When liquidity falters, even profitable UK businesses can find themselves stuck in a dangerous cycle. A gap between delivering services or goods and being paid in 30, 60, or 90+ days, can turn unexpected events, or even promising opportunities into cash-flow crises. The hidden costs of being unprepared go beyond obvious balance‑sheet strain. Weakened supplier relationships, missed deals, eroded negotiation power, and exposure to bad debt can quietly dismantle long-term potential.

For savvy UK SMB leaders, prioritising liquidity isn’t optional—it’s a strategic necessity. Flexible specialty financing solutions, including invoice finance, invoice discounting, bad‑debt protection, and selective invoice finance, offer practical, flexible ways to build agility, resilience, and growth-readiness.

This article examines the costs of poor liquidity, and the benefits of four specialty financing options to accelerate cash flow, minimise credit risk, and shield SMEs from the unexpected.

The costs of poor liquidity

- Operational drag & missed opportunities

Even profitable companies risk being sidelined when they cannot fund payroll, supplier commitments, or inventory. Top business accountants warn that looking only at the bank balance gives a false sense of security. Business owners, CFOs, and financial managers must seek payment more quickly and manage credit terms wisely to avoid being caught off-guard, especially in volatile times as the economy struggles to gain growth momentum.

- Strained supplier relationships & loss of leverage

Undercapitalised companies often resort to the practice of paying financial obligations late. This strategy often damages trust, straining supplier relationships. Without ready cash, businesses may lose out on early-payment discounts or struggle to stock up affordably, eroding competitiveness.

- Credit risk & insolvency exposure

Late payments aren’t just inconvenient—they’re dangerous. The European Commission notes one in every four SME insolvencies stems from late payments. Lack of liquidity magnifies this risk, especially when paired with sudden shocks.

- Opportunity cost & growth constraints

Expanding contracts, seasonal hires, strategic marketing—these often require upfront investment. Without liquidity, leaders must forgo high-value deals or growth accelerators.

- Distraction from core strategy

Chasing overdue invoices, scrambling for short-term loans, and firefighting crises often drain leadership focus, slowing innovation and long-term planning.

Specialty financing to the rescue

Specialty financing helps SMEs stay prepared for uncertainties by unlocking cash tied up in assets, such as invoice receivables, ensuring liquidity even when customers delay payments or markets fluctuate. Unlike rigid bank loans, these solutions are flexible and scalable, adapting as trading volumes or risks change. By smoothing cash flow and reducing reliance on overdrafts, SMEs can cover essentials like payroll and supplier payments while keeping resources available for growth.

Commonly used specialty finance options to build financial readiness, agility, and resilience, include the following:

Invoice finance converts unpaid invoices into working capital by using them as collateral. In the UK, it can advance 80–90% of their value—often within 24 hours. That rapid injection of cash lets businesses meet payroll, invest, and operate without overreliance on costly overdrafts or loans.

Key benefits include:

- Scalability: As invoice volumes grow, so does your available funding—making this an inherently growth-aligned tool.

- Flexibility & control: Invoice finance funds business expenses with few restrictions on use.

- Risk management: Providers often perform credit checks on customers, helping reduce exposure to late payment or default.

- Minimal collateral needs: Only invoices are used, protecting other assets.

- Operational efficiency: Some providers offer receivables management services, easing admin burdens.

Invoice discounting works similarly to invoice finance but is typically undisclosed to customers—so you retain control over collections. You continue handling credit control, while the finance provider advances a cash lump sum against your receivables—often up to 90%—without alerting your customers.

Advantages:

- Maintains brand and client trust: customers won’t know you’re using external finance.

- Flexibility: packages can be configured either as full turnover or selective/spot discounting.

- Rapid access: breaks free cash trapped in unsettled invoices—helpful during busy cycles or unexpected needs.

Considerations:

- Costs vary based on agreement type and volume—usually between 3–5% for selective models.

- You remain responsible if a client underpays or disputes an invoice, potentially adding risk.

- Confidentiality can come at a cost—some facilities charge more for full turnover or undisclosed arrangements.

Bad debt protection, is an optional feature often utilised alongside invoice finance. It is credit protection that ensures you’re covered if a customer defaults or becomes insolvent. You can choose which clients are covered and what percentage of the invoice value (up to 90%) you want protected.

This adds:

- Peace of mind, especially when onboarding new or unfamiliar clients.

- Predictable cash flows, reducing the need for reserves to hedge against bad debt.

- Privacy advantage, enabling you to focus on growth—not chasing defaults or absorbing losses.

Selective invoice finance (also known as spot or single-invoice finance), allows you to choose specific invoices to fund without committing your entire ledger. This flexible funding option provides SMBs an effective liquidity tool to overcome occasional cash-flow gaps.

Benefits include:

- Tailored liquidity for urgent needs—say, bridging a large client invoice or funding a one-off opportunity.

- Quick set-up and payout, without lengthy contracts.

- Ongoing control: you retain credit relationships with customers, unlike full factoring.

- Scalable and cost-efficient: advance rates typically range between 75% and 95% of invoice value.

This solution is perfect for businesses facing seasonal fluctuations or one-off opportunities where liquidity needs are intermittent but critical.

Building Agility and Growth

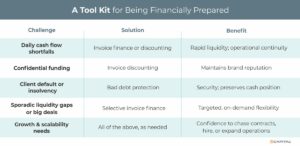

Each of these financing tools addresses different needs—but together, they form a toolkit that empowers SMB leaders:

Together, these solutions help business leaders stay ready—not reactive. With liquidity secured, you can:

- Seize new contracts or marketing pushes.

- Invest in stock, staff, or innovation.

- Smooth supplier relationships.

- Mitigate risks from customer non-payment.

- Reduce stress and free up leadership bandwidth for strategy, not scrambling.

Conclusion

For UK business leaders, being unprepared can result in missed deals, operational strain, poor resilience, or all of these. The costs of poor liquidity are too high to ignore. Liquidity isn’t just a financial indicator, it’s a strategic advantage.

In a fast-moving market, agility and resilience differentiate winners from those caught flat-footed. With the right specialty finance tools, SMBs can not just survive disrupted cash-flow cycles, but thrive through them.

Contact us to consult with a specialty finance advisor to seek advice or start the fast and simple process of qualifying for flexible specialty financing options.

Key Takeaways

- The hidden costs of being unprepared go beyond obvious balance‑sheet strain. Weakened supplier relationships, missed deals, eroded negotiation power, and exposure to bad debt can quietly dismantle long-term potential.

- Flexible specialty financing solutions offer practical, flexible ways to build agility, resilience, and growth-readiness.

- With the right specialty finance tools, SMBs can not just survive disrupted cash-flow cycles, but thrive through them.