when they need it.

We share a commitment to the long-term success of small to medium businesses, and our partnerships are enduring relationships focused on sustained growth and prosperity.

Frequently asked questions

about alternative finance

What is alternative financing?

Alternative financing is a tailored approach to business finance where solutions are designed around the specific challenges and goals of your company. Instead of a rigid, one-size-fits-all loan, providers like eCapital build flexible facilities that match cash flow needs, customer payment terms, and growth plans.

Through a mix of invoice finance, selective invoice finance, bad debt protection, cash flow financing and more, eCapital creates bespoke packages that help UK SMEs unlock working capital, safeguard against late or non-payment, and fund domestic or international trade. The result is faster access to working capital and greater financial confidence, enabling businesses to manage day-to-day operations while pursuing long-term growth.

How is alternative lending different from traditional lending?

Traditional lending from banks often involves fixed loans or overdrafts with rigid terms, lengthy approvals, and collateral requirements that many SMEs find difficult to meet. These facilities rarely adapt to the realities of cash flow gaps, extended payment terms, or sector-specific risks.

Alternative financing from eCapital is different. It’s built around your business model and growth plans, using flexible tools such as invoice finance, selective invoice finance, bad debt protection, and invoice discounting. Instead of waiting weeks for bank approvals, businesses can quickly unlock cash tied up in invoices, protect themselves against non-payment, or secure funding for domestic and international trade.

The key difference: alternative lending adapts to the business, while traditional lending expects the business to adapt to the lender.

What types of businesses benefit from alternative financing solutions?

Alternative financing is designed for SMEs that need flexible working capital solutions to manage cash flow, protect against risk, and fuel growth. In the UK, the businesses that benefit most include:

-

Transport & Logistics companies – to bridge gaps caused by long customer payment terms and keep fleets moving.

-

Staffing & Recruitment agencies – to cover payroll commitments while waiting for client invoices to clear.

-

Manufacturers & Wholesalers – to fund production cycles, purchase materials, and secure trade deals.

-

Service providers & SMEs across sectors – to unlock cash tied up in receivables and protect against late or non-payment.

Whether it’s covering day-to-day operations or seizing new opportunities, alternative finance gives businesses the flexibility and financial strength to grow with confidence.

Is bespoke funding only for businesses with weak credit?

Not at all. Bespoke funding is designed for a wide range of companies, from start-ups to established SMEs, and it isn’t limited to those with poor credit. While it can help firms that may find it difficult to secure a bank loan, many strong, growing businesses use it to unlock liquidity, manage payment cycles, and take advantage of new opportunities.

Unlike traditional finance, which often judges businesses solely on credit history and collateral, bespoke funding considers the overall strength of the business — its contracts, customers, and growth potential. This makes it a smart option for companies that want a more flexible, responsive way to access working capital.

How do I know which bespoke funding product is right for my business?

Choosing the right type of bespoke funding starts with understanding your business’s cash flow patterns, sector pressures, and growth goals. For example, companies with long customer payment terms may need a solution that improves day-to-day liquidity, while firms expanding into new markets might prioritise access to trade finance. Businesses concerned about late or non-payment could benefit more from protection tools that safeguard cash flow.

The best way to identify the right fit is to work with a funding partner who takes the time to understand your operations. At eCapital, specialists review your industry, customer base, and financial needs to recommend a facility that adapts to your business rather than forcing you into a one-size-fits-all product. This tailored approach ensures you access funding that not only solves immediate challenges but also supports long-term growth.