Navigating cross-border trade brings many rewards, but also significant cash flow challenges. Selling to overseas customers often means dealing with extended payment terms, invoice delays, currency fluctuations, and additional credit risks. These can quickly erode liquidity and hinder your ability to scale internationally.

Cross-border transactions often turns cash flow management into a maze, and traditional financing solutions frequently prove too complicated and often inadequate for the challenge. That’s where specialty financing comes in. Seasoned specialty lenders offer tailored financing tools designed to keep working capital flowing, no matter how complex your international supply chain.

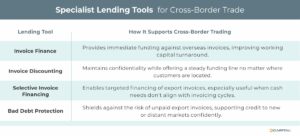

This article examines four specialty financing options to maximize cash flow efficiency and safeguard against bad debt when dealing with cross-border transactions.

Keep cash flowing

The strength of your balance sheet often hinges on one key factor—cashflow. For suppliers tied to cross-border trade, that cash is often locked up in accounts receivable for extended periods. Flexible specialty financing provides powerful, covenant-light funding agreements that can help UK suppliers unlock trapped capital and build resilience as international supply chains encounter continued volatility and uncertainty.

To maintain a steady cash flow, UK businesses are increasingly leveraging the benefits of specialty financing to enhance liquidity, increase credit protection, and improve profitability and sustainability.

Easy to manage, cost-effective specialty financing options include the following:

Invoice Finance

Unlock cash from every invoice: Invoice Finance solutions allow businesses to release up to 90% of the invoice value (minus a small fee) within 24 hours, with the remainder delivered once the invoice is settled. The financial provider manages credit control and collections, alleviating your organisation from this burden. The accelerated liquidity of invoice finance isn’t limited to UK invoices—it’s equally effective for international invoices. The benefits of this flexible cashflow solution gives businesses access to the working capital they need to cover costs, reinvest, and seize opportunities without waiting for delayed cross-border payments.

Invoice Discounting

Confidential, ongoing liquidity: With invoice discounting, you access funds upfront, again up to 90% (minus a small fee), while your organization retains control over your customer relationships and collection process. This confidential funding stream helps businesses conduct trade without disrupting established client relationships and ensures that cashflow keeps pace with growth, including overseas expansion.

Selective Invoice Financing

Flexibility for occasional needs: Need a tailored boost? Selective invoice financing lets you choose specific invoices to finance rather than committing your entire ledger. This is ideal for businesses facing irregular invoice timings or seasonal demand, and particularly handy when managing large international transactions or sporadic export orders. You receive a rapid advance (up to 90%) on chosen invoices, maintaining control while bridging liquidity gaps.

Bad Debt Protection

Safeguard against non-payment: Expanding cross-border often means greater risk of invoice default. Bad debt protection offers a safety net, providing cover (commonly up to 90%, minus fees) if a customer fails to pay. This reduces risk, allowing you to extend credit to new international clients with confidence, without exposing your business to damaging write-offs or cashflow shocks.

Selecting a partner for growth

When choosing a lender for cross-border trade, it’s important to look beyond capital and find a partner who understands international markets, regulations, and currency risks. The right lender should offer flexible solutions tailored to your cash flow cycles, transparent terms without hidden fees, and modern technology for easy invoice tracking and real-time visibility. Just as crucial is strong relationship support—having a proactive team that guides you through risks and opportunities ensures your financing partner becomes a trusted ally in global growth.

Conclusion

Flexible financing is a vital tool for UK businesses looking to expand internationally while managing financial risks. It provides liquidity, stability, and confidence to compete effectively in global markets. Invoice financing, discounting, selective financing, and bad debt protection equip your business with the liquidity and protection needed to thrive. By converting invoices into immediate working capital and guarding against default, these tools allow growth without compromising stability.

By working with independent funders experienced in delivering tailored cash flow solutions, businesses can secure the capital needed to grow exports while mitigating risks associated with international trade.

Contact us if your business is engaged in pursuing international opportunities. Our experienced team can help you bridge financial barriers, expand your horizons, and take your business to the next level.

Key Takeaways

- Selling to overseas customers often means dealing with extended payment terms, invoice delays, currency fluctuations, and additional credit risks. These can quickly erode liquidity and hinder your ability to scale internationally.

- Flexible specialty financing features powerful, covenant-light funding agreements that can help UK suppliers unlock trapped capital and build resilience as international supply chains encounter continued volatility and uncertainty.

- By working with independent funders experienced in delivering tailored cash flow solutions, businesses can secure the capital needed to grow exports while mitigating risks associated with international trade.